Real-time online video ad platform LiveRail found that health, drug, and medicine advertisements were some of the most blocked on its RTB video ad network in Q4 2012.

Real-time online video ad platform LiveRail found that health, drug, and medicine advertisements were some of the most blocked on its RTB video ad network in Q4 2012.

Through its Check Point technology, LiveRail lets publisher clients put up restrictions and blocks when it comes to what ads can win at an RTB auction.

LiveRail VP of product, Punit Sarin, said that the tool was originally developed to help with sales channel conflict, allowing publishers to “open up the gates to as many buyers as possible, and still have the peace of mind that, if they have a deal with Heineken, they don’t have to worry about another [alcohol] buyer accessing the inventory at a cheaper price through a remnant exchange.”

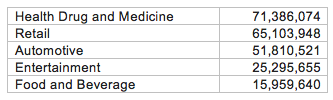

Looking at the 1.6 billion impressions served by publishers using the Check Point technology, LiveRail found that 16.5% were blocked. Health, drug, and medicine ads were the most likely to be blocked, with 71.4 million blocked impressions. Retail ads were next, with 65.1 million blocked impressions.

Most Blocked Categories By Impressions:

These ads were blocked mostly because of conflicts, or because publishers hope to do larger, direct sales deals with companies in the retail or health and beauty space, Sarin said. But Check Point also became a way for publishers to monitor the quality of ads that make it through the process.

“This is a huge concern because video comes from the TV world and TV budgets,” Sarin added, “so people want to maintain that high quality and those high revenues.”

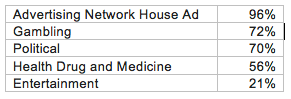

The data around the most frequently blocked categories, by percentage, demonstrates which ads were blocked from that perspective. Gambling and political ads had high blocking rates, 72% and 70% respectively, but the ad category that was most frequently blocked was “advertising network house ads,” or basically the other companies, players, and competitors in the advertising and RTB space.

Most frequently blocked Categories:

“There is still a lot of debate in the industry today, even on the display side, that putting your premium inventory in the programmatic environment will lower the cost or price or worth of it over time,” Sarin said. This helps publishers monitor those types of concerns, but he added that the Check Point tool can also benefit buyers, by providing transparency into the mindset of a publisher, as LiveRail can communicate back to buyers why a certain ad campaign didn’t run.