YouTube has sparked a brand fire, but can it ignite the same flame with content owners?

YouTube has sparked a brand fire, but can it ignite the same flame with content owners?

“YouTube invented short-form video and took the category from zero to 4 billion views over a period of five years, but then it flat-lined and nothing happened,” said Hilary Perchard, head of US investments for European broadcaster and pay-TV operator Sky.

“Then Facebook came along a year and a half ago and, on their own, doubled the market for short-form video while we saw [platforms like] Snapchat and Twitter enter video.”

Google doesn’t seem worried. It says brands are uploading more video content to YouTube than ever before and consumers, in turn, are viewing more video. After noting last week that watch time on the platform was up 60%, Google claimed advertiser spend is following a similar path.

In a YouTube brands report released late Sunday, Google claimed that the top 100 brands (as defined by Interbrand’s 2014 Best Global Brands ranking) have increased their number of video ads by 40%.

The top 100 brands with YouTube presences have amassed 40 billion video views across their respective channels, with close to half of those views occurring in the past year, while average spend per advertiser has increased 60% year over year.

Brands are investing in creating longer-form “made-for-YouTube content.” Ten percent of brand videos uploaded in the past year were 10 minutes long, compared to standard 15- or 30-second pre-rolls.

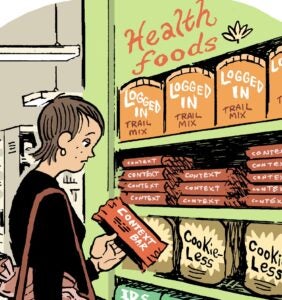

Google has pushed to make YouTube an advertiser-friendly platform by introducing ad formats like TrueView, which bill only when a user clicks to play and watches for at least 30 seconds or through the end of the video when ads are in-stream.

While YouTube focuses on helping brand advertisers monetize, Facebook focuses on views and keeping audiences engaged (and staying) in the Facebook environment. The social network is up to 4 billion video views per day, which is attractive to content owners who are interested in engagement – and more eyeballs.

But video content owners say Facebook needs to make progress on audience reconciliation before marketers or content owners invest more in the platform.

“Facebook doesn’t have a content ID like YouTube so your videos could be ripped off and you don’t know if it’s watched, let alone if you’re getting money for it, but these are problems they’ll have to solve,” Perchard said.

Despite these sentiments, Perchard said “we already know that Facebook is more important to us than YouTube in terms of video views.”

One of Sky’s brand objectives is to sell subscriptions for its pay-TV offerings (which include streaming service SkyGo), so audience reach is important and Facebook’s is massive.

Regardless of reach, one large broadcaster described a divide that exists between the big video platforms and media owners who want to monetize premium content in digital channels, YouTube in particular.

“There is the promise of scale and promise of audience with all these platforms,” the source said, “but if that comes at a cost to quality or transparency, it will be tough for these platforms to grow [as a place to] help people with their brand objectives.

“There’s been a large impasse between YouTube’s willingness to engage on business terms that the media partners feel are equitable in order for content and advertising to flourish on that platform.”