Oracle DMP has always had a comfortably high perch in terms of advertiser recognition and adoption. And make no mistake – it still does.

But Salesforce DMP has reached some pretty high branches in the year since the Krux acquisition, according to Advertiser Perceptions’ Q3 Programmatic Intelligence Report, released Wednesday. The findings come from a June survey of more than 300 decision-makers, split almost evenly between agencies and marketers.

An Advertiser Perceptions report released in April foreshadowed Salesforce DMP’s growing prominence among ad buyers, due to its thought leadership and customer service. That prediction has borne out, though Kevin Mannion, Advertiser Perceptions’ chief strategy officer, was still surprised by Salesforce’s surge.

“Salesforce’s emergence here wasn’t something I expected,” Mannion said. “Whenever you have an acquisition like this, it takes time for the dust to settle. For them to jump so far forward in a lot of the key areas says they are already in the marketplace in a way that advertisers understand.”

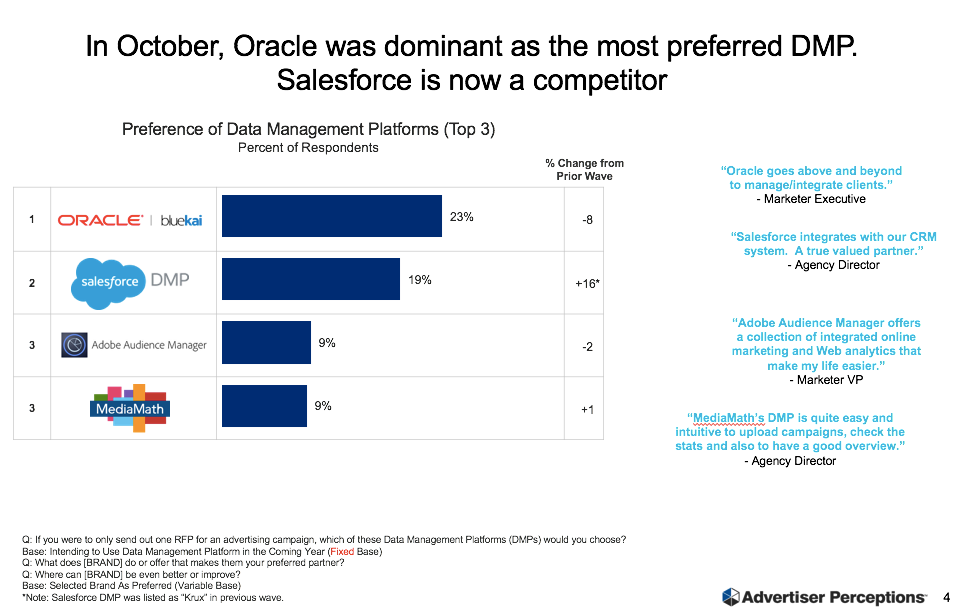

Last year, when Advertiser Perceptions asked survey participants which DMP they’d choose if they could choose just one, Salesforce wasn’t a contender, and Oracle was up by 20 points. Now, Oracle is only four points ahead of Salesforce.

Salesforce DMP performed well in a number of key buyer considerations. It topped DMP-DSP match rates. (Oddly, MediaMath came in second even though it’s an integrated DMP-DSP.) Salesforce DMP had continued strength in thought leadership, which helped with evangelism. And clients felt it was among the easiest DMPs to work with.

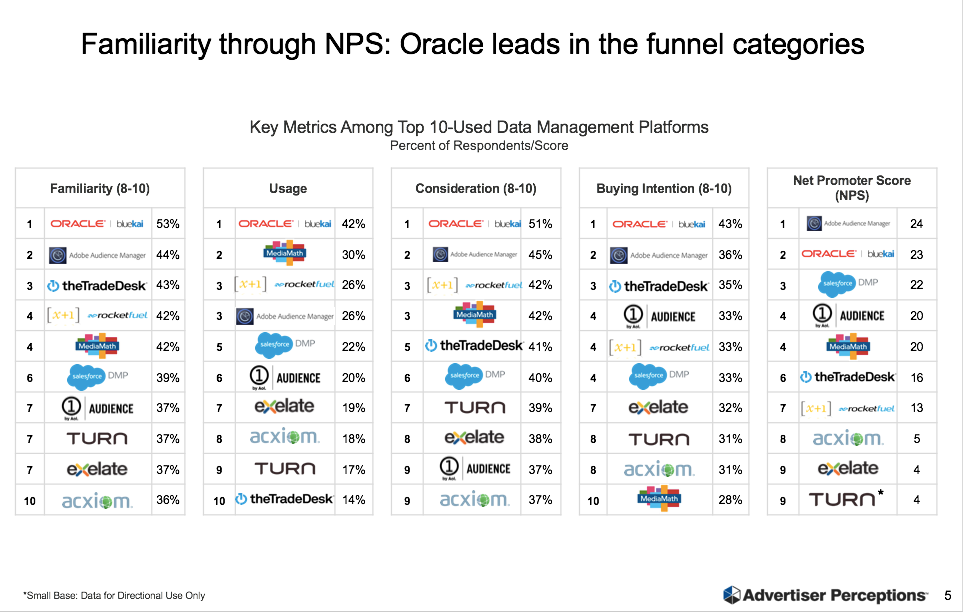

Despite these strengths, however, Oracle DMP still holds the crown in terms of actual use, intent to use and familiarity.

So, while Salesforce DMP has trended up in awareness and esteem, it needs to turn those positive vibes into sales to reach Oracle DMP’s heights.

It’s also important that Oracle not to get too fat and happy, as it’s lagging in many communication categories, Mannion said. Advertiser Perceptions found that Oracle isn’t communicating its tech expertise and road map as well as other hungry contenders like Salesforce DMP, MediaMath and The Trade Desk – to name just a few. And Oracle DMP is not particularly easy to work with (Salesforce DMP leads there), nor has it demonstrated keen understanding of client needs (MediaMath heads that category while Oracle DMP is 10th among 10 contenders).

So, Oracle DMP might need to start brushing up on its client/prospect messaging strategy lest it develop a reputation of trading on its name. And there’s a lot of room for change.

“Oracle has real competition, and it still feels like early stages,” Mannion said.

Disconnections

With the exception of Oracle, DMPs that were once used by marketers aren’t always in top consideration. The top DMPs used in the past, besides Oracle’s, include MediaMath’s and a third-place tie between [x+1]/Rocket Fuel (which is now part of Sizmek) and Adobe Audience.

Meanwhile, the DMPs that buyers most intend to use in the coming year, besides Oracle’s, include Adobe in second place and The Trade Desk in third. AOL and [x+1]/Rocket Fuel tied for fourth, while MediaMath slid to 10th.

These results are interesting because MediaMath performed well in numerous consideration categories – second in match rate to DSP (behind Salesforce), tops in identity management (ahead of the Trade Desk) and second in ability to collect data (behind Acxiom).

It also shared the top spot with Salesforce in understanding client needs and was second in thought leadership (behind Salesforce), third in being easy to work with (behind Salesforce and the Trade Desk), first in tech expertise (ahead of Salesforce) and second in innovation and road map insight (behind Salesforce).

So, what gives?

In large part, MediaMath just isn’t as well-known as Oracle, Salesforce and Adobe, so it has way more work to do to climb the consideration tree. Still, it’s not entirely clear why other lesser-known companies that weren’t rated as highly had greater intent to use.

The Future Is Fluid

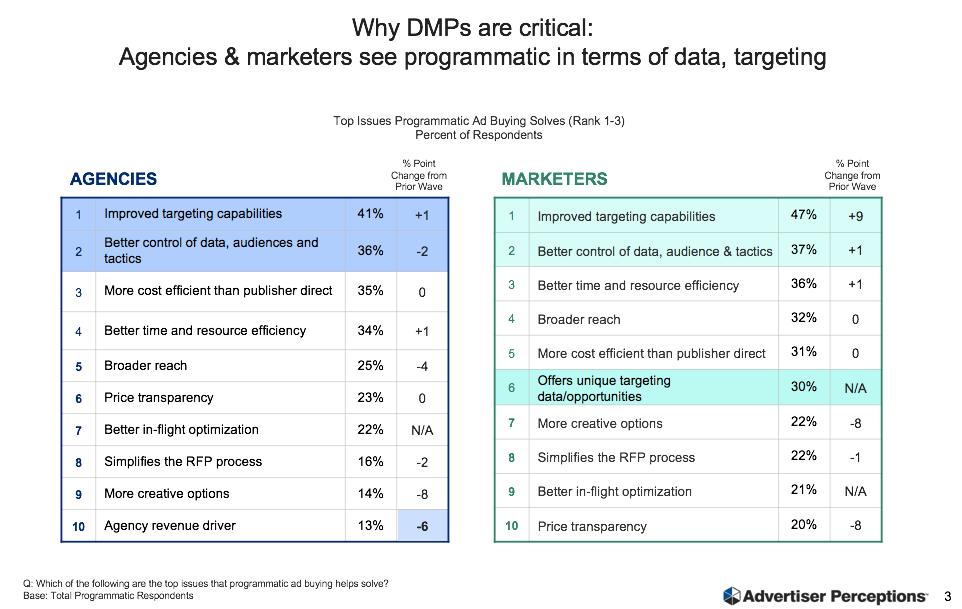

The DMP space is still in flux, and ad buyer consideration for the technology will remain high, particularly given the growth of programmatic and the needs of advertisers. Agencies and marketers both see programmatic as helping improve targeting and enabling better data control.

But those benefits bring growing concerns around fraud, brand safety and verification.

“When I look at where [the ad industry] is right now, the idea of data management platforms and what they can do for advertisers are a critical piece of what people are looking at,” Mannion said.

DMPs aren’t new technologies, but their growing capabilities have in recent years coincided with advertisers’ evolving needs – which finally presents vendors with an opportunity to stake their spots in the ecosystem.