Mobile advertising is on the rise and, looking at reports from the third quarter 2012, the use of mobile real-time bidding by buyers and publishers is also growing.

Mobile advertising is on the rise and, looking at reports from the third quarter 2012, the use of mobile real-time bidding by buyers and publishers is also growing.

Market intelligence firm IDC predicts that mobile advertising will reach $8 billion globally in 2012, jumping to $14.2 billion by 2014. Looking just at the U.S., market research firm eMarketer forecasts that $2.6 billion will be spent on mobile advertising this year, an 80% increase compared to 2011.

Nexage expects even more mobile advertising growth going into the fourth quarter, as many companies look to capitalize on consumers’ smartphone usage around the holidays. Nexage will have a full report coming out mid-December, but previewed for AdExchanger that demand for RTB ads increased 70% from the second quarter to the third, and the platform saw a 33% increase in auctions during the quarter.

“RTB is moving from a disruptive technology that at first was thought of as a remnant strategy, and it is becoming more mainstream,” said Victor Milligan, CMO for mobile advertising platform Nexage.

Karsten Weide, program vice president for Digital Media and Entertainment for IDC, notes that there is still a ways to go with mobile RTB compared to desktop: “In the mobile world, I am hearing from providers there are like three bids, which is just enough to make it work. But it is just a matter of time before it goes to mobile.”

Milligan said that the strength of demand for RTB on mobile, along with the acceptance of higher prices, is an important part of the future of mobile advertising. Nexage also reported that CPMs increased 44% between Q2 and Q3 on the Nexage exchange.

“One of the big headlines for the third quarter was the growth in strength in RTB,” said Wes Biggs, CTO and co-founder of Adfonic, a buying platform for mobile. “We knew that it was a growing ecosystem, but by the end of the quarter we were getting close to 50% of our inventory coming from RTB.”

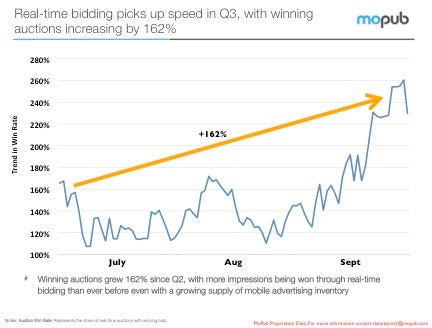

Adfonic officially reported that RTB ads made up 34% of all the impressions from its network in the third quarter, an increase from 21% in the second quarter and 8% in Q1 2012. On MoPub’s RTB exchange for mobile ads, more RTB impressions were won than ever before, with winning auctions up 162% since Q2 2012 (download report).

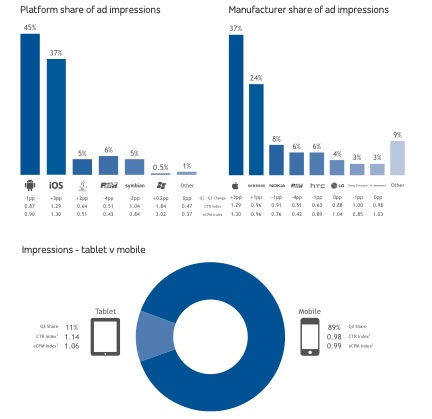

In other mobile ad data, tablets saw 11% of all mobile ad impressions during Q3 2012, according to Adfonic, while 89% of impressions came from mobile phones. Millennial Media reported that data slightly differently, showing that 75% of impressions on its network came from smartphones, 5% from feature phones, and 20% from non-phone connected devices.

When it comes to manufacturers’ share of impressions, Apple was the leader, followed by Samsung, according to both Adfonic and Millennial Media. Adfonic reported Apple saw 37% of all impressions, while Samsung came in at 24%, and Millennial reported that Apple had 31.5% of impressions, compared to Samsung’s 24.4%.

But looking at the operating systems, Android saw the largest share of impressions, 45%, followed closely by iOS with 37%, according to Adfonic. On Millennial’s platform, Android had 52% of impressions, while iOS had 34%.

Looking forward, we can expect continued growth in mobile advertising. As Weide described it, “2015 will be the year that, for the first time, there will be more users accessing the internet through a mobile device rather than a computer, so advertisers will continue to follow the eyeballs.”