Programmatic impressions rose to levels about equal with direct sales in 2013 , according to new data from analytics firm Adomic (formerly YieldMetrics).

Programmatic impressions rose to levels about equal with direct sales in 2013 , according to new data from analytics firm Adomic (formerly YieldMetrics).

Adomic compared ad impressions transacted through programmatic, direct and ad network sales. Some ad networks also conduct programmatic transactions, but those numbers could not be calculated and were included only in the study’s ad network totals.

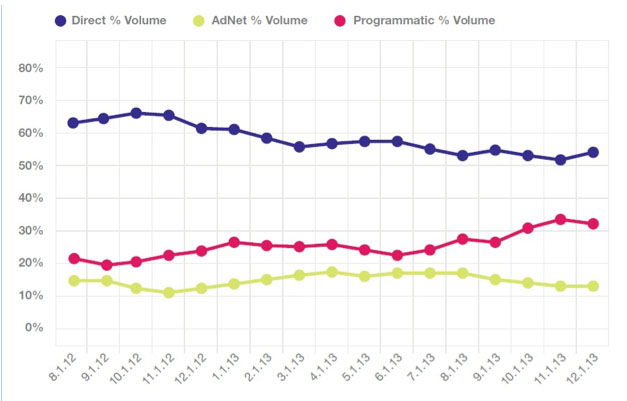

Measuring from December 2012, Adomic found programmatic delivery rising from 28% of impressions to 36% in December 2013 among the top 1000 advertisers, compared to 42% for direct sales. By Q4 2013 programmatic and direct sales ads were roughly equivalent in volume among that same group.

Top 1000 Advertisers: Direct vs. programmatic and ad network volumes since August 2012

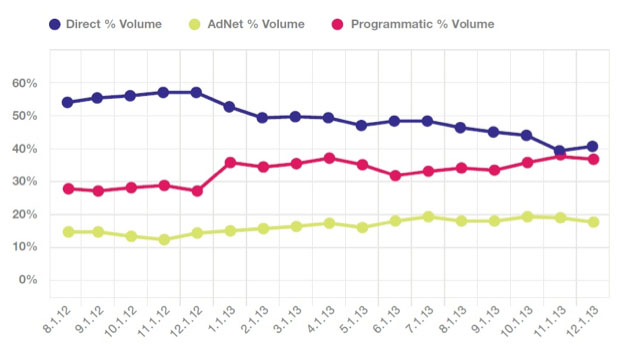

Among the top 500 publishers, volume of direct sales impressions dropped 8% while programmatic impressions sold rose 9% from the December 2012-2013 period.

Top 500 Publishers: Direct, programmatic, and ad network impression volumes on average across the top 500 publishers over the last one and a half years.

In a larger group of 3,000 publishers, Adomic saw a larger drop of 55% of impressions sold in direct sales in December 2012 to 41% a year later. This coincided with a rise of programmatic sales from 29% to 40% over the same period.

Top 3,000 Publishers: Direct, programmatic, ad network impression volumes on average across the top 3,000 publishers over the last one and a half years.

Growth of programmatic adoption was led by direct-response advertisers in gifts and occasions, dating, and fitness and weight loss.

Leading Programmatic Advertisers: The verticals that used programmatic the most as a percentage of their volume among the top 1,000 advertisers in 2013.

Adomic collected its data via Web crawlers on its PathSource platform, which mines publisher websites and records the method of delivery for each ad impression.