The podcast universe is developing fast, and NPR is shaping it.

NPR, which began making podcasts over a decade ago, has a US audience of 11.4 million listeners and 80 million downloads monthly across 36 podcast shows. It’s been ranked consecutively for 13 months as the top podcast publisher by measurement firm Podtrac.

“Even before [Serial] dropped, we saw our audience grow every year to millions and millions of people,” said Bryan Moffett, chief operating officer of National Public Media (NPM), which sells sponsorships for NPR and PBS.

Unlike the broadcast side of its business, which is regulated by the FCC, NPR sells sponsorships against its podcasts (though it doesn’t allow hard endorsements or pricing messages to stay on-brand with its audience). Revenue from podcasts have doubled every year since 2015, and podcast sponsorships account for 30% of NPR’s overall sponsorship revenue, up 20% year over year.

NPR is also at the forefront of innovation in the podcast advertising space.

In podcasting, it’s difficult to know whether a listener who has downloaded a show has heard an ad. NPR is chipping away at that challenge with measurement guidelines and what it hopes will become open industry standard technology that makes podcasting more transparent and automated for advertisers.

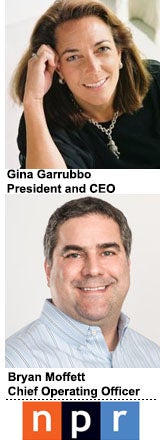

Moffett, along with NPM’s president and CEO, Gina Garrubbo, spoke with AdExchanger.

AdExchanger: How is measurement developing in podcasting?

BRYAN MOFFET: We’re working on a technology called Remote Audio Data (RAD) that [can measure if] somebody actually listened to a podcast.

Today, when you send an MP3 file, all you know is somebody started and completed downloading. We’re embedding a URL into the file before we send it, where players can send us listening events. Did people get to the 25% point? The 50% point? The sponsorship? The playback platform sends that back to us without PII.

Publishers baking in ads themselves can encode the information in the file. Publishers doing [dynamic ad insertion can use their] ad server to insert the data.

Which publishers and platforms are on board? Is Apple open to this?

BM: Triton and AdsWizz are ready to support it and Art19 is evaluating it once we put the bow on it, [hopefully] within the next month or two. Apple is talking to us, but it would be a big gap [if they didn’t participate]. That’s about 60%+ of our listening.

How has programmatic evolved in podcasting since you launched the PodWave exchange with AdsWizz in July?

BM: [About] half a dozen publishers using AdsWizz’s ad server contribute excess inventory into PodWave. It’s programmatic in the sense that it aggregates inventory from different publishers that NPM can sell in channels, like arts and technology. But it’s not fully programmatic in that buyers can just hook in and buy directly.

What kind of data can you target against on PodWave?

BM: We can do demographic, gender or age targeting across the network and behavioral targeting among a smaller subset that’s just getting interesting enough to sell at scale. We can’t target against first-party data yet because device IDs aren’t tied together as cleanly as you’d think. Maybe in a year or two.

Is there enough scale for programmatic in podcasting?

BM: Everybody is selling what they have pretty well. The supply doesn’t necessitate a huge push into the programmatic marketplace.

Are you seeing more interest from brand advertisers to sponsor podcasts?

GINA GARRUBBO: It’s taken three years, but the number [of brand sponsors on our shows] has doubled. We’ve been doing more brand awareness and purchase intent studies, which they feel good about it.

[We work with] Discover, Whole Foods, Subaru, AT&T, American Express, Delta, State Farm and ExxonMobil. They want their message heard by an upscale, educated, hard-to-reach audience on an uncluttered environment.

Do you see a future for podcasting on large streaming audio platforms like Pandora and Spotify? What does that mean for smaller publisher networks in the podcast space?

BM: We’re probably where the video-on-demand space was five to six years ago. There were options but no clear winners. Now, everybody has several apps, and you can find the same content on multiple, but they all serve different niches.

On-demand audio will end up there in four or five years too. Right now, it’s all Apple. I suspect there will be five to six major players, and I would love it if NPR was one of them.

Edited for clarity.