NASCAR fans are loyal fans – and loyal fans are gunning to engage.

NASCAR fans are loyal fans – and loyal fans are gunning to engage.

But until last week, NASCAR, which acts as a governing body for stock car racing in the US and around the world, didn’t have a way for its fans to show their loyalty through the organization’s mobile app, a linchpin of its overall digital strategy.

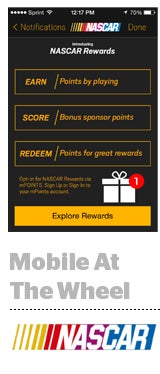

NASCAR relaunched its app, complete with new rewards-based loyalty functionality powered by mobile loyalty platform SessionM, to coincide with the Daytona 500 last Sunday.

Registered users of the app can now earn points based on their frequency of usage, for checking in at a racetrack, accessing the app during a live broadcast, making purchases on NASCAR.com or engaging with videos, rich media ads or branded games.

NASCAR’s loyalty play also has an attractive location component. Users can earn points for checking in at a physical venue, say a retail location, restaurant or stadium, or for checking in during a live TV broadcast. Users who upload photos of receipts can earn points for offline purchases.

“We were looking to create a really good user experience and to bring value to the most loyal users of our app,” said Tim Clark, senior director of digital platforms for NASCAR Digital Media.

NASCAR reassumed control over its digital and social properties, including NASCAR.com, its phone and tablet apps and its Facebook, Twitter and YouTube accounts, from Turner Sports in 2012 and relaunched its digital experience the following year, complete with live scoring, access to in-car audio and video, driver stats, results, sporting news and real-time race highlights. Turner will continue to handle NASCAR’s digital ad sales through 2016.

The racing body’s official app, sponsored by Sprint and Toyota,is an on-the-go hub for all of these features, each of which can now function as a points-earning opportunity for fans and a potential native play for advertisers. Users can earn mPOINTS, as SessionM’s loyalty currency is called, by engaging directly with advertisers like Walgreens and shipping startup Shyp.

NASCAR collects basic user information upon registration, including email address, age and gender. It uses these to personalize content. It also leverages its SessionM relationship to access users across the SessionM network of apps.

SessionM’s loyalty tech is integrated with about 1,200 apps, including Sony’s Crackle, TMZ, Flixster, apps from Warner Brothers, CBS local sites and Moviefone, as well as a variety of fitness, sports and entertainment apps. SessionM uses those integrations to tap into active audiences on behalf of clients like NASCAR.

“By virtue of the fact that we power all of these loyalty programs, where consumers opt in to create an account, we have access to a large logged-in audience across apps, which gives us a lot of rich first-party data,” said SessionM CRO Bill Clifford. “If a brand is trying to reach 35-year-old male sports enthusiasts, we can target users that meet those criteria across SessionM’s coalition of apps.”

As users spend more time in apps across the network, engaging with features and taking voluntary surveys, SessionM collects behavioral data and other attributes. Apps like NASCAR’s can benefit from that information to inform its audience acquisition and activation.

“Over time, we might have about 55 different datapoints on registered users,” Clifford said. “From there we can acquire users into NASCAR’s app or retarget existing fans between races or throughout the long season to keep them coming back.”

SessionM also runs a program that allows its developers to reinvest the ad revenue they generate through the platform in audience acquisition for a discounted rate. According to Fiksu, the average cost per loyal user is up about 40% to $2.90 since December. SessionM charges its apps $1.25 on a cost-per-install basis.

SessionM also runs a program that allows its developers to reinvest the ad revenue they generate through the platform in audience acquisition for a discounted rate. According to Fiksu, the average cost per loyal user is up about 40% to $2.90 since December. SessionM charges its apps $1.25 on a cost-per-install basis.

“SessionM has an expansive network of other apps and loyalty programs, and we’re looking to learn from them as we continue to evolve our app experience,” Clark said. “We try to be as unobtrusive as possible and we never dive deeper that we need in terms of basic data collection. We never look to gather any data that we can’t use to improve the user experience. Everything we do have got to be mutually beneficial for the user.”

But advertisers also can benefit from NASCAR’s engaged audience. According to Clifford, more than 70% of users watch video ads in NASCAR’s app, with a 98% completion rate on 15-second spots and a 95% completion rate on 30-second spots.

“We’ve found that when an experience feels native, people are more likely to engage, which drives a higher value exchange between brands and consumers,” Clifford said.

In terms of inventory, the vast majority is sold directly, although SessionM does facilitate a few private programmatic direct deals.

“We view this as extremely premium inventory and we think brands view it in the same way,” Clifford said. “We’re not talking about banners and interstitials.”

Clarke declined to share the exact number of monthly active users on NASCAR’s app.