“Data Driven Thinking” is a column written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is a column written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Rob Leathern, CEO of XA.net, an online advertising company.

What’s an ad network anyway? Some would say: an entity that manages yield for both publishers and advertisers, and cuts checks to publishers that are a percentage share (usually fixed) of revenue of deals they source with advertisers. I’m not sure if there’s a different name for a company that just decides what percentage they want to pay to their publishers based on whim, but I still think it’s an ad network, and, 2011 is going to show us again just how powerful and persistent this model still will remain. Here’s why:

Reason 1: Improving margins. Why wouldn’t you want to be a big, bad ad network? The world’s biggest ad network has “over a thousand engineers working on display” according to what their vice president of product told a group of partners gathered at the Doubleclick AdX dinner in San Francisco two months ago. Naturally I’m talking about Google. And things seem to be getting better in terms of margins there for them, not worse. In moving towards “more transparency”, Google disclosed what they are paying their AdSense publishers on average in a posting on the Inside Adense blog in May 2010, namely 68% of revenue. Naturally it’s an average, and variable based on publisher in ways that are never disclosed to the publisher, and of course something akin to this data has been available via Google’s public filings for some time. Unfortunately for the publishers out there, these numbers have been dropping as you can see here. Though there is a small difference between these quarterly traffic acquisition cost figures and the amount revealed by Google to its publishers, it’s clearly on a downward trend from 75% to 72% in 2009 from Q1 to Q4, then down to 68% by the time the May announcement rolled around. In reading some of the comments on the Google Adsense blog – a lot of publishers are excited since they assumed the split was 50-50! It’s the same thing as a prospective employee getting excited about a 50,000 share option grant — the number means nothing without knowing what share it is of the pie. At the end of the day – it’s really about how many cents of every advertiser dollar gets into the end-publisher’s pocket, regardless of where those fees are shaved off from. Nobody can fault Google for doing a very nice job of creating a contextual match engine that improves monetization for almost any page that has content on it… and then building a behavioral/display business on top; but transparency is not what their model is built around.

Reason 2: Willing partner ecosystem. When you’re the biggest network on the block, there’s no shortage of people wanting to play. Have your buying account shut down for “hosting malware” or having ads that “don’t provide enough user value”? Ah – don’t worry about it, it’s just the standard process and you’ll be back up and running in no time. And we know you’ll be back because you’ll have no choice but to come back.

Reason 3: Data synergies. What self-respecting ad network wouldn’t want to take advantage of the synergies available to it from various bits and pieces of user and response data floating around out there? Maybe cut a deal with someone to get hold of some great search data, and you’re in good shape as a network since you have some true differentiation! Unless of course you also own/are the search engine I guess, even better…

Reason 4: Website transparency not needed all of the time. Advertisers are getting stickier about knowing where the ads they are paying for are running (imagine that!) but when you’re a network you can, of course, hide the identities of some of your sites for reasons of “potential channel conflict”. A lot of transparency is great, thanks, but since advertisers think they can get the same stuff here as there (it’s not the same because impressions aren’t commodities, but let’s keep that story for another day) let’s keep them thinking by having our publisher be an “anonymous” site in the network instead! Even better, let’s also have the same publisher show up in multiple spots as both anonymous and attributed, but with different prices attached.

Reason 5: You can’t make enough money just aggregating publishers. It seems unlikely publisher aggregators will make enough money doing just a publisher-side business at 10-15% margins. If Google can take 30%, well perhaps you can get close to that just by taking it out of both sides equally, and each side will think they got a good deal – just look at Right Media for example. Take 10% from one side, 10% from the other, and then instead of running a second price or Vickrey auction, run a “50% auction” and split the difference between the bid and second winning bid in coming up with the clearing price… voila, you have your 30% margin!

It appears Rubicon got the memo and bought the remnants of FAN, the Fox Audience Network, and now runs a pretty decent self-service interface for ad buying in MyAds. The MyAds blog says, “Currently, all of your new and existing campaigns will continue as usual without any changes. In the future we will be gaining more ad impressions and targetable unique users to help your advertising programs grow [sic].” Very soon I’m sure Rubicon will take the covers off and embrace its true ad network-ness, too.

Reason 6: Let’s just call things different. (yes that’s what I said!) Everyone gets a new brand in 2011. It’s already started: thanks to the Google Display Network (new!), the artist formerly known as a second price auction is now a “Money Saving Technology” called a “discounter”, “After each auction is run and your ad is ranked, the AdWords Discounter adjusts your actual CPC so you pay the minimum amount required to exceed the rank of the next ranked ad.”

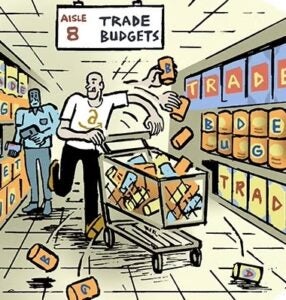

Reason 7: One stop shopping, and not just for ads. It’s really annoying to have to go to different companies for all the things you need to run your business, so why not trust your ad network to also provide you with an adserver, a DSP to get inventory from other providers, a search engine marketing system, analytics, oh and what about your email, blog, calendar, contacts and a wiki too?

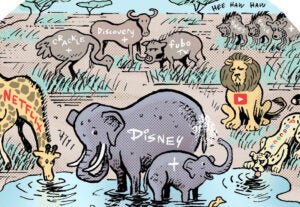

Reason 8: There is no such thing as a conflict of interest. So why worry? In the words of Mr. Terence Kawaja, why worry about conflicts of interest at all? In a space like this where the companies who supply the technologies are now competing with their customers, who are competing with companies who buy inventory from them AND who are buying data from companies buying media from their competitors, isn’t everyone in the same boat now?

The one constant seems to be through all this – everyone is going to work with ad networks in 2011, especially with Google. That’s why 2011 is going to be the year of the ad network. QED.

Follow Rob Leathern (@robleathern), XA.net (@xa_net) and AdExchanger.com (@adexchanger) on Twitter.