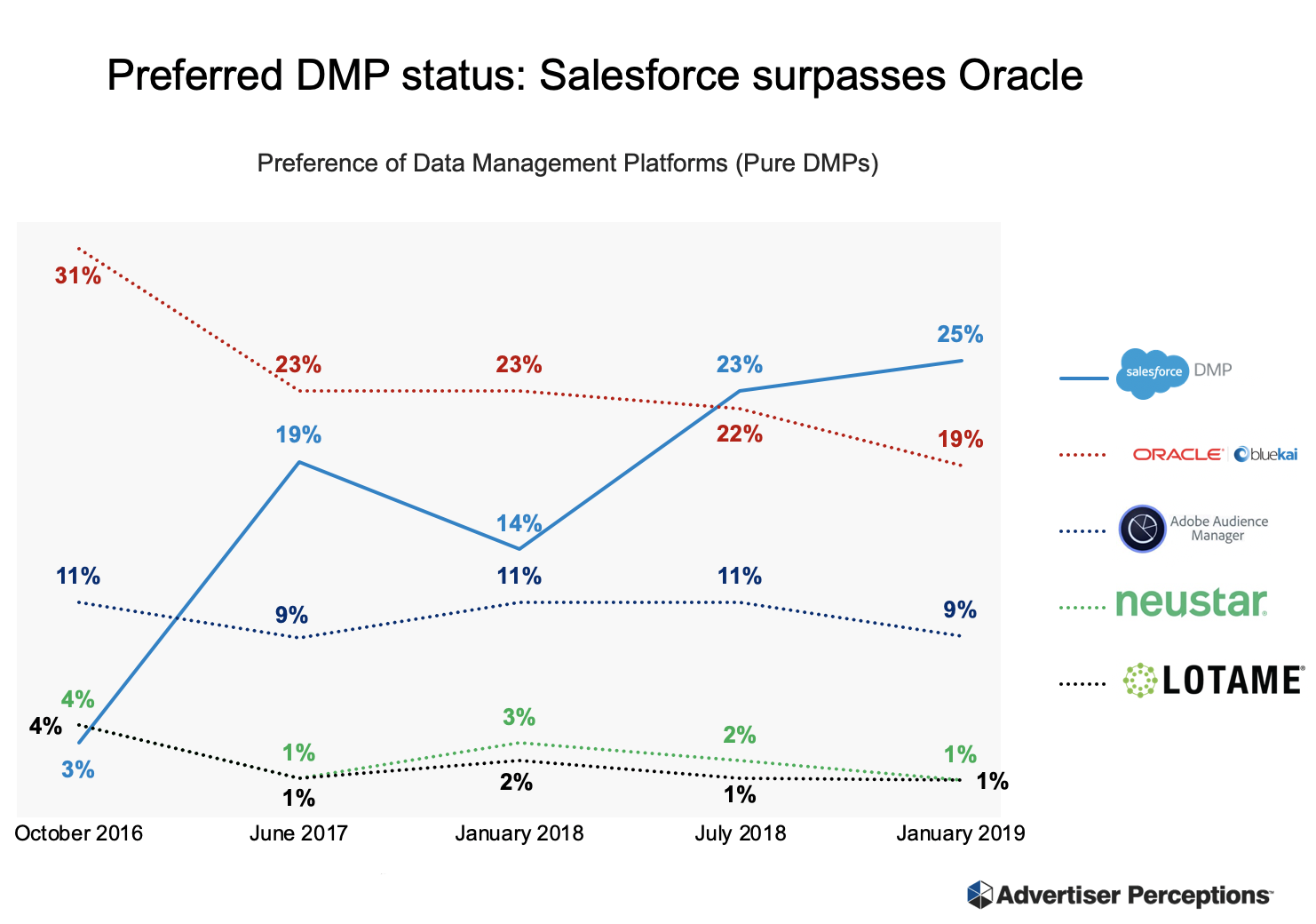

If you’re a data-management platform (DMP) and your name isn’t Salesforce or Adobe, it’s starting to get pretty chilly out there.

Oracle’s BlueKai DMP is a strong third, while Neustar and Lotame continue to chug along – but Salesforce and Adobe undoubtedly lead the pack, at least when it comes to how advertisers think about the DMP landscape.

In its latest DMP report, released Wednesday, market research firm Advertiser Perceptions polled more than 400 marketers and agency executives who are directly involved in the purchase of programmatic advertising with annual digital ad budgets of at least $1 million.

“I wouldn’t count Oracle out, but all indicators point to Salesforce and Adobe succeeding in the marketplace, whether that’s on the DMP front or with a customer data platform, which is where the market is heading,” said Kevin Mannion, chief strategy officer at Advertiser Perceptions.

Oracle BlueKai was the only one of the big three marketing cloud DMPs to lose ground on key funnel metrics. Although current clients are positive about their recent customer experience with Oracle, its DMP trails Adobe on consideration, buying intent and net promoter score.

Why are marketers so hot on Salesforce?

Salesforce appears to be doing a good job marketing itself, and its messaging is resonating in the marketplace.

When marketers were asked to explain why they prefer the Salesforce DMP, they used words like “innovative,” “flexible,” “easy to use,” “integrated” and “service,” and they seem clear on Salesforce’s offering.

But Salesforce is also making “tremendous headway” with agency buyers, Mannion said, 43% of whom now say they’d be most likely to use the Salesforce DMP, up from 34% in November 2018. For comparison’s sake, only 36% of agencies have purchase intent for Oracle BlueKai, down from 42% in late 2018.

Adobe ascendant

Adobe struggled a bit last year. Its net promoter score plummeted from the top spot to the fourth, below Neustar, and Adobe came in dead last for communication with clients.

But the tide is turning for Adobe, which muscled its way to the top over the last few months, rising from third place for consideration and buying intent last year behind Oracle and Salesforce, to a solid No. 2 in both categories. (Salesforce supplanted Oracle, now in third place, for consideration and intent.)

But Adobe has a history with marketers, particularly on the creative side, which provides a platform to cross-sell other solutions, including its DMP. Adobe seems to do well with current clients who are already sold into other Adobe products, Mannion said.

As one marketer, which spends around $250 million on digital advertising a year, put it to Advertiser Perceptions: “Simplification drives this decision as we use multiple products and services from Adobe.”

The hybrids

Although Salesforce, Adobe and, to a lesser extent, Oracle dominate the DMP space, there are a bunch of other companies – The Trade Desk, MediaMath, Amobee and Google’s DV360, for example – that bundle DMP services with their primary demand-side platform offerings.

MediaMath leads for ease of implementation and data inventory discovery, with The Trade Desk right on its heels. MediaMath also tops the list for data collection, storage and aggregation.

But a new entrant on scene, DV360, shot to the top of the list for audience segmentation – which tells you a lot about the hybrid category, Mannion said. Google only just launched its DMP out of beta as part of DV360, and it’s already way ahead of the competition in some areas.

“The DMP isn’t a strong emphasis for these providers,” he said. “The whole concept behind DV360 is that it’s easy to use the whole stack, which includes a DSP, an SSP, an exchange and now a DMP.”

The CDP factor

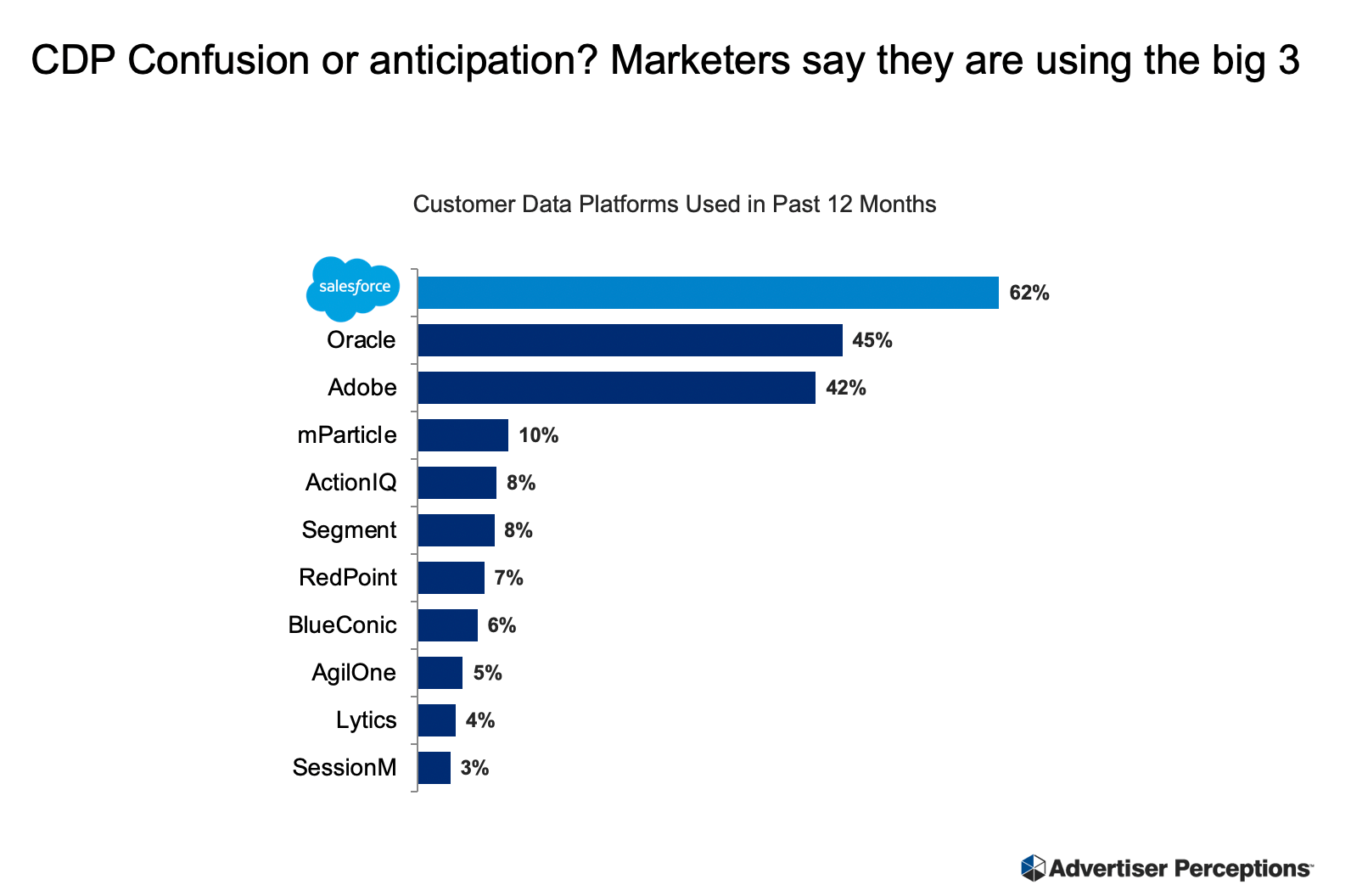

Advertiser Perceptions also took the temperature on how marketers feel about customer data platforms. After dallying on the CDP front – and even being somewhat dismissive of the trend – Salesforce, Adobe and Oracle are all running headlong to meet growing market demand with CDP offerings of their own.

In response to a question about which customer data platforms they’ve used in the past 12 months, most marketers (62%) named Salesforce, while 45% pointed to Oracle and 42% said Adobe.

It’s quite a strange finding, considering Advertiser Perceptions conducted its study in January, long before any of the marketing clouds even had a beta CDP offering available, and speaks to reigning confusion in the marketplace on the definition of a customer data platform.

It’s quite a strange finding, considering Advertiser Perceptions conducted its study in January, long before any of the marketing clouds even had a beta CDP offering available, and speaks to reigning confusion in the marketplace on the definition of a customer data platform.

But regardless of whether marketers really know what a CDP is, the marketing clouds have been doing a bang-up job of marketing themselves as the place to go for a CDP, even if they don’t have fully-baked solutions yet.

Seventy percent of marketers associate Salesforce with CDP tech, while Oracle and Adobe get 57% and 53% of mindshare, respectively – far higher than the pure play CDPs. Seventeen percent of marketers associate mParticle with CDPs, and it just goes down from there: Segment (16%), ActionIQ (15%), RedPoint Global (12%), SessionM (11%), AgilOne (11%), BlueConic (10%) and Lytics (8%).

“The customer data platform is an exciting concept, but when we asked marketers what they mean when they say ‘CDP,’ the answers were just all over the map,” Mannion said.

Privacy as an afterthought

In Forrester’s DMP Wave, released last week, Salesforce and Adobe were named as leaders in large part because of their focus on privacy by design and consent management.

But Advertiser Perceptions found that regulatory compliance doesn’t seem to be a big driver of DMP purchase intent, at least not compared to more technical features, like data inventory discovery, ease of implementation, audience segmentation and data capture. GDPR compliance was the second to last priority on a list of 13 performance criteria related to intent.

That was a bit surprising, Mannion said, but perhaps it can be attributed to the collective dominance of the marketing clouds in the DMP space.

“Marketers seem to be assuming that they can trust the big three,” he said. “Right or wrong, they seem to expect that the marketing clouds won’t violate GDPR or the California Consumer Protection Act or whatever federal privacy laws we might have.”