“Let it go, let it go” is the theme song for any advertisers who might’ve had their hearts set on an ad-supported option for Disney+.

There won’t be one, Disney revealed during an investor day event on Thursday in Los Angeles.

Disney’s direct-to-consumer (DTC) streaming service, slated to launch in the United States on Nov. 12, will be ad-free and cost $6.99 per month or $69.99 for an annual subscription, which brings the monthly price down to $5.83.

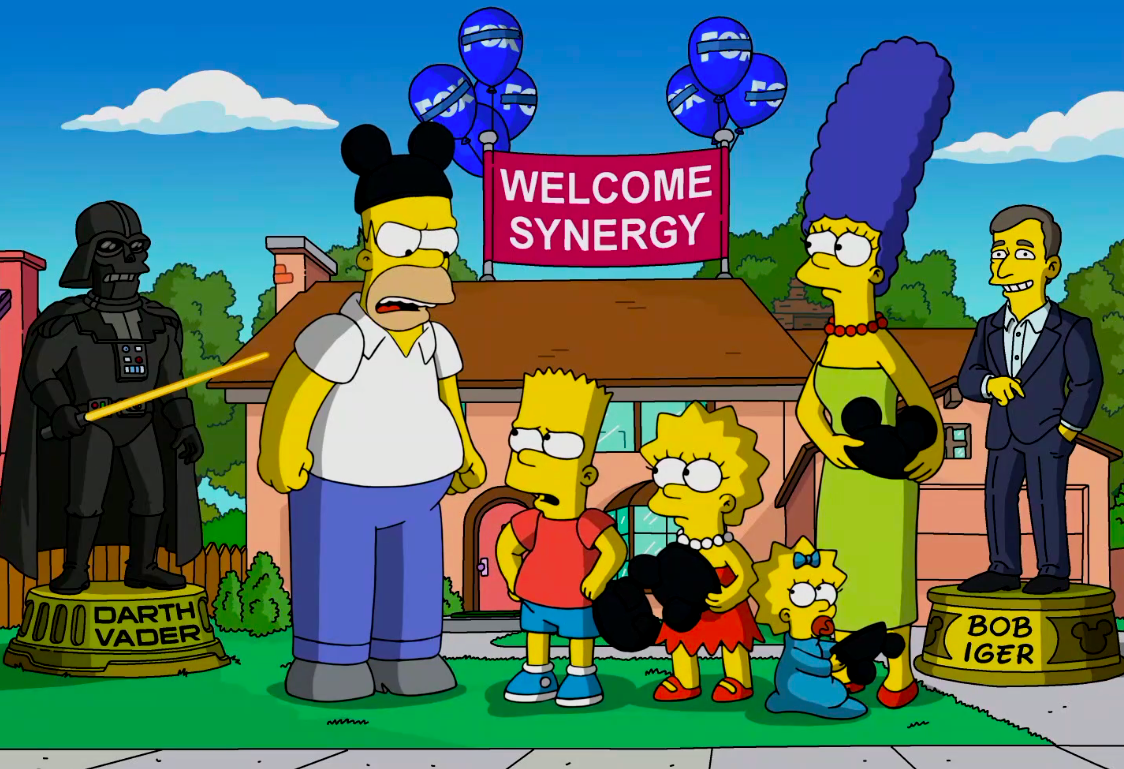

Even cynics who debate how many subscriptions poor consumers are supposed to sign up for before fatigue sets in have to admit that’s a pretty good deal for all the exclusive content Disney promises will be available on Day One. There’ll be classics from the vault as well as shows, documentaries, movies and a slate of originals from Disney-owned brands (Pixar, Star Wars, the Disney Channel, Marvel and National Geographic), plus select programming from the 21st Century Fox acquisition, including all 30 seasons of “The Simpsons.”

The catalog will keep growing as new programs are produced specifically for the platform and original films exit their theatrical release and home entertainment windows. The whole shebang is cheaper than Netflix, which costs $7.99 per month for a basic plan (for now). Netflix is set to hike its monthly price to $8.99 for all subscribers in May.

Disney expects somewhere between 60 million and 90 million subscribers by the end of 2024. Roughly one-third of subscribers are predicted to be domestic, and the rest will come from international markets. The plan is to spend around $1 billion on original content for the platform next year and to ramp that up to the mid-$2 billion range by 2024, which is also when Disney anticipates the service will achieve profitability.

The launch of Disney+ and the company’s DTC strategy writ large are both top priorities, said Bob Iger, Disney’s CEO and chairman.

“What we are putting forward is an aggressive strategy,” Iger said. “We’ve been all in from the beginning – we are really committed to this.”

But Disney’s DTC strategy includes more than just Disney+. There’s ESPN+, which Disney predicts will go from 2 million paid subscribers today to between 8 million and 10 million by the end of 2024, and Hulu, in which Disney now has a 60% controlling stake.

But Disney’s DTC strategy includes more than just Disney+. There’s ESPN+, which Disney predicts will go from 2 million paid subscribers today to between 8 million and 10 million by the end of 2024, and Hulu, in which Disney now has a 60% controlling stake.

Although Disney+, ESPN+ and Hulu will remain separate offerings, Kevin Mayer, Disney’s chairman of direct to consumer and international, hinted that the three services will “likely” be available as a bundle at a discount at some point.

Iger was insistent, however, on Disney’s reasoning for not creating a “fat bundle that looks more like traditional media.”

“As we look at the marketplace, we feel that consumers should have more flexibility in terms of what [they] subscribe to,” he said.

And Mayer was just as adamant about keeping ads off of Disney+.

“We made a judgment that the best way to serve consumers right now is to charge $6.99 a month without ads, and I think consumers will love that service,” Mayer said. “On the other hand, Hulu does have ads, but for Disney and these brands at this time, no ads is the right call.”

Apple made the same call for its streaming service, Apple+, which will also be ad-free and feature original programming. No word yet on how much that one will cost.

Here are a few other highlights from the Disney+ debutante ball:

![]() Disney plans to launch a huge, blowout marketing push to spread awareness and subscriber intent for Disney+ over the next few months that’ll include everything from in-theater and live event promotions to an “aggressive” paid media campaign through November and beyond. “As we launch, performance marketing will kick in and we will utilize data-driven analytics to identify segments and acquire additional subscribers,” said Ricky Strauss, president of content and marketing for Disney+.

Disney plans to launch a huge, blowout marketing push to spread awareness and subscriber intent for Disney+ over the next few months that’ll include everything from in-theater and live event promotions to an “aggressive” paid media campaign through November and beyond. “As we launch, performance marketing will kick in and we will utilize data-driven analytics to identify segments and acquire additional subscribers,” said Ricky Strauss, president of content and marketing for Disney+.

![]() BAMTech, the video ad tech provider that Disney acquired last year, is being rebranded as “Disney Streaming Service.” The entity formerly known as BAMTech serves as the underlying technology layer for Disney+ and ESPN+.

BAMTech, the video ad tech provider that Disney acquired last year, is being rebranded as “Disney Streaming Service.” The entity formerly known as BAMTech serves as the underlying technology layer for Disney+ and ESPN+.

![]() Disney is “actively” evaluating an international rollout strategy for Hulu, but the decision on how to approach it isn’t unilateral, since Comcast and AT&T both still own minority stakes, not to mention that each new market has its own considerations, from regulations and broadband infrastructure to consumer receptivity and streaming. “There’s still work to do, but we’re looking at it pretty hard,” Mayer said. “We’ll make decisions in the near term.”

Disney is “actively” evaluating an international rollout strategy for Hulu, but the decision on how to approach it isn’t unilateral, since Comcast and AT&T both still own minority stakes, not to mention that each new market has its own considerations, from regulations and broadband infrastructure to consumer receptivity and streaming. “There’s still work to do, but we’re looking at it pretty hard,” Mayer said. “We’ll make decisions in the near term.”

![]() With the Fox acquisition, Disney also got its hands on Indian media conglomerate Star and its streaming service Hotstar, which just hit 300 million monthly active users. “The average Indian consumer already spends 2.5 hours on video every day, and in two years, that is set to double,” said Star’s CEO Uday Shankar. “This is a thriving market for advertising and consumer payments.”

With the Fox acquisition, Disney also got its hands on Indian media conglomerate Star and its streaming service Hotstar, which just hit 300 million monthly active users. “The average Indian consumer already spends 2.5 hours on video every day, and in two years, that is set to double,” said Star’s CEO Uday Shankar. “This is a thriving market for advertising and consumer payments.”

![]() CEO Iger is still expecting to step down when his contract expires at the end of 2021. The Disney board is actively looking for a successor.

CEO Iger is still expecting to step down when his contract expires at the end of 2021. The Disney board is actively looking for a successor.