Despite the troubles Twitter has had maintaining its audience growth rates, particularly in the US, it has consistently reported revenue increases. Its Q2 2014 revenue was no exception: The company hauled in $312 million – a 124% YoY increase.

Twitter again beat analyst predictions that the social media company would see revenues of about $282 million. Advertising accounted for $277 million in Q2, a 129% YoY increase, driven by higher engagement, according to CEO Dick Costolo. “This translates to higher ROI,” he added. Mobile advertising was 81% of total advertising revenue.

Other high points:

On those pesky monthly active user (MAU) numbers

Like a popcorn kernel stuck in its teeth, Twitter has been unable to dislodge worries about its audience growth rates. While Twitter’s growth rates in Q2 2014 increased 24% to 271 MAUs (60 million US, 211 million international), this is another slowdown from the 25% worldwide increase it reported last quarter.

Twitter wasn’t hammered on this point quite as heavily this quarter compared to previous quarters.

This is possibly because Twitter executives effused about the possibilities reaching logged-out individuals that consume Twitter content.

“There are hundreds of millions of users who come to Twitter every month but don’t log in,” Costolo said. “It’s two to three times that of just our monthly active user base.” He added this “total audience and reach represent a significant opportunity” and while Twitter will “experiment” with attracting them – such as by making profile pages more attractive – there aren’t immediate plans to monetize logged-out audiences.

Of course, Twitter derives revenue from advertising, which loses its power and value when it’s not targeted to logged-in users. So it’s fair to question how valuable logged-out Twitter audiences are. But Costolo noted that logged-out Twitter visitors tend to give strong intent signals – for instance, arriving via search query.

“Long-term, those signals will provide us with the data we need to deliver the right kinds of monetization experiences,” Costolo said.

Mobile movement, MoPub and more

If there’s one characteristic uniting Twitter users, it’s mobility. The company reported 211 mobile MAUs (78% of total MAUs), a 29% YoY increase.

Naturally, Twitter has moved to bolster its mobile offerings, most notably with last year’s acquisition of mobile ad exchange MoPub.

“We continue to see our big bet on programmatic buying, mobile buying and the accelerated investment in mobile advertising all map so directly to precisely the kind of work we’re doing in MoPub,” Costolo said.

Anthony Noto, the incoming CFO (replacing Mike Gupta, who will transition to a position overseeing Twitter’s strategic investments), said MoPub is seeing strong growth, with 170 billion ad impressions going through the platform over the last 30 days.

Noto also hinted at how the acquisition of retargeting platform TapCommerce last month will tie into the MoPub investment. “[It] will allow us to take the demand and aggregate it across not just Twitter inventory but the network inventory we’re seeing on the [MoPub] exchange,” he said.

Time for timeline views

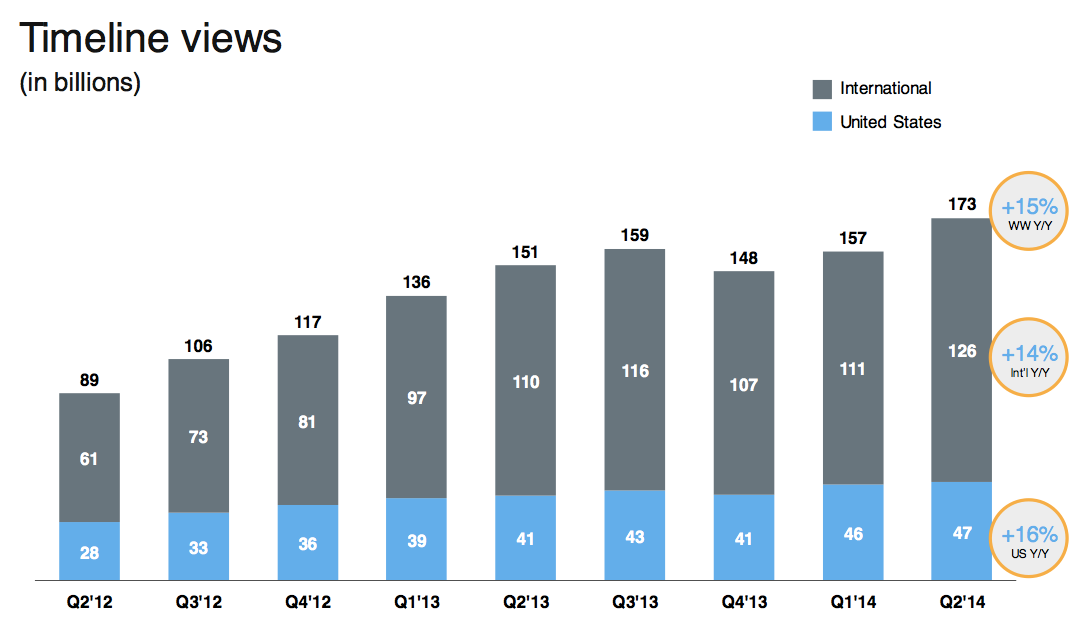

Another bright spot: Twitter’s timeline views worldwide improved. In Q4 2013, it faced a significant decline from 159 billion to 148 billion, followed the next quarter by a modest recovery to 157 billion. However it had 173 billion timeline views in Q2 2014, besting its Q3 2013 high. This marks a 15% YoY increase.

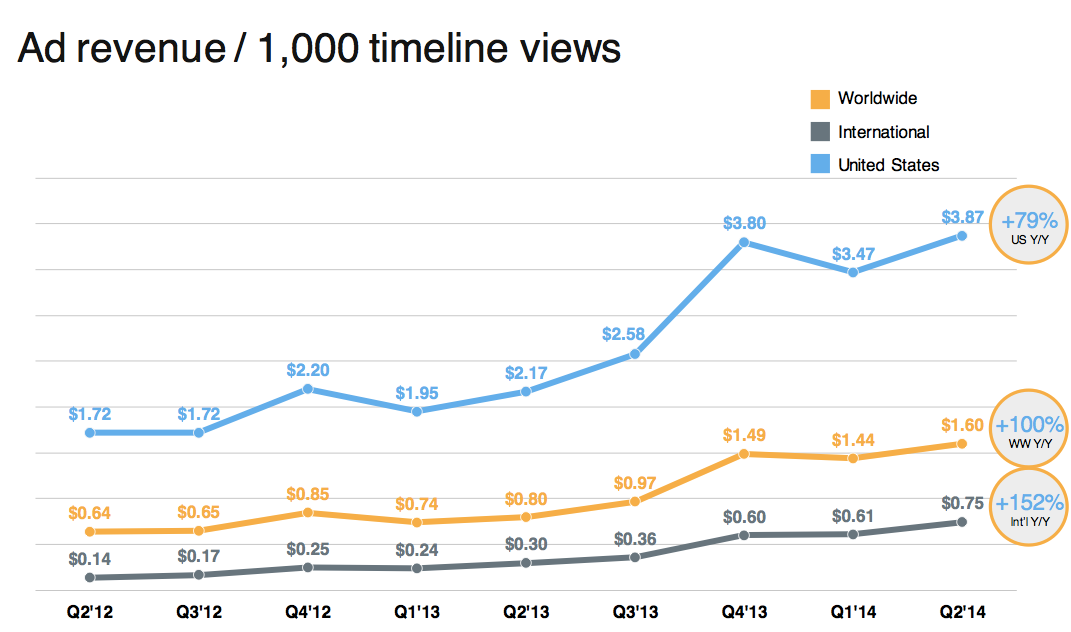

And advertising revenue per thousand timeline views was $1.60 in Q2, a 100% YoY increase. There are strong disparities between the US ($3.87 per thousand views) and internationally ($.75 per thousand views).

Noto said this relates to the relative maturity of the US market as well as the fact that the international label represents multiple geographies, with different levels of maturity. “And the devices used to access Twitter are very different [internationally] and that lends itself to not as much consumption,” Noto added. As those devices become more advanced, he predicted the international vs. US gap will begin to close.

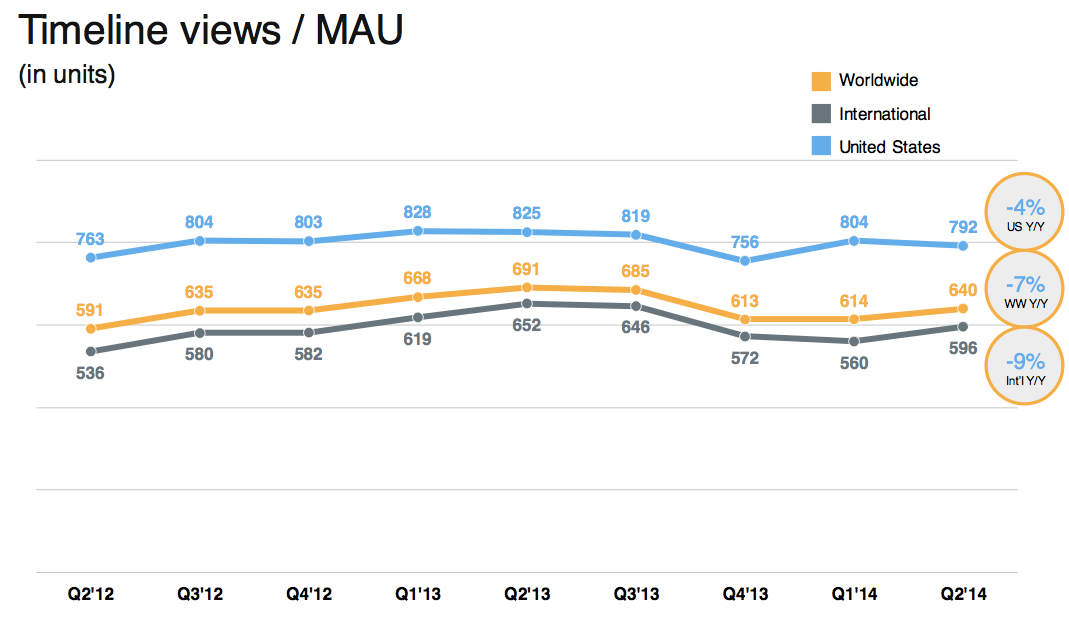

Some analysts were disappointed around timeline views per MAU, which declined YoY 4% in the US and 9% internationally. Twitter had a phenomenon for this in the US, saying that Q1 benefited from annual events like the Super Bowl and the Oscars, fervor that the World Cup – an event for which Twitter didn’t count timeline views – couldn’t replicate.

Costolo also emphasized the product changes Twitter makes affect timeline views per MAU.

Ecommerce, video and beyond

Twitter was coy about products it would release in the future, particularly those focused on ecommerce and video.

While analysts inquired about Twitter’s ecommerce plans, particularly around a recent partnership with Amazon, the execs emphasized these were merely experiments and that commerce frequently occurs on the Twitter platform. However, Twitter recently acquired CardSpring, a platform that enables the creation of payment applications, “which complements our commerce strategy.”

On the subject of video, Noto said Twitter intends to launch in August a video offering through which users can upload and share video on the Twitter platform and measure its effectiveness. This upcoming solution will likely use assets from SnappyTV, which Twitter said in June it would acquire.