Google wants to prove it’s on retailers’ sides – big time.

Google wants to prove it’s on retailers’ sides – big time.

During a Google Shopping presentation for press at the company’s New York headquarters Wednesday, the search behemoth rolled out a slate of new mobile shopping features.

They include: Shopping Ads for Best Queries, which lists results for products based on online reviews; Google Now Price Drop card, an ad unit that alerts users when the price has dropped on an item they searched for; and Google Now In-Store Cards, an ad unit that surfaces information about nearby stores, like hours of operation and available deals for loyalty club members.

Google is also testing out a new feature called Purchases On Google, which is essentially a buy button that lets mobile shoppers purchase directly from Shopping Ads within search results, which the company hinted about in May.

Consumers who click on the “Buy on Google” tab are taken to a branded product page hosted by Google (merchants still manage the transaction and fulfillment process). Advertisers pay on a cost-per-click basis. Jonathan Alferness, VP of product management for Google Shopping, said shoppers can check out using payment credentials stored in their Google account.

About a dozen merchants are beta testing the product, with a full US rollout expected within the next month. Jason Spero, VP of performance media at Google, said the motivation was to meet the needs of consumers who want to transact on mobile.

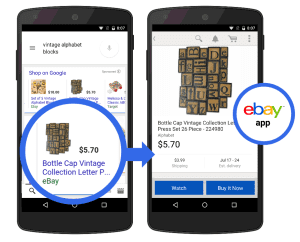

Google also rolled out app deep-linking for its Shopping Ads unit. (Deep linking was already available on regular search ads.) Consumers clicking on Google search ads can land on a specific product page within a merchant’s app – assuming the app is already installed – instead of a website.

“We’ve been largely focused on the digital world, but in the back of our minds we … always knew digital influenced people before they went to shop-in store,” Spero said.

With its push to measure “store visits,” Spero said Google wants to ultimately answer the question, “Did that YouTube video someone watched or the display ad or media they saw influence someone to the store?”

Google is also exploring ways to tie local intent queries to store sales. Google’s Local Inventory Ads have taken off, with Alferness citing 34x increases in queries near a user’s location. It’s also the first time Google has integrated local inventory feeds with Google Now, its voice-activated search mechanism.

Google is working on developing store visits and sales methodologies to bolster the mobile component.

“We need a good understanding of where things happen in the physical world,” Spero said, adding Google’s investments in mapping technology and partnerships with retailers to link geo-coordinates to media, have paved the way for some of these new ad products.

Deeper nuances are emerging around product particularities. For instance, it wants to answer the question, “If digital media ultimately drove someone to a store, for what period of time should the marketer credit the media that influenced that action?”

If the product in the consideration and purchase phase is a larger-ticket item like a car, perhaps the window should be weighted more than if the consumer was in-market for a short-term purchase like toothpaste or a taco, Spero said.

If the product in the consideration and purchase phase is a larger-ticket item like a car, perhaps the window should be weighted more than if the consumer was in-market for a short-term purchase like toothpaste or a taco, Spero said.

How it works from the sales perspective: When someone engages with a Shopping Ad, a third-party data partner like Acxiom or Datalogix could then link that information to a user’s profile. Through partnerships with retailers and access to loyalty card, purchase and affinity data, they would then link that information back to ad exposures through AdWords to close the loop.

While the data represents a “meaningful” sample, it’s by no means exhaustive since every consumer doesn’t join a loyalty program, Spero said. He added that Google is not trying to “corner the market on measurement,” but instead wants to surround the marketer and retailer with as much visibility as possible.

The stakes are high, especially in light of criticisms that marketers are paying more to drive a mobile search click on Google, but not necessarily seeing the return in traffic or revenue per visit yet.