“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is written by Philip Inghelbrecht, co-founder and CEO at Tatari.

Facebook and TV are two similar customer acquisition channels in advertising, despite one being “online” and the other being “offline.”

Both platforms allow advertisers to target certain demographics and interests by selecting audiences (Facebook) or combining networks, rotations and programs (TV). When TV and Facebook are less targeted, they may compel people to buy products or services that they may not have identified or considered as a need. In essence, they are both demand-generating, as opposed to search engine marketing, which is demand-harvesting.

Marketers should compare the performance of Facebook to TV, but to do so they have to first account for cannibalization and incrementality. In many cases, TV may present growth managers with a lower true customer acquisition cost, especially as Facebook spend and retargeting increases.

Facebook: Prospecting And Retargeting

There are two common types of Facebook campaigns: prospecting and retargeting.

Prospecting campaigns target individuals who are identified as belonging to a particular profile, usually demographic in nature. For example, the campaign may target single women 25-44 with an annual income of $50,000 or more. The campaign, however, can also contain other information such as music preferences, political affiliation or pet ownership.

Prospecting campaigns do not target people who have previously purchased from the company or visited the company’s website. Hence, without the prospecting campaign, those individuals may have a low probability of buying the company’s products.

In a retargeting campaign, the marketer instead targets only past customers or visitors to the company’s website. While it is true that retargeting increases the likelihood of these customers (re)purchasing the company’s products, many would have (re)purchased the product even without retargeting. Once all the purchases are counted, there is too much credit given to retargeting, and, as a result, the average customer acquisition cost is understated.

For example, a prior website visitor might have a 10% probability of making a purchase without a retargeting campaign and a 15% probability with a retargeting campaign. Many marketers use the full 15% to evaluate the effectiveness of retargeting instead of the difference (15% – 10% = 5%). The difference – 5% – represents the incremental impact of the campaign. The remaining 10% represents cannibalization, or the wasted marketing spend on people who would have purchased anyway. If the company uses the full 15%, then the failure to account for cannibalization will overstate effectiveness by a multiple of three (5% x 3 = 15%).

If the marketer does not account for cannibalization, the customer acquisition cost from retargeting will appear to be lower than it really is. As a result, many marketers believe that retargeting is wildly profitable or worse, some will even ignore the initial cost of prospecting, which is required before one can retarget. The actual ROI, in fact, is lower and possibly even negative.

To measure retargeting cannibalization on Facebook, marketers can perform an A/B test by comparing a public service ad that is non-company-related to a core company-related ad, both shown to the same target group. In each scenario, Facebook users are cookied and conversion rates are calculated.

The idea is that some users who only see a public service ad will still convert and purchase the company’s product. This helps distinguish cannibalized (non-incremental) users from non-cannibalized (incremental) users.

Particularly, the conversion rate for the public service ad will represent cannibalized marketing spend: those customers who would have purchased without retargeting. The difference between the actual ad conversion rate and the public-service ad conversion rate is the non-cannibalized (or incremental) conversion rate.

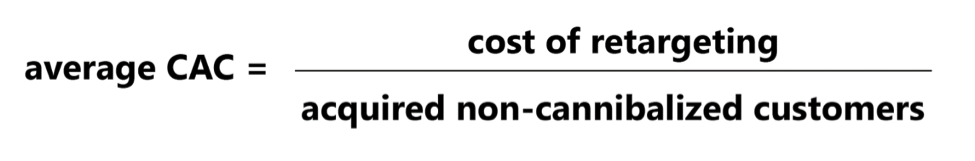

Marketers can then calculate the customer acquisition cost from retargeting by using the following formula:

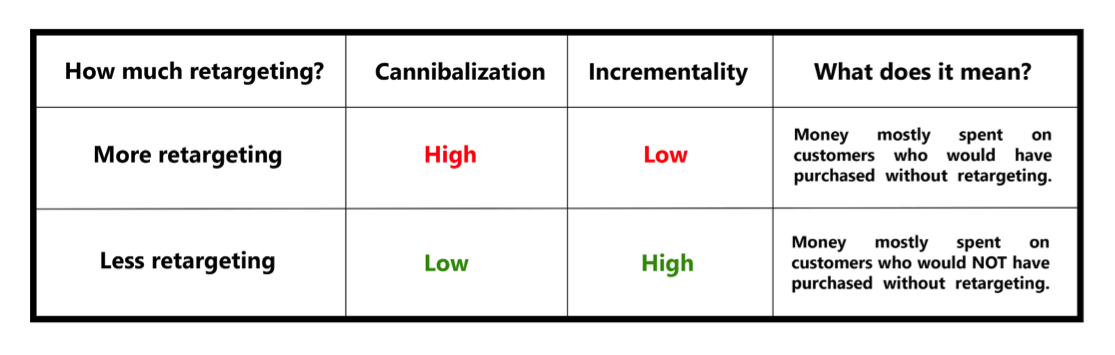

To summarize how these concepts tie in together, the table below shows the relationship between retargeting, cannibalization and incrementality.

The reason why the concept of incrementality is so important when comparing Facebook to TV is because TV advertising typically lacks retargeting, which means it has a higher degree of incrementality compared to retargeted Facebook campaigns.

While a retargeting campaign on Facebook only targets users who have previously shown interest in buying the company’s product, a TV campaign has a very broad reach and is therefore almost the opposite in that regard.

Directly comparing Facebook advertising with TV advertising is like comparing apples to oranges, unless the performance of the Facebook campaign is adjusted for incrementality stemming from retargeting.

Follow Tatari (@TatariTV) and AdExchanger (@adexchanger) on Twitter.