Streaming TV continues to get all of the attention from advertisers. Much of this excitement is coming at the expense of linear, which still commands close to half of all TV viewing. Amid the rush to buy up streaming inventory, many advertisers are missing some key points of differentiation about what’s labeled as streaming and what it actually means.

To many, content delivered via a platform like Amazon Prime Video automatically qualifies as streaming. But what about content delivered via a live feed, like Thursday Night Football? Nearly all viewers who watch will interact with the content via the live linear feed, which makes it much closer to linear TV. Clearly, the terminology gets muddy.

There is a similar muddiness when it comes to CTV advertising and how advertisers pursue the channel. CTV is now available in nearly 90% of US households and takes up a third of viewing time, but only 40% of CTV audiences are exposed to ads in this environment.

Meanwhile, a significant amount of the inventory distributed to that 40% is actually sold via linear. This is especially prevalent with FAST networks, which currently account for 20%-25% of ad-supported streaming.

How can this be?

Buying by the numbers

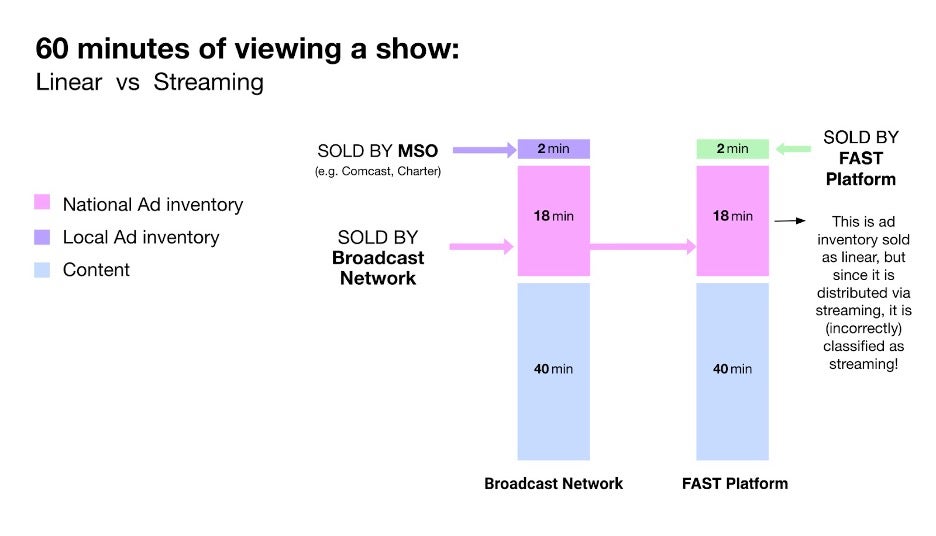

Let’s examine a one-hour prime-time program that airs on both linear TV and a FAST channel.

Say this program has about 20 minutes of commercial time and 40 minutes of content. Those 20 minutes of commercial time are divided further, with 18 minutes sold by the cable network on a national basis and the two remaining minutes sold by the cable network or MSO (such as Comcast or Charter) on a local basis.

For the FAST airing, which happens at the same time as the linear broadcast, the two minutes of ad time that went to the MSO are now handed over to the FAST platform to sell. The FAST platform in this case would be the distributor of the content, typically either a virtual MVPD (such as YouTube TV or Sling) or a TV OEM (such as the Roku Channel or VIZIO). Many folks in the ad industry would likely assume that the remaining 18 minutes of national ad time would be sold by the FAST platform as well.

That is incorrect.

Those 18 minutes are actually the same 18 minutes of ads that the national network sold for its linear broadcast. So while all of this inventory is distributed as streaming to FAST viewers, it is sold as linear. To classify this as streaming, from an advertiser point of view, is inaccurate.

To access the majority of inventory that runs against a program on a FAST platform, ad buyers would need to make linear purchases. If FAST is nearly a quarter of the ad-supported streaming market, then between 20% and 25% of all ad-supported streaming can only be purchased via linear. Some posit that more than 90% of all ad impressions delivered via CTV are actually in broadcast.

This example demonstrates how little “true streaming” inventory is actually available via the DSPs and platforms that promise to connect advertisers with audiences. Those two minutes of inventory sold by the FAST platform represent a measly 10% of the inventory in the program.

Worse, this limited inventory is often sold at CPMs 5x greater than what linear commands, for the same impression. Buyers who truly wanted to reach the audience watching the program would have a much better chance of engaging with their audience if they made the linear buy. In this case, that would give them the complete audience, not just the fraction watching via FAST.

This is one of many reasons why advertisers can’t trip over themselves in the rush to add more streaming inventory to their media plans. Linear still represents a great opportunity for reaching audiences in an efficient, affordable, high-performing way at scale. There is plenty of inventory available to go around.

Those who choose to cut off linear in the pursuit of streaming-only may be relegating themselves to fighting over 10% of all impressions, while their competition finds a path to cost-efficient air time.

“On TV & Video” is a column exploring opportunities and challenges in advanced TV and video.

Follow Tatari and AdExchanger on LinkedIn.

For more articles featuring Philip Inghelbrecht, click here.