SDK mediation is still a major headache for developers.

SDK mediation is still a major headache for developers.

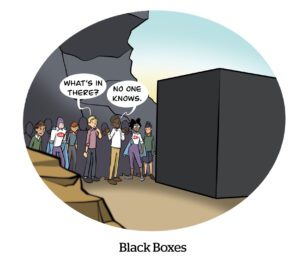

“We constantly hear from publishers that they want full control of their inventory – they don’t want to send their inventory into a black box,” said Ajitpal Pannu, chief business officer of mobile ad exchange Smaato, which on Wednesday launched a tool designed to act as an interface between multiple demand-side partners.

Most developers have several ad network SDKs integrated into their app, and they choose the order in which those networks get called, a process that takes continual calibration to get the best results.

When an ad call happens, developers toss their inventory into the void to await the verdict on eCPM. But because it’s not a true dynamic auction, developers can often miss out on the most attractive pricing for their inventory. If there are three ad networks integrated, for example, and No. 3 happens to have the best price, a developer will never know there was a better deal to be had available if network No. 1 grabs the impression at a lower price.

Smaato is integrating a number of other ad servers, ad networks and exchanges into its publisher platform, SPX (Pannu declined to name which ones), in order to give publishers a bit more flexibility around who they monetize with. Publishers will also be able to add in their own partners, as well as run their direct-sold and private exchange deals through SPX.

One such publisher is Fingersoft, the Finland-based game studio responsible for Hill Climb Racing, which has been downloaded more than 400 million times since 2012.

“The performance of a single network may vary a lot from month to month, week to week, day to day and hour to hour,” said Jarkko Paalanen, Fingersoft’s director of business development.

Which makes mediation between multiple networks a time-consuming process. Paalanen estimates that he and his team are forced to dedicate around 30% to 40% of their time to ads ops. It’s time they’d rather spend actually developing their apps.

Mediation “is not our core focus,” Paalanen said. “We want to build games versus allocate time to evaluating new advertising partners.”

Pannu is the first to admit that Smaato’s SDK manager isn’t the first mediation tool on the market. But while other players manage ad traffic through a waterfall-type situation, with tags for various ad networks only loading once someone else has passed on a particular impression header bidding is taking that on in the desktop environment – Pannu claims that most mobile apps are still subject to the vicissitudes of the waterfall.

Smaato’s tool creates a unified auction where the highest bid wins – which may or may not be serviced through Smaato’s platform. In cases where the impression goes to another ad server, Smaato sacrifices the revenue to its competitor.

Smaato is willing to do that in the hopes of making its platform stickier with publishers looking for better prices without having to expend too much time actually managing the monetization. A sort of one-stop-shop scenario in which publishers use Smaato’s SDK – Smaato is working with around 90,000 app developers and publishers – to get a handle on all their other SDKs.

“When there are a daisy chain of SDKs, publishers lose control over the decisioning,” Pannu said.

From Paalanen’s perspective, ad ops might pay the bills, but he’s not interested in spending his whole day pulling the levers.

“We would much rather have the partner focus on optimizing and getting on the top versus me allocating my team’s valuable time to monitoring a given partner’s fill rate and eCPM,” Paalanen said.

It’s a similar wariness to the one that he and many other developers are beginning to feel when it comes to SDK integration in the first place.

Developers are limiting the number of partners they work with, partially as a self-preservation mechanism – mobile ad companies live or die by their SDK integrations, which makes them fairly aggressive in their outreach – and partially because there’s a trend toward fewer SDKs doing more, rather than separate SDKs for each specific need.

“I would rather not integrate any SDKs,” Paalanen said. “Each SDK seems to have problems that are unique to them … and there are constant maintenance updates for integrating many versus integrating only one or two.”