Paul McLenaghan is Vice President, AdAdvisor Platform for TARGUSinfo.

Paul McLenaghan is Vice President, AdAdvisor Platform for TARGUSinfo.

AdExchanger.com: TARGUSinfo launched AdAdvisor data solution in February of 2009. Knowing what you know now, what one change would you make to the AdAdvisor strategy if you could start over again?

PM: I don’t think we would have changed our approach at all. We knew we wanted to launch a solution with appeal to both the supply side and the demand side of the industry, as well as avoid competing with potential clients by acting as an ad network or agency. Sticking to our company’s core as a neutral third party, we made a conscious decision to not pursue buying media as a way to sell our data, but rather partner with agencies and leading advertisers to power their efforts. As a result we are engaging equally successfully with both the supply side and the demand side of the industry.

How does TARGUSinfo differentiate amongst its competitive set today?

One key differentiator is the fact that AdAdvisor is built on core competencies that TARGUSinfo has been perfecting over the last 17 years. We are the market leader in multiple industries when it comes to delivering attributes in real-time to improve the profitability and personalization of our clients’s interaction with a customer or prospect. AdAdvisor is really no different in that regard; it is simply an extension of a large and very successful set of solutions we have been offering for many years.

Secondly, we built the audience targeting data assets and methodology using proven offline scoring and analytical process. We believed it was important to build the capability ultimately focused on advertisers and their desire to use their own data to drive branding and acquisition. With an existing client base of over 1,000 clients and long-standing relationships with some of the largest media spenders online today – we are in a strong position.

Lastly – our position as a privately held and profitable company with years of consecutive growth and profits give us the ability to invest and built long-standing strategic relationships.

Lately, it seems data providers such as TARGUSinfo are offering access to their cookie data so that buyers can see which segments may of particular value. Can you talk about this? Is this a new way of selling data?

We are working closely with some partners to expose our data transparently for the purposes of analytics and to build custom audiences. To date, it isn’t a new way of selling data, but on the sell side, we are helping publishers understand more about the makeup of their inventory. On the buy side, we have a number of partners that use our segments (which are discrete parts of our Audience Groups), as part of their bidding algorithms and to build custom audiences based on performance or brand lift.

You’ve announced recent deals with Pulse 360, Metamarkets and others. As well as Demdex and BlueKai. What are the takeaway from these deals?

These are all good examples of different sectors of the industry utilizing data to improve their offerings, whether its ad serving, analytics, data management, or optimization. As the ecosystem has grown ever more diverse, our client base and the variety of business models we are supporting or in discussions with has also grown.

Beyond data targeting, is data analytics important to TARGUSinfo’s solution? How is this the analytics business?

Without analytics, it is impossible for data buyers to value data properly, and also for data providers to serve their clients. Our clients are increasingly turning to us for analytics on how our data interacted with a campaign, even if our data was not being specifically used for targeting. These insights help ensure that the next campaign has a greater chance of success by using the right data in the right way.

As more companies offer analytical capabilities and transparency on the value of data assets, it will continue to show that not all data has the same value, and that pricing, scale and quality are key to evaluating and integrating the right data assets.

Your Interactive Insights summit in Las Vegas has special focus on demand-side platform and ad networks as it relates to AdAdvisor. Are they the biggest buyers today? What buying trends are you seeing from clients today?

We see our ad network and DSP clients as great channels for exposing our data to a large percentage of the available inventory. At the same time, our teams based in New York and San Francisco are in meetings with agencies every day, creating awareness of our data, helping plan campaigns, powering campaigns for some of the largest advertisers online, and building strategic relationships at the senior levels of the agencies.

As far as trends, we continue to see a lot of activity driven by trading desks running campaigns through DSPs. We are also seeing increased of interest in the video advertising space, which is why we are excited about our long-standing relationship with TidalTV and the recent deal with Adap.tv.

Please discuss the product roadmap. For example, what new targeting segments have you added in the past year and what’s in the pipeline?

We think in terms of Audience Groups, which are built from the data assets we expose in our solution today. These Audience Groups are comprised of groups of individuals that all behave in a similar fashion and based on verified offline data assets that include brand preferences, life styles, life stages, and demographics. We have close to 1,000 predefined Audience Groups in our repository, and we also have created hundreds of customer Audience Groups for our clients.

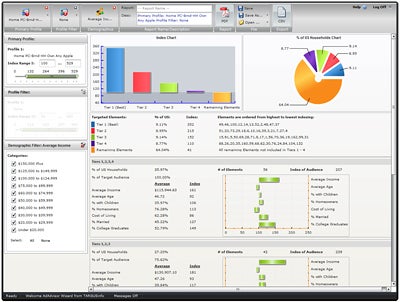

This month, we are excited to preview our audience self service capability for existing integrated clients, enabling them to build custom Audience Groups on top of all of our data assets (see screenshot below):

Click Image For Audience Groups Close-up

In general, what is the biggest mistake that buyers are making with targeting data today? What do you recommend?

The biggest mistake buyers make is in not knowing how to apply data to the various stages of the purchase funnel. We all know that intent data is not really effective on a branding campaign as the individuals have already made their decision. Life stage data is not ideal for bottom of the funnel messaging, but it continues to be purchased and overlaid on acquisition campaigns.

One of the disturbing trends we see in the market is actually on the sell side of the data ecosystem. There is a pricing race to the bottom across a number of data providers. Continued downward pricing pressure, “all you can eat” pricing deals for small monthly amounts, and selling data assets lower than the cost of goods sold, is committing venture money after business that isn’t sustainable.

Follow Paul McLenaghan (@PaulMcLenaghan), TARGUSinfo (@TARGUSinfo) and AdExchanger.com (@adexchanger) on Twitter.