Privacy is the number one reason why marketers say they want to partner with a customer data platform.

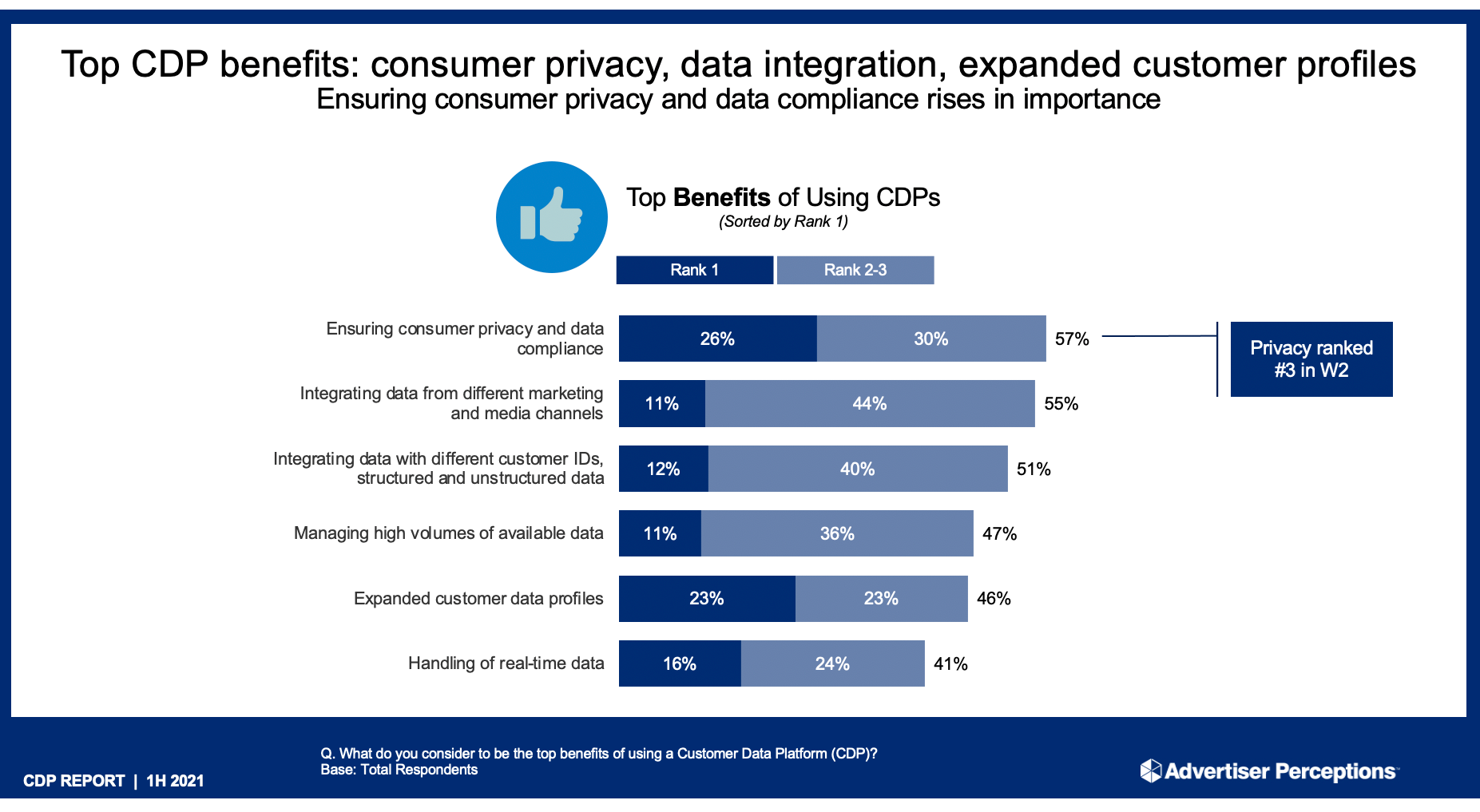

Twenty-six percent of marketers cite data compliance and ensuring consumer privacy as the top benefits of working with a CDP provider, according to the companies surveyed by Advertiser Perceptions in its wave on the CDP market covering the first half of the year.

Data security and privacy were ranked third on the list of CDP benefits in the last report.

Privacy being top-of-mind among marketers is a sign of the times, said Stu Schneiderman, SVP of business intelligence at Advertiser Perceptions.

The customer journey is getting more complex and digitally driven – a process that picked up speed during the pandemic – and it’s happening against a backdrop of regulatory scrutiny and platform changes, like Google’s planned phaseout of third-party cookies in Chrome.

“This has fostered the need for marketers to get their data houses in order so they have all their data connected in a single place where they can take action on it,” Schneiderman said. “At the same time, though, they realize that marrying data from multiple sources can put them at risk of privacy missteps or data breaches.”

Clouds still flying high

That’s why marketers are working with CDPs – but which CDPs are they choosing to work with?

It’s, yet again, a tale of two cities.

The marketing clouds still dominate the CDP market. Fifty-two percent of marketers say they use Microsoft Dynamics 365 Customer Insights, Microsoft’s mouthful of a CDP, followed by Salesforce (48%), Adobe (41%), Oracle (30%) and SAP (23%).

Ironically, the clouds have been sucking the air out of the CDP market even before they had their own CDPs to sell. Last year, Advertiser Perceptions found that more than half of marketers said they were using the Salesforce CDP before Salesforce’s CDP was even generally available.

Clouds have gravitational pull in the market. Marketers are using so many other components of a cloud, they might assume there’s some CDP tech tossed in there, too.

It’s also possible that some marketers are giving “credit to a cloud CDP where credit is not due,” Schneiderman said.

Some Microsoft Azure clients, for example, might think of Microsoft as their CDP because they used Azure as the foundation to build their own homegrown CDP solution.

A relatively small percentage of marketers, between roughly 12% and 15%, actually do choose to build their own CDP. At least for now, they’re happier than those who choose to license CDP technology. Seventy-five percent of marketers with a homegrown CDP say they’re satisfied, while just 63% of those working with an external CDP say the same.

But ask the build-your-own crowd how they feel a year from now, and they might be singing a different tune.

“It wouldn’t surprise me if their satisfaction eroded over time,” Schneiderman said. “It’s incredibly difficult to continue investing and enhancing to keep up with the Joneses.”

The clouds part

Although the marketing clouds continue to cast a long shadow, a few independent CDPs are finally starting to break through the cloud cover and gain mindshare.

Third-nine percent of marketers say they’re considering Exponea as they’re CDP, while 38% have Segment in their consideration set, and 33% of marketers are thinking about kicking the tires on BlueConic, AgilOne, Optimove, SessionM or Tealium.

Still, there’s a long road to hoe between consideration and signing a contract. On average, marketers will have five CDPs in their consideration set.

“It’s promising for them, but we’ll need to see whether that consideration converts into use,” Schneiderman said. “The CDP market is still a very crowded place.”

Today, usage numbers remain modest for the indie CDP market. Less than 10% of marketers say they currently use either Optimove (9%), Exponea (9%), Tealium (8%), AgilOne (8%), BlueConic (7%), Lytics (7%), Amperity (7%), SessionM (7%), mParticle (6%), Treasure Data (6%), ActionIQ (5%) or Redpoint Global (4%).

Doing more

But there’s an opportunity for CDPs, indie or otherwise, to position themselves effectively as the online ad world undergoes massive change.

It’s not news that the end of third-party cookies in particular is causing an acute level of stress throughout the advertising industry.

Marketers are “in scramble mode” trying to get ready, said Kevin Mannion, president and chief strategy officer at Advertiser Perceptions.

At the same time, though, marketers are also starting to get comfortable with the CDP category.

Beyond the need for technology to help with data compliance, companies are increasingly using CDPs in support of a growing number of marketing use cases. Marketers spent the last few years getting their data organized. Now they’re starting to do more with that data, Schneiderman said.

Seventy-percent of marketers use their CDP for digital advertising (up from 63% during the second half of last year), while 64% apiece use their CDP to do customer segmentation and email marketing, compared with 61% and 58% respectively during H2 2020.

The vast majority of marketers (89%) are also working with more third parties to help with the data onboarding process, activation and ongoing management.

Offloading some of the thornier CDP-related grunt work on an agency or consultant partner means marketers have more time to spend on strategy and sophisticated use cases.