This report concludes our series on programmatic buying in the BRIC countries. Read the earlier pieces on Brazil, Russia and India.

Tencent. Baidu. TaoBao. These websites are some of the most popular portals in China and, combined, made more than 42.8 billion yuan in advertising revenue in 2012 (approximately $7 billion), according to data from iResearch. This is not a surprise.

However, because these publishers have such large reach in China, they have a certain power not only over the online advertising market, but also the programmatic buying space.

The below chart from iResearch shows just how much top portals in China control the advertising space. In its 2012-2013 China Online Advertising Report, iResearch found that the top 10 publisher sites in China earn 78.2% of online advertising revenue and the top 20 sites earn 85.5%.

“What you have is some very strong, embedded, powerful publishers who are technically very savvy — Alibaba, Tencent, Baidu are the big three — and they have all launched exchanges of their own,” explained Stuart Spiteri, CEO of Brandscreen, an Australian ad-tech company that provides DSP and trading-desk services in the APAC region, including China.

“What you have is some very strong, embedded, powerful publishers who are technically very savvy — Alibaba, Tencent, Baidu are the big three — and they have all launched exchanges of their own,” explained Stuart Spiteri, CEO of Brandscreen, an Australian ad-tech company that provides DSP and trading-desk services in the APAC region, including China.

Lawrence Wan, managing director of Amnet China, the programmatic trading desk launched by Aegis Media in September 2013, said, “China has always been a supply-side game. When I try to explain to my colleagues overseas, they don’t quite get it because the power is usually within the advertisers and clients. Here it’s the other way around.”

On the publisher side, ecommerce site TaoBao and search engine Baidu both have ad exchanges while Tencent, which also has an ad exchange, launched its Tango DSP earlier in 2013.

Advertiser demand was part of the reason why Tencent introduced Tango, said Peter Cheng, general manager of the advertising platform in Tencent’s online media group, in an email to AdExchanger.

“Tango’s revenue is still small compared to our traditional display ad and content partnership revenue,” he said. “However, on the Tencent Ad Exchange, Tango accounts for a good portion of the ADX revenue.”

Grace Huang, CEO and co-founder of local DSP iPinYou, told AdExchanger that the big public exchanges — Google and TaoBao — are doing a lot to influence publishers to open up their inventory.

“In China, the main big portals are very dominating, so there are more private exchanges in China than in other markets,” she said. “Tencent, Sina, YoKu — these big publishers are forced to open up their inventories.”

But even as these publishers seemingly get more involved in the programmatic space, it has caused different types of problems and challenges for the growth of the market. One way this is apparent is the lack of data or data-management platforms.

For example, when publishers have their own private exchanges and are starting public exchanges and DSPs, they use their own data on their own networks. Therefore, they control more than the average ad-tech company in the US, which hinders the external data-management systems, and keeps transparency low in terms of pricing and performance.

“China tends to be more of a vertical integration from a technology stack perspective,” said Andy Fisher, chief analytics officer of CRM agency Merkle, which recently opened its second office in China, in Nanjing, after starting its Shanghai office in 2010. He added that these large publishers in China can combine several steps in the programmatic process under one roof.

Cheng backed that up, noting, “As you can imagine, publishers and advertisers in China are reluctant to share data due to trust and privacy concerns. Thus, there are very few DMPs available in China for the time being, which makes it difficult for DSPs to access quality audience data for effective targeting.”

Additionally, the publisher power also means they control what inventory is available on real-time exchanges.

“Sometimes, the media doesn’t want to open up premium inventory or all of inventory and make it transparent in terms of pricing,” said Sara Ye, president of Chinese operations for IPG’s Mediabrands Audience Platform (MAP). “It’s harder for trading desks and DSPs to really go further and have more premium inventory available in this ecosystem.”

Growth of Programmatic Buying

But despite the challenges that stem from such strong publishers in China, the RTB and programmatic market is growing.

Roy Zhou, the CEO of local DSP Yoyi Media, sees the global advertising conglomerates as drivers of programmatic buying in China.

“They all had experience at the beginning with programmatic buying in the US and they allocate a lot of budget on ad-exchange platforms in the US and Europe,” he said. With the advertisers’ experience and the publishers’ interest, “that’s why in less than two years the inventory on top of the ad-exchange platforms has increased from zero to 5 billion.”

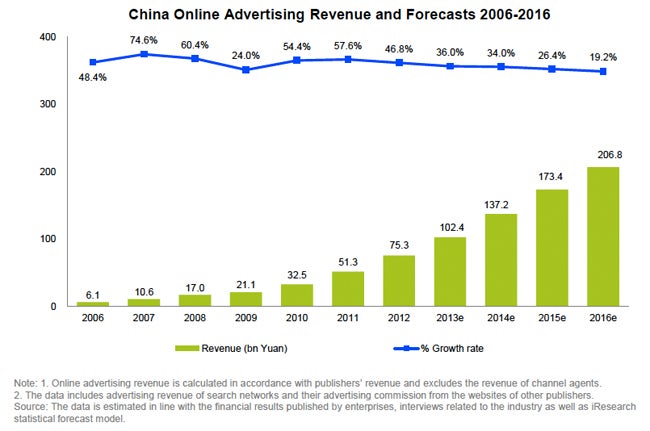

Overall, the online advertising industry is estimated to be 102.4 billion yuan in 2013 ($12.4 billion), according to iResearch.

Bob Chao, VP and chief analyst for iResearch, noted that 2012 was the birth of RTB in China, but that 2013 will bring more growth. He told AdExchanger the DSP display ad market in China was about 548 million yuan [approximately $90 million] in 2012, and will reach 1.53 billion yuan[or $251 million] in 2013, an increase of 180%.

“The opportunity [for programmatic buying] in China right now is enormous,” said Merkle’s Fisher. “Even though, percentagewise, the amount of media flowing through programmatic and leveraging RTB techniques is lower, that is going to accelerate and surpass countries like the US.”

Chen Yong, the general secretary of the Interactive Internet Advertising Committee of China (IIACC ), described the market of RTB as “a dumbbell,” with both small advertisers and large global brands spending money on RTB.

“Many small brands’ and advertisers‘ focus is on ROI and RTB can meet their needs,” he said in an email to AdExchanger. “Based on variables such as time and seasons, small brands and advertisers adjust their ads everyday, to better target different consumers. This is one side of the dumbbell.”

The larger, global advertisers have the technical knowledge of RTB and are interested in a data-driven business model. They are jumping on the trend in other countries and see the impact RTB is having, so they are also interested in the market in China.

“The brands and advertisers in the middle part of the dumbbell need to join in the RTB market,” Yong concluded, “but that may take time.”

Another unique aspect of the Chinese programmatic market is that there are local, regional and global players all in the sandbox. Some of the many DSPs include local players iPinYou and Yoyi Media, regional companies like Brandscreen and global companies such as Turn and Invite Media. Google’s ad exchange is joined by private and public exchanges from portals such as Tencent, TaoBao, Baidu and Sina.

As both global and local companies get into the programmatic space in China, there are also regulatory issues that must be navigated, explained Brandscreen’s Spiteri.

“There is an element of regulation that requires, by law, the publishers to authorize all of the content, including the creative advertising messages, on their sites,” he said. “If you have a bid match, you have an audience match and you want to place an ad through an exchange or a DSP, the publisher has to approve the creative.”

Brandscreen has been working on building such pre-approval infrastructure into its offering, Spiteri said. The local ad-tech companies may understand this process — and the homegrown publishers — better than others coming into the space, providing them an edge in an already competitive market.

There are a lot of unique characteristics to the programmatic space in China, but for all of the challenges and growth, it’s important to remember that the Chinese RTB and programmatic market is still very new.

“In our definition, 2012 was ground zero; it was the first year when RTB started to take shape,” said iPinYou’s Huang. “The key factors are the exchanges—TaoBao, Google—started their business in 2012. iPinYou started our DSP. Trading desks like Cadreon started to do test campaigns in 2012. Looking at it as if it’s a person, I would say that this year is the youth, like our teenage years.”

Tencent’s Cheng sees continued growth, but noted, “it may take a few years before it becomes mainstream.”

Video And Mobile

According to iResearch’s Chao, video will be the next big area of growth for RTB, as it is maturing as an advertising medium overall, and large companies such as Tencent have started testing the waters.

“The video advertising market in the first half-year increased 55% compared to the same period of last year,” he said. Mobile still needs to mature as an overall advertising platform, and the major social networks in China haven’t yet embraced RTB.

The IIACC partnered with the IAB for a joint report on consumer mobile trends in the US and China.

Yong, of the IIACC, said the study found that the smartphone market in China develops fast and that users in less developed cities often rely on smartphones more than their counterparts in more developed cities.

With this growth, “advertisers are focused on mobile advertising market, and budgets for mobile online advertising are growing very fast,” he added. “However, we cannot ignore that there is always a time lag for the recognition of new forms of advertising.”

* Calculations done using XE.com, as of Oct. 21, 2013.