Fandom is building out a full-funnel offering for marketers. And its acquisition of several media brands from Red Ventures is the latest step forward in that initiative.

On Monday, Fandom snapped up GameSpot, Metacritic, TV Guide, GameFAQs, Giant Bomb, Cord Cutters News and Comic Vine from Red Ventures.

Fandom paid in the “mid 50s” range, or more than $50 million, in cash, according to a source with knowledge of Fandom’s financials.

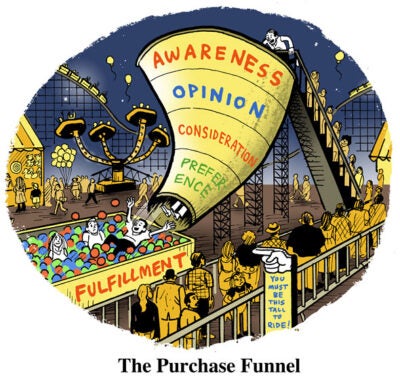

The acquisition improves Fandom’s reach among fan communities, which will supplement its offering for marketers throughout their journey through the marketing funnel, said Fandom CEO Perkins Miller.

“We have brands that catch you at different points of intent,” Miller said. “We can meet a fan at different parts of their journey and offer advertisers that 360-degree, full-user-journey package.”

For example, gamers could go to GameSpot for the latest news on upcoming releases, then later go to Metacritic and Giant Bomb to check out reviews before committing to making a purchase, Miller said. Ad messages can be tailored to these users depending on the sites they visit and where they fall in that purchase journey.

Fandom projects that the ability to do intent-based marketing will also boost affiliate sales on Fanatical, an ecommerce platform Fandom acquired in February 2021, Miller said.

“It seems like a pretty short walk to go from GameSpot, Metacritic or Giant Bomb and into Fanatical to purchase a game,” Miller said. “So, we think that connective tissue is going to be pretty strong.”

The new slate of sites will have a “significant impact” on the company’s bottom line, Miller said, although he declined to share specifics about the impact on Fandom’s overall ad revenue.

Data-based segmentation

Fandom also plans to use the acquisitions to gather a broader array of first-party data, which will span 350 million users and 50 million to 60 million pages of content, Miller said.

Fandom will monitor on-site user behavior, including the contextual data on sites visited, and use that data to power its FanDNA first-party data platform.

Fandom uses these data points to create contextual targeting segments. These segments include typical fodder like “Harry Potter fans,” or they can be even more esoteric, targeting people who are generally interested in wizardry.

Marketers can use the FanDNA platform to find lookalike audiences to target across Fandom’s portfolio of sites, Miller said. This can be helpful for entertainment brands looking to mitigate churn in a marketplace saturated with subscription offerings and media to consume, he added.

It’s not yet clear how Fandom will change the ad experience on its new acquisitions. Fandom’s user-edited wikis feature prominent “adhesive” video and display ad units that maximize viewability and video completion rate (VCR).

These ad placements are the result of an extensive testing process in mobile and desktop environments to “get the highest degree of visibility without impairing engagement,” Miller said.

But adhesive units don’t necessarily appeal to gamers, a key audience segment for Fandom and one that’s often stereotyped as finnicky and quick to use ad blockers. In response to the acquisition, critics of Fandom’s ad experience posted their concerns that the company will saturate its newly acquired sites – like GameFAQs, which is lauded for its low ad impact and minimalist design – with takeover formats and sticky ad placements.

Rather than apply the Fandom wiki ad experience across its newly acquired portfolio of brands, Fandom will instead conduct a similar testing process for each of its media properties to find an ad experience that delivers against marketing KPIs without interfering with end user intent, Miller said.

“People find the path of least resistance to get to the content they love,” he said. “We definitely don’t believe in ‘one size fits all,’ so we’ll be doing the same evaluation with the teams at GameSpot, Metacritic and the others to figure out the right structure to capture that intent.”

On the editorial side, Fandom plans to have a light touch, Miller said. He declined to speculate about editorial changes, staffing cuts or further M&A activity.

“The goal is to continue the good momentum and the positive work of these businesses over the last year,” Miller said. “So, job one is don’t break anything.”