It’s been a busy 10 months since AdExchanger published its inaugural Marketer’s Guide to Cross-Device Identity. Since then the market has seen significant developments, including technology evolution, merger activity and shots across the bow from government regulators.

Below, we pick up where we left off with an important update to our overview of the cross-device landscape.

As device fragmentation increases, so has the industry’s adoption of cross-device technology.

“We were talking about the cookie – now we’re talking about cross-device,” said Brian Anderson, a partner at LUMA Partners, speaking at AdExchanger’s Industry Preview event in January. “[Cross-device] is a critical component in the marketplace in order to provide mass personalization.”

It might be folly to call 2016 the “year of cross-device.” As Mike Juhas, senior director of sales at CPXi-owned AdReady, noted, “The bottom line is that cross-device strategy should be an integral part of any scalable campaign and not be considered this year’s hot new thing.”

Regardless, as time spent on mobile continues going up and to the right, cross-device technology is in the spotlight as marketers start to ramp up their spend in a material way.

But significant challenges remain, including privacy issues, reach vs. accuracy and the thorny little matter of the Internet of Things.

A Quick Recap Before Diving In

There are two primary methods used to establish user identity across devices – deterministic and probabilistic.

Deterministic matching taps into known user data to make a match, generally an email address used to log into multiple devices. (Think Facebook, Google, Amazon, Twitter, AOL.)

The probabilistic approach draws on a variety of anonymized data signals like IP address, device type, browser type, location and operating system to create likely statistical connections between devices. (Think Drawbridge, the recently acquired Tapad, Crosswise, Adelphic, Adbrain.)

Probabilistic ID vendors will often use what is called a truth set – a core of licensed deterministic data – to train their algorithm over time.

That makes it sound pretty black and white – but it isn’t.

There is also a growing trend around data companies like Oracle adopting a blended approach in certain cases, using a combination of probabilistic to complement their deterministic matching capabilities in an attempt to reach the scale of players like Facebook and Google.

Although LiveRamp, for example, relies on deterministic data to power its Customer Link product, it leverages probabilistic matches for clients who want additional reach, hence its use of Drawbridge’s Connected Consumer Graph.

As LiveRamp product VP Anneka Gupta told AdExchanger in November when LiveRamp revealed its partnership with Drawbridge, “[This is] becoming really important in channels like mobile where it takes more time to aggregate enough deterministic data to have significant reach.”

As LiveRamp product VP Anneka Gupta told AdExchanger in November when LiveRamp revealed its partnership with Drawbridge, “[This is] becoming really important in channels like mobile where it takes more time to aggregate enough deterministic data to have significant reach.”

Walled Gardens

The deterministic players – mainly Facebook with Atlas and Google, which finally came out with its own cross-device solution in June after months of speculation – are often referred to as walled gardens, aka enticing and effective Shangri-La playgrounds of near-perfect cross-device identity matches where marketers can achieve both scale and accuracy with one noteworthy catch: Marketers can’t take their insights with them. What happens in a walled garden stays in a walled garden and can’t be used to inform campaigns elsewhere.

Although marketers generally find this state of affairs frustrating, it hasn’t stopped them from spending with the big guys, as clearly evidenced by Facebook’s and Google’s respective blockbuster Q4s.

Facebook has demurred that it’s all in the name of privacy. Patrick Harris, Facebook’s director of global agency development, has said that if he had his druthers he would replace the term “walled garden” with “privacy garden.” (It hasn’t caught on.)

The Privacy Question (With No Clear Answer)

The proliferation of devices has made it harder – in fact, near impossible – for consumers to opt out across devices.

Cookie-based opt-outs are half a headache. As Adobe privacy product manager Vinay Goel acknowledged on a June conference call with brand clients and partners about its then forthcoming cross-device data co-op product, “If you clear your cookies and then the consumer comes back to the site, they are being targeted and profiled again. This is one of the limitations and challenges with cookie-based opt-outs.”

Although self-regulatory programs like AdChoices and AppChoices, created by the Digital Advertising Alliance (DAA), aim to help consumers get a handle on where their data is being used, there are obvious limitations.

For one, the opt-out process requires an heroic amount of effort and industriousness on the user’s part. Users who want to opt out have to do so on a per-browser, per-device basis – and then diligently maintain their preferences. It’s asking a lot.

The industry is just “not there yet” when it comes to universal opt-out, admitted Genie Barton, VP and director of the Council of Better Business Bureaus’ Online Interest-Based Advertising Accountability Program. Barton was speaking during a panel discussion at the Federal Trade Commission’s (FTC) November workshop on cross-device tracking in Washington, DC, attended by policymakers, academics, privacy researchers, technologists and ad industry reps.

“When folks in the advertising space talk about scaling up cross-device tracking in an exchange, they tend to be talking about a probabilistic solution and that introduces some challenges,” said Jonathan Mayer, privacy advocate and newly minted Federal Communications Commission chief technologist, in a previous interview with AdExchanger. “If they offer an opt-out, they can only do so with a likelihood, but no guarantee, that the opt-out will transfer to other devices.”

The FTC Digs In

The FTC’s cross-device workshop was a watershed moment, making it clear that the commission, although not motivated to regulate, has its eye on the industry.

As is its wont, the FTC attacked the issue from the consumer protection perspective.

“I think it’s fair to say this area is evolving rapidly and may be … challenging traditional consumer expectations about their privacy,” said Justin Brookman, policy director of the FTC’s Office of Technology Research and Investigation, at the workshop.

For research purposes, Brookman and his team ran a mini analysis of the top 20 sites for news, sports, shopping, games and reference (100 sites in all) to see if they could tell when cross-device tracking is happening.

For research purposes, Brookman and his team ran a mini analysis of the top 20 sites for news, sports, shopping, games and reference (100 sites in all) to see if they could tell when cross-device tracking is happening.

“We spent days trying to get a sense of what’s going on,” Brookman said. “It’s really hard to determine objectively, from the end user point of view, when cross-device tracking is going on … [And] that raises the question: How much transparency should there be? What do consumers expect? Do they want to be overloaded with information? If cross-device tracking is going on, what should consumers be told and how?”

The industry is still hashing all of that out, but some consumers aren’t waiting to sharpen their pitchforks.

The FTC accepted public comments on cross-device in the months leading up to and the month following the workshop.

A number of respondents had choice words for the ad industry, including James from New York, who said: “Please make an effort to inhibit the intrusion of almost anyone into the lives of almost everyone.” Paula from Georgia was even more to the point: “‘Relevant’ advertising is a negative for me – not a positive. Please make sure my privacy is more important than the almighty dollar!”

The Thing Is…

There’s another question to add to the end of Brookman’s list: What are the privacy implications of cross-device tracking when the Internet of Things enters the scene? Arguably, anything that gives off a signal is fair game for the device graph, whether it’s an Apple Watch or a connected toothbrush.

But before the proverbial smart toaster becomes a fixture in the kitchen, smart TVs are getting comfy in the living room. By 2019, smart TVs are slated to make their way into more than 50% of TV viewing households across the US, UK and Japan, according to recent research from IHS.

In November, right before the FTC’s cross-device workshop, an article in ProPublica called attention to the fact that smart TV maker Vizio had updated its privacy policy to say it had begun collecting and sharing cross-device user data with advertisers. Users who weren’t interested had to proactively opt out.

A few days after that, a piece in Ars Technica decried a practice known as audio beaconing, which takes advantage of inaudible, high-frequency sounds embedded in ads to track user behavior across devices, including TVs, phones and tablets.

Both scenarios call attention to the thorny issue of what notice and choice, aka privacy policies, should look like in a world where anything that can be connected to the Internet will be connected to the Internet.

The cross-device landscape is still either the privacy Wild West or a hotbed of innovation, depending on your perspective. And, privacy policies, rather than the privacy safeguards most consumers believe them to be, are really just legal documents for companies to protect their derrieres in the case of a breach.

(According to research from University of Pennsylvania professor and privacy pundit Joseph Turow, between 55% and 65% of US consumers believe that when a website has a privacy policy it means that site won’t share user data with other companies, which is patently untrue.)

“We fully understand the important part that innovation plays … [but] if you’re looking at your TV kind of side-eyed and worry about what’s going on there, that could turn into a dangerous spiral,” the FTC’s Brookman observed at an International Association of Privacy Professionals event in November. “For consumers, everything they own is a little black box and we’re trying to make sure that their interests are provided for.”

Reach vs. Accuracy

Privacy issues aside, the industry is dealing with its own issues, namely how to strike the right balance between reach and accuracy.

A device graph – the mapped connections between devices – is only as effective as its ability to find a lot of matches (reach) with a level of statistically relevant precision (accuracy).

For companies that aren’t deterministic titans like Facebook or Google with both scale and accuracy, one usually has to suffer in favor of the other. If a marketer wants reach, match accuracy usually goes down. If a marketer wants exactitude, scale goes out the window.

There’s an extra nuance there, though. As Tim Abraham, director of data platforms at Adbrain, explained:

“Accuracy is a metric that doesn’t necessarily mean what people think it does. In the context of cross-device identification, accuracy is calculated as the number of matches correctly identified, as well as the number of non-matches correctly identified. In other words, it’s the number of times a probabilistic prediction was correct, but also includes ‘non-match’ predictions from the total pool of predictions it made. Marketers don’t care very much about the non-match predictions because they want the predictions of correct device matches. But there will actually be many more non-matches than correct matches, so this massively skews the accuracy score, making it look much better than it really is.”

In other words, device graphs are getting credit for being accurate about inaccuracies. It’s a head-scratcher.

So is the fact that the two primarily probabilistic device graphs on the market have been verified by Nielsen as being insanely accurate. According to Nielsen, Tapad’s cross-device connections are 91.2% accurate, while Drawbridge received a 97.3% accuracy score.

To put that into perspective, when AOL worked with comScore on a verification project in 2014, the results came in at 93% accurate – and that’s for a deterministic data set.

How, then, were the Tapad and Drawbridge numbers so high? The answer could lie in the subtle difference between accuracy rate and match rate. While the match rate is defined as how many times one is able to correctly connect two or more devices, the accuracy rate includes correctly identified non-matches.

Nielsen compared samples from both the Tapad graph and the Drawbridge graph to data from its own third-party panel as the truth set.

In the test with Nielsen, Drawbridge’s accuracy rate was 97.3%, but its match rate was 10.3%. (Tapad didn’t publicly release its match rate.)

Tyler Pietz, a VP and programmatic strategist at IPG trading desk Cadreon, explained it like this: “For the purposes of a study, it’s pretty easy to focus on the stats that position you in the best possible light – but you can’t provide a 10% match rate for an advertiser. … To put this in context, if an advertiser has a pool of 100 desktop cookies and wishes to find a corresponding mobile device for each, then a 10% match rate would equate to identifying a match device for 10 out of the initial pool of 100 desktop cookies.”

There is a fair amount of skepticism in the industry around probabilistic methods and whether cross-device recognition and targeting is as advanced as the vendors who sell it claim.

As evidenced with AOL’s comScore number, even deterministic matching isn’t 100% accurate 100% of the time.

As evidenced with AOL’s comScore number, even deterministic matching isn’t 100% accurate 100% of the time.

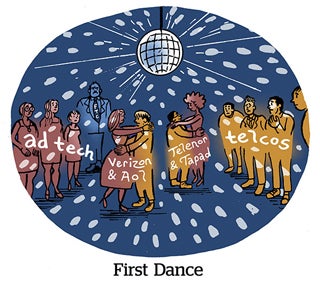

Cross-Device Consolidation

But that hasn’t dampened M&A in the cross-device space.

The biggest move by far was Verizon’s $4.4 billion acquisition of AOL in May. Verizon is no noob to the cross-device game. In 2012, Verizon Wireless rolled out an addressable advertising division in the form of Precision Market Insights, whose stated goal is to solve for consumer identity using mobile.

Verizon’s move to snap up AOL looks like a clear sign that the telecom wants to go toe to toe with Facebook and Google.

Telecoms feel like they’ve been “missing out on the marketing action that Facebook and Google have dominated for a long time,” said Kamakshi Sivaramakrishnan, CEO of Drawbridge. “They’re awakening to the fact that data has been transacting on their networks, but they have had no real piece of it. This is the first step in creating a strong digital presence, and the next step is connecting the devices, either using technology or in a more explicit manner. … The carriers will be very active acquirers in the near future.”

Prescient words. In January, Drawbridge’s top competitor, Tapad, was acquired by Norwegian mobile carrier Telenor for $360 million.

Telcos see lucrative potential in cross-device recognition and targeting, wrote Matt Keiser, CEO of programmatic email platform LiveIntent.

Keiser elucidated his point with a ”Wheel of Fortune” reference in a recent column for AdExchanger:

“Verizon and Telenor have the consonants of deterministic data, in terms of the actual devices and their respective anonymized IDs. They recognize the biggest opportunity is having the option to dial up accuracy or scale to best serve marketers across devices and channels. So they went shopping for vowels, which took the form of AOL and Tapad, respectively. For me, buying letters to get closer to solving the puzzle in ‘Wheel of Fortune’ is the most obvious parallel to cross-device. It’s just the ‘Tip _f th_ ic_b_rg.’”

Also in January, Verizon Ventures, the investment arm of Verizon Communications, sunk $5.5 million into intent-targeting platform Qualia, which recently merged with cross-device vendor BlueCava in an effort to capitalize on the combination of their respective data signals.

It’s a sign of the times, Verizon Ventures executive director Mark Smith told AdExchanger.

“Being able to take intent data and on a real-time basis look at where those consumers are going across screens is vital, because no action today is done in isolation,” Smith said. “Combined, they’re addressing how you can begin to piece together a story around ad decisioning and provide attribution about how a [mobile] exposure contributed to a sale or other action.”