While the majority of Alibaba’s revenue comes from advertising, most is direct-response or performance-based.

While the majority of Alibaba’s revenue comes from advertising, most is direct-response or performance-based.

Now the Chinese ecom juggernaut has its eye on brand dollars and is looking to digital ad company AdChina to get the ball rolling. Alibaba announced Wednesday that it’s claimed a majority stake in the company.

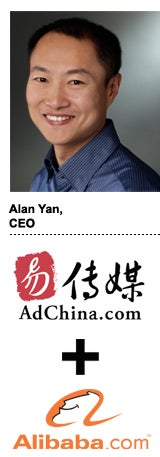

Brands are part of AdChina’s DNA, which is what attracted Alibaba to the company, said AdChina CEO Alan Yan.

“We really are the No. 1 platform providing programmatic products and services to brands in China,” he said. “We’ve been doing brand advertising since the beginning. It’s been one of our main focuses since we were founded in 2007.”

Yan, who described AdChina as “an end-to-end supply and demand platform, including mobile,” noted that the company maintains relationships with roughly 1,500 brands, 100 agencies and 400 publishers.

“This is great for Alibaba, it’s great for us and, hopefully, it will be great for the industry here in China,” he said.

Yan chatted with AdExchanger after the ink was dry.

AdExchanger: What does AdChina give Alibaba that it doesn’t have yet?

ALAN YAN: Alibaba has a huge advertising business. Currently, about 80% of their revenue comes from advertising, but most of it is purely performance-driven and from advertising services to their Taobao and Tmall merchants, which is a bit how Amazon was before.

But about a year ago, Alibaba started exploring how to expand its business into brand advertising. They want to serve brands with their unparallelled user data. Alibaba has probably the best user data in the Chinese marketplace.

When did AdChina enter the frame?

For more than a decade, Alibaba has been focused purely on merchant and ecommerce-centric advertising. To get into brand advertising and marketing, they found that it would be better to work with someone to accomplish their goals. They looked around the market and AdChina was the best option for them.

Right now there’s almost no overlap between what we do and what they do, which makes us a very good match. We serve the large and medium-sized brands and publishers and Alibaba serves the long tail. That’s part of why it makes so much sense for us to work together.

What does AdChina get out of the deal other than the investment?

Data is the key for us going forward and there are only a very few companies in this market that own scalable big data assets and universal identifiers. Alibaba is one of those companies.

As part of the agreement between us, Alibaba will fully open 100% of their user data for us to use.

Will the Alibaba deal have any impact on how you run day-to-day operations at AdChina?

There will be no change other than the fact we’ll have more resources. Alibaba has agreed that we’ll remain independent and the day-to-day will be handled purely by AdChina. Alibaba is not going to have anyone join the management team and its involvement will be purely on the board level.

What’s going to happen on the mobile side of things?

We’ve had our own organic growth through certain acquisitions we’ve done in the past. We run an independent mobile ad exchange and we served over 1.2 billion impressions on a daily basis last quarter.

We also launched the first mobile DMP here a few months ago. Alibaba sees the strategic synergy of using what we’ve built on the exchange side, as well as our DMP, to further strengthen TANX [Taobao Ad Network and Exchange]. Our mobile exchange combined with TANX essentially creates the largest mobile ad exchange in the China market.

Will your existing clients now get full access to Alibaba’s data?

Previously, Alibaba didn’t work with a DMP. They housed all of their user data themselves and there was no way for them to really harness its potential.

We’ve built an enterprise-level DMP that’s been adopted by a number of large advertisers and agencies who will now have the opportunity to tap into Alibaba’s user data, which will essentially be managed by us. The AdChina DMP will be able to further empower our customers.

We’ll also work with Alibaba’s AliCloud infrastructure to build a cloud-based private marketing cloud for advertisers.

Do you see AdChina launching a marketing cloud product down the line? Paid media has been a bit slow to roll out in US marketing clouds, but it seems like you guys would already have that covered from the beginning.

I see great potential in terms of innovating technologies based on this model here in China. Frankly speaking, once we’ve finished building this private marketing cloud using our enterprise solution and Alibaba’s big data in AliCloud we can really start to look at the CRM area.

When will you make a move, if you do?

I imagine that three to five years from now we’ll be working with the Alibaba Group to create alternative solutions for advertisers in terms of consumer relationship management. The CRM technology market is a big market. In fact, it’s a huge market. But it’s also separate from advertising. Even so, CRM Is part of the sales and marketing infrastructure for almost all brands.

Think about what would happen if we combined all of the ecommerce data from Tmall, Taobao and Alipay – hundreds of millions of user data points, including demographic, intent and mobile data – with CRM data. It could be a great opportunity for us in the coming years.

Everyone calls Alibaba the “Amazon of China” or the “eBay of China.” Is that kind of reductive?

There isn’t a single company in the US that is the exact counterpart of Alibaba. If you look at the major Internet companies in China, maybe some are similar to something like Google. Tencent, for example. But we can’t simply say that Alibaba is the “Amazon of China” or the “Amazon plus eBay of China.” Alibaba is more than that. Its market cap is two times that of Tencent and four times that of Badou. There is no model for them to copy. They do whatever they think is right for them.

How has the programmatic landscape in China evolved over the last few years and where does it stand now?

By now, the entire market has realized that programmatic is here. It’s not just a concept anymore. Programmatic in China is a real business. But without big data flowing through the ecosystem, programmatic doesn’t work. The owners of the data have actually been quite aggressive in exploring how to monetize and build a business from their data. It’s one of the reasons Alibaba is joining with AdChina.

With that kind of data we can also start to think about cross-screen advertising, which is something that’s on people’s minds. It’s also interesting to mention that about two weeks ago, two of the top three TV networks in China came and talked to us about programmatic TV.

The AdChina/Alibaba deal will trigger and accelerate programmatic branding in this market. Alibaba is the largest advertising platform and they have the best data – and to be able to fully use it is a great thing for the industry.