As more marketers use data to deploy targeted offers, clear differences are emerging in how industry verticals embrace digital strategies, a study has found.

As more marketers use data to deploy targeted offers, clear differences are emerging in how industry verticals embrace digital strategies, a study has found.

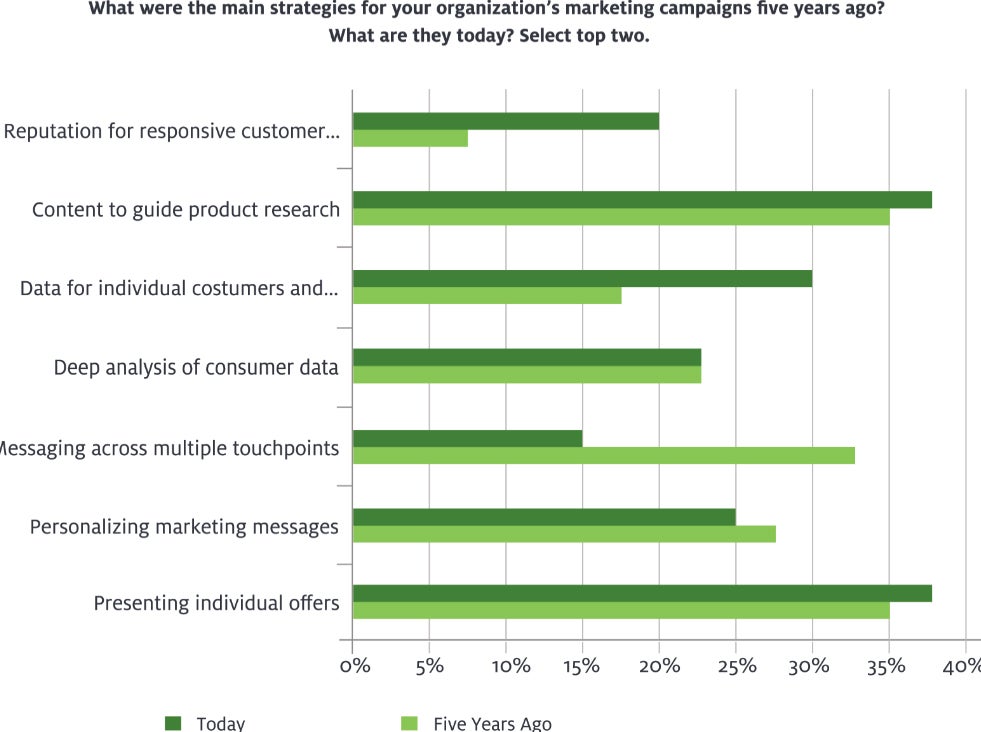

Digital technology company Lyris and the Economist Intelligence Unit found in “The Digital Marketing Gap” that some of the most widely growing areas of strategic importance to marketers include: content to guide product research, the presentation of individual offers beyond simple personalization, and debunking data about individual customers. The study surveyed 409 consumers and 257 marketing executives in the US and UK in categories spanning clothing/retail, banking, travel, media, automotive and entertainment.

The travel industry appears to lead other sectors in relying on data collection and analysis to guide product research, with 23% of executives in the travel vertical identifying this as a strategic imperative over the cross-industry average of 18%. Similarly, automotive came in at the top across industries for applying consumer data analysis to targeted offers, increasing from 13% five years ago to 50% of automotive marketers citing the use of data for individualized promotions as core to digital marketing strategy.

Entertainment was another ripe area for data, with tailored messaging and individualized offers nearly doubling in importance with entertainment marketers, increasing from 24% five years ago to 46% now. Some 66% of entertainment marketers invest only 1-10% of marketing budgets on mobile, the study found.

Like automotive, the media sector appropriates much of its spend on email, with 33% of marketers putting more than one quarter of their marketing budget toward this channel. Media, apparently, dropped off slightly in its investment of consumer data analysis, with 45% citing the use of predictive analytics as a key marketing skill, a 7% decrease from five years ago.

The banking sector put the most emphasis on customer retention, with 42% of executives citing this as a top priority, but still lagged behind other sectors when it came to transitioning from personalization to true, individualized offers and promotions. Big data was cited as a challenge to 44% of banking executives surveyed.

When it came to clothing/retail, 71% of consumers said personalized messaging no longer matters because of the volume of items received, but 25% expressed a willingness to take messaging more seriously if information on past orders or transactional information surfaces in future messaging. Clothing/retail marketers said expanding and diversifying the customer base was a key priority, growing in importance from 24% five years ago to 33% today.