“On TV & Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is by Vijoy Gopalakrishnan, chief research officer at iSpot.

Historically, the technology used to deliver TV programming and advertising to viewers has evolved much faster than the ability to measure it.

Now, as CTV and streaming explode, there’s an opportunity for measurement to get ahead, establishing future-proof currencies for today’s multiformat reality.

Yes, “currencies.” Plural.

The single-currency model leaning on program ratings as a proxy for ad measurement is rapidly losing its value. Today, brands have more sophisticated means to measure the effectiveness of TV advertising than simple GRP guesstimates that triangulate how many people might have seen an ad on linear. The industry has matured to measure reach, frequency, impact and advanced audiences across platforms with greater precision through innovations in ad cataloging, ad verification and addressability.

Brands also have different KPIs for advertising now. Some treat TV as a performance vehicle for delivering conversions. For automakers, that could mean a web visit or dealership foot traffic. For DTC brands, it could mean an app download or a sale. For insurance, an intake form or a call center inquiry.

That’s why a new two-currency model must emerge – one for ads and another for programming – that provides media owners and advertisers an opportunity to prove both audience delivery and its impact. There are massive advantages here:

Increased accuracy

Measuring ads separately from programming is more accurate – period. Verified ad exposures give a second-by-second view of activity of consumption. That clarity enables networks to earn more money, and brands to get a better handle on waste.

Measuring and verifying ad impressions independently from programs is also the only way to consistently deduplicate cross-screen measurement.

Ultimately, accurate reach and frequency numbers unlock more important impact metrics. Already, advertisers have stopped buying based on programming popularity alone, focusing on bottom-of-funnel metrics like return on ad spend (ROAS) instead of return on content spend (ROCS).

Highly specific targeting

Streaming environments are decoupling ads from programming, meaning ads no longer travel with the same program as they once did. Two families watching the same show on Hulu could see entirely different ads during commercial breaks.

So if ads don’t travel with the programs they were purchased against, those programs can no longer be used as a proxy for ad measurement.

In fact, when ads are measured independently from programming, ads can be sold against multiple audiences at scale. Imagine the same ad slot in the same program serving one Pizza Hut creative to viewers aged 55+ but a mobile-focused spot to viewers aged 18 to 54. Advertisers will pay a premium for that level of targeting – if the measurement can back it up.

And that’s a big “if.” Creating a separate currency for ads versus programming is easier said than done. It requires very specific and unique capabilities, including:

1. Robust ad cataloging

Ad-based measurement needs every second of advertising to be identified and fingerprinted. Only then can ads be captured and measured, regardless of whether they come from broadcast or cable, linear or streaming.

2. Smart TV automatic content recognition (ACR)

The second strand of ad DNA to verify reach and location of ad exposures comes from automatic content recognition (ACR) data. Unlike cable boxes that may register false positives when the TV is off but the box is on, ACR provides insights into anything shown “on the glass.” That means ACR can distinguish between different ads shown to different households against the same program, regardless of format, while more accurately illuminating reach and frequency.

Visualizing the advantage of separation

A benefit to more granular, second-by-second measurement of TV advertising and programming is that it provides immediate answers. Digital-like measurement delivers digital-like speed and accuracy.

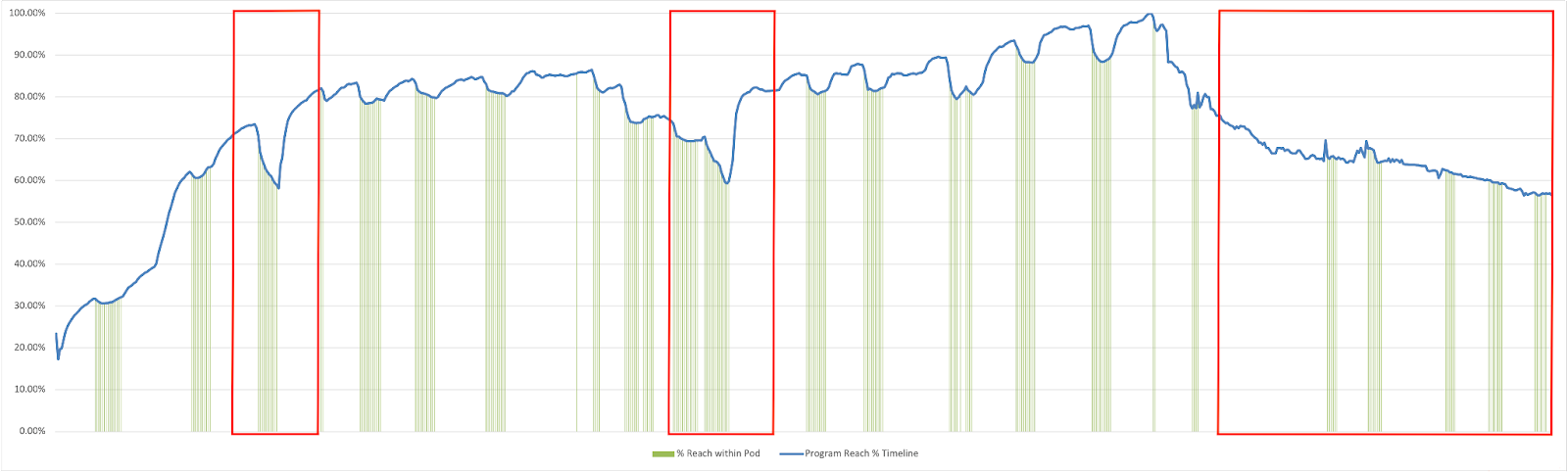

Below is an analysis of the audience of a recent sports broadcast compared against the reach achieved by ad pods in real time. The blue line displays minute-by-minute audience reach as a percentage within the program, and green bars are the ad pods.

The average within-program reach is 74%, but the highlighted pods in the red boxes have a within-program reach of just ~60%. Did the advertiser pay for the 74% within-program reach or the 60% reach of the ads?

Selling a rating based purely on averaging impressions across ad pods within a given program was once the standard. Now? Age, gender, ad reach, exposure frequency, second-by-second viewership and the relationship of those metrics to sales activities are a necessity.

Minute-by-minute audience transparency is not only good for advertisers; it’s the very proof of value networks need to justify pricing and remove the guesswork.

Follow iSpot (@ispottv) and AdExchanger (@adexchanger) on Twitter.