Publicis has outperformed its agency holding company peers, including WPP, Omnicom, Dentsu and IPG, largely on the strength of its retail and ecommerce acquisitions.

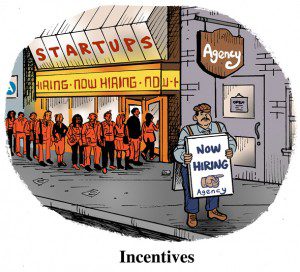

The Publicis commerce strategy will be put to the test, though, as agencies plan to curtail spending with Publicis-owned businesses. You read that right: agencies.

Many of Publicis’ fastest-growing and most strategic business units – including CitrusAd, Profitero, Epsilon and Conversant – earn a large chunk of their revenue from other agencies.

Although investors applauded Publicis’ buying spree of new businesses focused on retail media and ecommerce, several of those businesses count numerous other agencies among their client base.

AdExchanger spoke with execs at all of the major agency holding companies, as well as prominent independent ad agencies and three marketers at large CPG brands, who all said that they’re reevaluating how they work with Publicis-owned businesses.

The commerce brag

Other agencies are being spurred to action in no small part by Publicis CEO Arthur Sadoun, who in the company’s earnings report last month flexed its retail ad tech and SaaS businesses as key differentiators in winning accounts and collecting strategic data.

He bragged to investors that the holdco is leading in CTV and retail media thanks to Epsilon (acquired in 2019) and CitrusAd (acquired in 2021).

Sadoun also said that Profitero, the ecommerce SaaS analytics business Publicis bought in 2022, has been a key to winning new business by “connecting our identity to the inventory of the client.”

Prior to its acquisition in 2022, A key element of Profitero’s value prop was its status as a broadly available agency tool. Dentsu, IPG, MDC Partners, VaynerMedia, Horizon Media and Publicis all used and contributed data to Profitero.

But the tool is less valuable today than it was when it was independent, according to three Fortune 50 CPG brand marketers, all of whom spoke with AdExchanger on condition of anonymity.

It’s particularly frustrating, one marketer said, because Publicis identified promising tech companies only to practically remove them from the market.

Four years ago, Profitero was among the best innovators in ecommerce software, she said. CitrusAd, too, was making a run at being an open competitor to Criteo and the walled garden platforms.

Fast forward, and “neither of those companies has iterated since they were acquired,” the marketer said, and Citrus lost flagship retailer clients including Albertsons and GoPuff.

Meanwhile, Criteo, which has historically gone direct to brand, had been losing ground to Citrus, because the latter’s solution was built for agencies. But since the CitrusAd deal, Criteo has been able to consolidate agency budgets and its revenue coming from major holding companies grew by 50% year-over-year, CEO Megan Clarken told investors in July.

One reason Publicis has failed to innovate on its acquisitions is that, well, tech is difficult, said one agency buyer with a background in ad tech. He pointed to Criteo and other retail retargeting companies like RTB House, which are active in the Chrome Privacy Sandbox, in IAB Tech Lab working groups and in other tech forums.

“Publicis isn’t built for that,” he said.

The data edge

The data edge

The other issue – and one that mid-level agency buyers have elevated to corporate holding company leaders – is that the Publicis SaaS and ad tech businesses collect valuable data from agency customers.

Profitero, for example, is a livewire that runs directly into a brand’s pricing and promotions.

And then there’s Conversant (the DSP that came along with Publicis’ acquisition of Epsilon in 2019), which collects data about the creative, the targeting parameters, the successful and unsuccessful aspects of a campaign and more from the agencies it works with.

That data is all just sitting there in the ad serving and delivery system. And it could be very useful in a bakeoff or RFP, said one holding company data analytics leader – although he hedged.

“I don’t think any of that data does get used that way,” he added.

Pulling back from Publicis

Still, agencies are becoming wary.

Retail media buyers at three holding companies told AdExchanger they plan to halt or pull way back on spending with Conversant.

One buyer said his agency began an internal review in February, when Sadoun also flexed Epsilon’s growing importance to the business – as well as its access to valuable data sets about its competitors in market.

Another buyer said they recently stopped spending on Conversant entirely, and now classify it internally as a shoddy inventory reseller (an actual category used internally, he added, not just an offhand adjective).

Should Publicis care?

Publicis may continue to grow even if other agency holding companies stop spending with Citrus, Profitero, Epsilon and Conversant.

Outside holding company budgets are “immaterial” to Publicis’ ad tech and SaaS businesses, a Publicis spokesperson told AdExchanger in an email.

That does depend on how you define “material.”

For instance, Omnicom Commerce and Flywheel, a retail media agency it acquired last year, spent nearly $250 million in the past year with Publicis-owned tech, primarily CitrusAd, according to an Omnicom exec who spoke on background. That may sound like a lot, but it’s down dramatically in the past year and will soon be petering away to zero, they said.

But, for Publicis, outside agency budgets are immaterial because “these services are primarily dedicated to our clients,” according to the Publicis spokesperson. They added that new business may now be going directly to the brand, rather than via the holding company.

And another point in Publicis’ favor: Investors like this trend.

Publicis’ profit margin is now 3% better than any other agency holding company, Sadoun boasted last month. That’s because Publicis is now thought of more as a “transformation partner,” he said.

But SaaS and ad tech margins are better than agency margins, so the new retail businesses are pushing Publicis’ overall margin up.

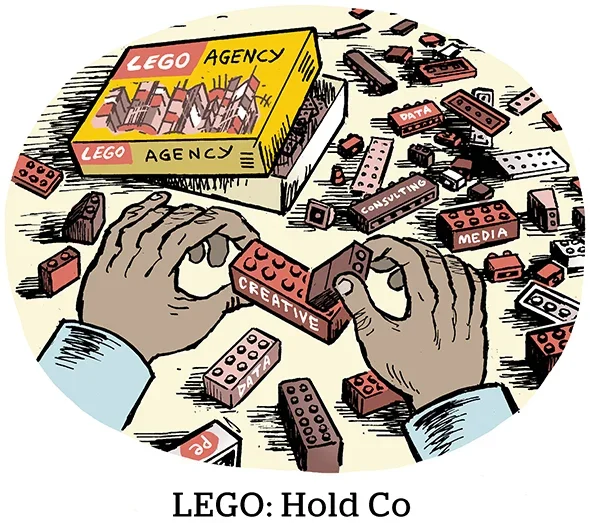

In other words, call the waah-mbulance, because Publicis is only doubling down on a new approach to tech and data acquisitions that take it further from traditional agency business models – with more to come.

Publicis has an overall M&A budget of between $750 million and $900 million, Sadoun told investors in July, and the holdco has further potential commerce-related deals on the table right now.

“Commerce is a big area for us,” he said. “This is definitely an area where we’re going to continue to invest.”