Programmatic buying and RTB in the Asia-Pacific region continues to grow, with impressions over the past year spreading out across different countries and inventory from a wider variety of publishers hitting the market.

Programmatic buying and RTB in the Asia-Pacific region continues to grow, with impressions over the past year spreading out across different countries and inventory from a wider variety of publishers hitting the market.

A new Real Time Media Insights report from Brandscreen, an ad-tech company that provides DSP and trading-desk services in the APAC region, found that the programmatic marketplace is maturing in several ways.

Overall, the market is growing and impressions are spreading across the region. Brandscreen told AdExchanger that in January 2012, the Australia/New Zealand market saw 51% of the impressions in the programmatic space, dropping to 22% by April 2013. Meanwhile, the Southeast Asia and subcontinent region, including India, grew from 32.5% to 69.1%.

Additionally, as more publishers opened up their inventory, and global ad-tech companies moved into the region, Google lost some of its dominance there. This diversification is healthy, said Yacov Salomon, chief data scientist for Brandscreen.

“Any healthy market will ultimately have more diversity in offerings,” he told AdExchanger. “As we’ve progressed [as an industry here], we’ve seen AppNexus and Rubicon come in, we’ve seen more inventory go through them and now, it’s much more of an even playing field.”

Salomon confirmed that, in January 2011, 86.6% of programmatic impressions went through Google, while AppNexus wasn’t even on the map and Rubicon saw 3.4% of impressions. By April 2013, Google had dropped to 40.1%, while AppNexus grew to 33.4% and Rubicon rose to 20.7%.

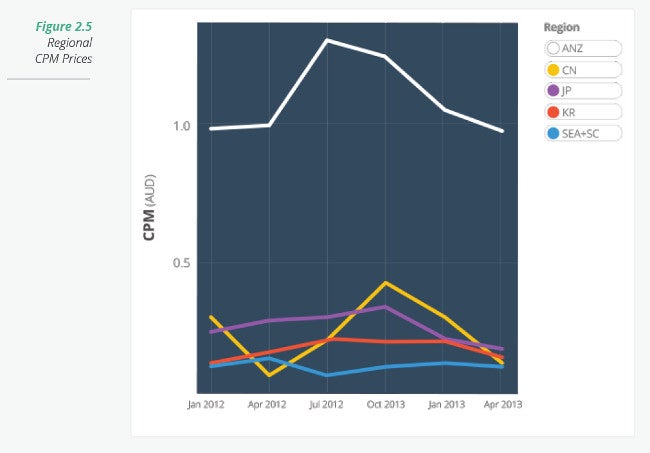

Additionally, as inventory opens up and the overall number of impressions increases, CPMs are also fluctuating and demonstrating different trends in each country.

“A lot of people mistakenly think of Asia as one place, but there is a huge diversity of markets there,” Salomon added. “Markets like Japan and Singapore, from a socioeconomic perspective, maybe have a lot more in common with Australia and New Zealand, but they still have significantly lower CPMs.”

In this chart, the Australia and New Zealand region show significantly higher CPMs than other countries in the region, while China has more ups and downs and Korea and Southeast Asia/subcontinent are starting to stabilize in terms of CPMs.

“The new technology of real-time buying, with all the targeting and abilities we have, its promise is that we’ll get better performance,” Salomon said. “We’ll have the algorithms and we’ll have all the options, and we’ll be able to target people a lot better. You don’t need to buy a lot of impressions, but each one will be more guaranteed to get the performance you’re looking for. These graphs show that.”

Overall, the APAC region is becoming more mature when it comes to programmatic and RTB. Australia and New Zealand, the most mature of the countries, are starting to give way to countries like India and China, where advertisers are learning more about programmatic in general and publishers beyond Google are starting to open up their inventory.