Remember 2008, when the App Store was full of fart apps? That’s not the sort of inauspicious start Apple has in mind for Apple TV.

Remember 2008, when the App Store was full of fart apps? That’s not the sort of inauspicious start Apple has in mind for Apple TV.

“Sure, you’ll get lots of weird stuff at the beginning – the Fireplace app was the most popular Apple TV app over the holidays – but we’re going to see it evolve,” said AppLovin CEO and co-founder Adam Foroughi. “The same type of genres that matter on phones and tablets will matter on TV, everything from gaming and entertainment to news and utilities.”

That’s certainly how Apple sees the world. As company CEO Tim Cook gleefully declared when Apple released the most recent generation of Apple TV, powered by the tvOS operating system, in September: “We believe the future of television is apps.”

It’s unclear how much runway Apple still needs if it’s going to realize that vision. In September, J.P. Morgan estimated that Apple would sell 24 million Apple TVs in 2016. How that prediction is panning out is unclear and Cook wasn’t much help on Apple’s Q1 2016 earnings call on Tuesday, noting only that this was the “best quarter by far for Apple TV sales.” He didn’t get more specific.

Hard sales numbers aside, the volume of tvOS apps is growing markedly. There are now more than 3,600 apps in the TV App Store, up from roughly 2,600 in December.

But scale is still a barrier to entry for advertisers.

“Brands need an audience, and for now, that audience is relatively small and brands don’t care about it enough to do more than spend a little test budget,” Foroughi said. “But when it gets more mainstream and there are more ways to consume content, that’s going to change.”

Speaking of scale, inventory is an issue. There’s just not enough of it. Static display ads, that hoary workhorse of app monetization, aren’t going to cut it on television, and video will probably be scarce, just like it is everywhere else.

Although it’s still too early to tell, it’s likely users will engage with their Apple TV over longer, but fewer, overall sessions – it’s a lean-back device, after all – so “apps that normally score well on shorter sessions – often ad-driven apps – will be challenged to generate enough inventory,” said Martijn van der Gun, an independent developer based in the Netherlands who’s using AppLovin’s tvOS SDK to help monetize several home workout apps.

That said, van der Gun is bullish on the platform. Advertiser interest may be nascent, but apps are putting down roots.

“Installs are pretty good, considering the short time that Apple TV has been available, although install rates aren’t as high as compared to other devices, [like phones],” said van der Gun, who noted that he sees hundreds of daily downloads of his tvOS apps. “But there are still only a few fitness apps available on the Apple TV, which is definitely to our benefit.”

The Screening Process

Also to the developer’s benefit is the fact that Apple seems particularly invested in helping developers embrace Apple TV.

Also to the developer’s benefit is the fact that Apple seems particularly invested in helping developers embrace Apple TV.

In December, Apple started hosting a series of “Tech Talks” across major cities in the US and across the globe to educate developers on building and designing for tvOS. Stops on the roadshow include New York, Los Angeles, Austin, Seattle, Berlin and Tokyo.

“They’re really working with developers to teach them about the opportunities here,” said TUNE CEO Peter Hamilton, who attended Apple’s Seattle Tech Talk.

AppLovin’s Foroughi has also noticed an accelerated approval process for tvOS apps. Whereas a new iPhone app usually spends roughly a week or so in review before Apple shares feedback, tvOS apps are only spending one or two days in the queue.

That’s likely due, at least in part, to the fact that there are fewer tvOS apps being submitted, but Foroughi suspects that there’s probably also a special queue specifically set up for iOS. “Apple cares about this and they’re trying to keep the app flow as high as possible so more content comes through,” Foroughi said.

Paid Programming

It’s also not 100% clear, as it never is, exactly what Apple wants from advertisers. Beyond user experience guidelines, Apple doesn’t print or distribute rules around the best way for a developer to monetize, whether than be through in-app purchases or through a paid, freemium or paymium model. (Paymium is when a user pays to download an app and then continues to generate revenue by making subsequent in-app purchases.)

The paid model does seem to be winning out, though. At its Tech Talk in Toronto on Dec. 7, Apple told developers that 47% of tvOS apps are paid, 38% are free/ad-funded, 12% are freemium and 3% are paymium.

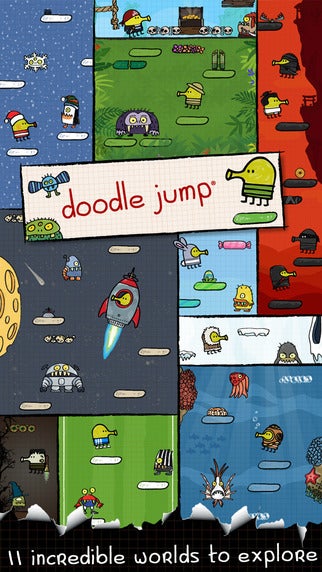

“Apple TV opens up TV-based gaming to developers who are much more familiar with monetizing through advertising and in-app purchases,” said Matt Turetzky, chief operating officer of NYC-based app publisher Lima Sky, maker of the “Doodle Jump” game, which hit No. 1 in the App Store’s paid app rankings for a period in 2010. There’s now a tvOS version.

Turetzky expects that monetization for “Doodle Jump,” which uses AppLovin’s tvOS SDK, will be a blend between an ad-funded model and traditional TV “with a greater focus on branded video advertising.”

Turetzky expects that monetization for “Doodle Jump,” which uses AppLovin’s tvOS SDK, will be a blend between an ad-funded model and traditional TV “with a greater focus on branded video advertising.”

Video is one of the most natural ad formats, Foroughi said.

“Just think of commercials which on Apple TV might translate into a pre-roll or a user watching a video in the middle of a game to get more lives,” he said. “But the app has to have a natural video integration point. Something like the Fireplace app, for example, would be terrible for content publishers. You can’t put video ads between the flames.”

The Advertiser Perspective

One advertiser already experimenting with video placements on tvOS is HotelTonight. The hotel booking app launched its first video campaign on Apple TV in January.

The spots are similar to the branded video content HotelTonight ran as part of a user acquisition campaign across AppLovin’s publisher network last year.

But it’s a little more complicated in the TV environment, said HotelTonight CEO and co-founder Sam Shank.

If users see an app install ad on their phone, they can tap to download on that same device. If they see the ad on their TV, though, they’d have to switch to their phone if they want to install the app, which creates another layer of friction. HotelTonight has no plans to create its own app for Apple TV right now.

Which is why Apple TV feels more like a branding play at the moment, although digital targeting is where the potential lies. For now, HotelTonight is just doing country-based targeting, but Shank said he expects that “the targeting parameters will get more sophisticated over time.”

“Apple TV is more of a channel for awareness now, rather than transacting,” Shank said. “But I could imagine a scenario down the line where TV apps and the apps on your phone are in sync, which might lend itself to a transaction experience.”

There are clearly still kinks to work out before Apple TV becomes a regular part of an advertiser’s budgeting considerations, but the opportunity is there.

Even though Apple TV launched in 2007, before both Roku and Chromecast, its market share lagged against competitors. But in November, less than three months after its most recent launch, Apple TV became the leading set-top box, with 31% of the streaming TV hardware market, according to Slice Intelligence.

It’s also true that Apple sleek platforms have always been attractive to brands and advertisers alike.

“Apple TV is interesting because most brands don’t build Android-first, they build Apple-first – and that should have meaningful ecosystem effects,” said Michael Katz, CEO and co-founder of mParticle. “Apple essentially has a monopoly on high-value users, so things sort of trickle down from there.”