Say what you will about the rise of AVOD, plenty of people prefer streaming without ads – and advertisers still want to reach them.

On Thursday, Roku announced two new ad formats to help brands get in front of both ad-free viewers in addition to people streaming with ads.

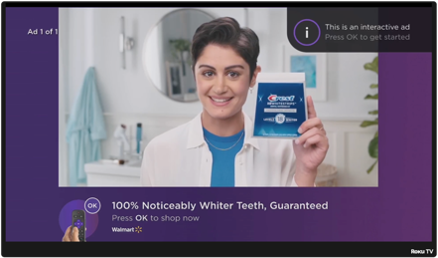

Its new marquee spots are ad units on the home screen, which it typically reserves for content recommendations from media companies. Advertisers will also be able to buy full-screen interactive ad units called “showrooms.”

This isn’t Roku’s first foray into less conventional ad inventory. It launched shoppable TV ads last year, for example.

But these latest formats are a chance to target ads to any Roku viewers, including ad-free ones, by reaching them on the home screen before they start streaming content, said Peter Hamilton, Roku’s senior director of ad innovation.

Power in numbers

Roku’s operating system currently reaches over 70 million global households, and with its own smart TVs now for sale, its scale could keep ticking upward.

The new marquee ads are now publicly available to brands, while showrooms are still in alpha testing with select clients. Showrooms will launch publicly before the end of the year, and both ad units will be available through direct deals, not programmatically.

Advertisers can match their first-party data with Roku’s to target marquee ads. The system will also use machine learning to suggest which ad creatives will generate the most clicks.

If a viewer clicks on a marquee ad, that advertiser can then retarget that same viewer with a 30-second spot in an ad-supported streaming service within or outside of Roku. Its OneView DSP can also find and target Roku audiences off platform with display units online.

Because marquee ads and 30-second spots are completely different formats that require different creative assets, retargeting someone who was exposed to a marquee ad with a video could boost awareness without that feeling of annoying ad repetition that viewers complain about.

And if viewers click on marquee ads with their remotes, Roku can use that conversion as a signal of purchase intent to inform targeting and retargeting.

It’s difficult to predict, however, whether TV viewers will choose to click on ads in this context, but it could happen. Viewers are five to 10 times more likely to click on a shoppable ad with their remote than to scan a QR code, according to Roku’s internal research.

Viewers are also more likely to interact with ads when they’re in market and less likely to interact when their intention is just to watch TV and be left alone.

“The challenge is making these ads relevant for users who are looking for entertainment,” Hamilton said.

Roku is encouraging brand partners to consider a call to action in marquee ads to draw attention, but it’s still too early to say what that might look like.

And for whoever doesn’t click on the ad, the ad exposure is an impression that counts in an advertiser’s retargeting campaign.

Window shopping

Still, shoppability is part of the goal for both of Roku’s new ad units.

Marquee ads will support checkout options by the end of the year where applicable, in addition to letting viewers send themselves product information or reminders via text or email, which counts as lead generation for Roku.

Once showrooms are available, advertisers can purchase full-screen interactive ad units whereby viewers can scroll or click through to see details about a specific product. The platform will also make some showrooms shoppable with checkout options through an advertiser’s site.

For example, in an automotive brand’s showroom, a viewer can click around to see different features and customizations available for a particular model.

Roku didn’t share which advertisers are testing showrooms, but said it’s starting with automotive with plans to add other verticals such as QSR and travel. Viewers will have the option to send themselves email or text reminders from a showroom, too.

Brands, meanwhile, will be able to access purchase intent data from automotive data services provider Cox Automotive, which they can use to strategize about how to reach audiences. Roku partnered with Cox earlier this year.

If consumers are earlier in the purchase consideration phase, for example, an automotive brand may choose to retarget them on TV to increase awareness, whereas those with higher purchase intent might be more receptive to a direct-response ad in search or display.

Cox Automotive can also tell advertisers who is more likely to buy from a competitor brand based on the automotive sales data it shares with Roku. Advertisers can then choose to run conquesting campaigns that specifically target and try to convert a competitor’s audience.

Add shoppability to the appeal of reaching ad-free audiences, Hamilton said, and the company expects “a good amount of advertiser demand” to follow the launch.

Reaching viewers prior to and in between streaming sessions is how brands can stand out, he said.