Last quarter, not a single CPG broke into the top 25 list of brands spending on programmatic desktop display.

Last quarter, not a single CPG broke into the top 25 list of brands spending on programmatic desktop display.

This quarter, according to Casale Media’s Index report for Q2, two made it into the top 10. Kellogg’s and Mondelēz took the sixth and eighth spots, respectively. (Data for the report was pulled from Casale’s Index Exchange SSP.)

It’s a trend that’s not relegated to display. As AdExchanger reported at the end of August, mobile CPG spend was also up in Q2 across multiple exchanges.

“About 90% of what we do today is still display, but the increase of CPG mobile spend is indicative of the cross-screen trend,” said Andrew Casale, VP of strategy at Casale Media. “The rise in CPG spend is happening everywhere.”

CPG was the second-biggest sector in terms of programmatic spend in Q2 at 14%, behind retail at 26% and financial at 12%. Casale Media came to its findings by indexing all of its impressions for the second quarter, roughly 300 billion across 50,000 brands.

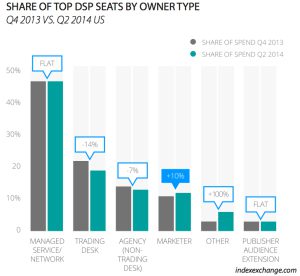

Casale also noted that more brands appear to be willing to get down and dirty with programmatic, bypassing agencies, trading desks and other managed service providers. The share of spend coming from the marketer community increased from 11% in Q4 2013 to 12% last quarter.

Although it might not seem like massive growth, it is representative of a nascent but steady trend tied to the increase in CPG spend.

Although it might not seem like massive growth, it is representative of a nascent but steady trend tied to the increase in CPG spend.

“Quite a few of the big CPG marketers, like Kellogg’s, Mondelēz and Kimberly-Clark, are familiar with doing programmatic direct,” Casale said. “We’re seeing a rise in CPG spend and an increase in spend coming from marketers starting to do buys directly. The trends are linked.”

It’s also interesting to note that of all the other players on the buy side, only the advertisers themselves increased their direct spend. In fact, volume coming from trading desks was down 14% between Q4 2013 and Q2 2014. “It appears marketers are not going through trading desks as much,” said Casale.

Now that multiple big brands are aboard the programmatic train, Casale said he feels more comfortable calling it a trend.

“Sometimes in programmatic we’ll see little micro-trends because one marketer, for whatever reason, decided to spend a big amount of budget programmatically, and that artificially moves the needle,” he said. “Over the years, it’s happened that something looks interesting one quarter, and the next quarter you realize it was only driven by one big brand. But what we saw in Q2 is spend being led by multiple large brands all moving at the same time.”

The report also drilled down a bit deeper into CPG, breaking it down into subcategories. Forty-nine percent of CPG spend was on food and drink, while 22% went to personal care and cosmetics and 17% to pharma. Casale came to its finding by delineating each piece of creative in its exchange with a subcategory tag.

The numbers make sense given Kellogg’s’ and Mondelēz’s prominence on the list of top spenders. “Perhaps if there was more spending by Unilever, for example, then other types of products would have been more dominant,” said Casale.

As for how Q3 is shaping up, Casale said it’s looking pretty similar to what he saw last quarter.

“We expect to see another jump in share of spend coming from marketers directly and a continued increase,” Casale said. “CPG is also holding right now in terms of number for Q3. What we saw in Q2 was not an anomaly.”