“On TV & Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is by Paul Gubbins, VP, CTV Strategy, Publica.

While definitions of what actually constitutes a connected TV (CTV) impression are still being widely debated, brand safety companies discover new cases of fraud in streaming on a regular basis.

This fraud is the reason the majority of ad buys in CTV are still being transacted via private marketplace (PMP) deals and not within the open exchange – or open marketplace (OMP), as it is more commonly referred to – because advertisers think that the open marketplace is murky at best and fraudulent at worst.

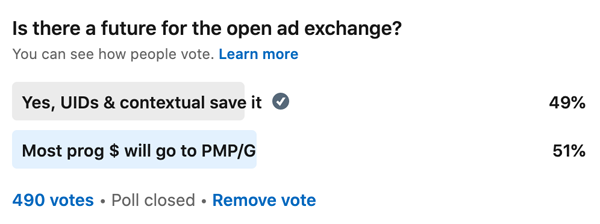

In digital display and mobile app advertising, the open marketplace has suffered because IDs are either becoming harder to extract or just removed altogether by browsers. Although initiatives such as Unified ID 2.0 will continue to support a vibrant open marketplace after the eventual decline of third-party cookies, people still think private marketplace and programmatic guaranteed deals are the future in digital display, as my recent poll concluded.

However, CTV is not facing the same challenges. IDs are still very much present and can be passed in a privacy-compliant way by streaming apps that are not forced to adhere to the terms imposed by big browsers or mobile app stores. Why is this? Well, the majority of smart TVs have their own operating systems that are unique to CTV.

In the free ad-supported streaming TV (FAST) and ad-supported video on demand (AVOD) streaming ecosystem, we will see inventory liquidity continue to grow, driven by consumer adoption. It is these publishers that will benefit from the value that can be extracted from a transparent open marketplace.

Because of this growth in consumer adoption, I believe the open marketplace will grow in value for both streaming buyers and sellers over the next several years – in line with advancements in measurement and brand safety.

1. CTV Inventory offers security with brand safety tech

In addition to app-ads.txt, new initiatives such as Ads.cert 2.0 from the IAB Tech Lab, still in development, mean it will soon be possible via cryptography for a server firing an advertising pixel to authenticate with the server receiving it. One application of this is in SSAI (server-side ad insertion),where the impression pixel is fired server-side.

Why is this important? Well, more and more publishers are adopting SSAI as a way to deliver seamless streaming experiences. Thus far, SSAI solutions have been a perceived gateway for bad actors to enter the CTV supply chain, and this has driven a lot of potential buyers out of the OMP.

2. CTV inventory has deterministic identity

The CTV IDs passed today are not subjected to the same headwinds as those in display advertising. The main identifiers passed in CTV advertising today by the big streaming apps are deterministic: the RIDA (Roku), TIFA (Samsung), AFAI (Amazon) and VIDA (Vizio). This means advertisers, their agencies and DSPs can still find scaled audiences within the OMP when publishers opt to surface their inventory in this way.

3. CTV inventory liquidity is more than just BVOD (Broadcast Video On Demand)

There has been a lot of talk recently about the potential for CTV inventory scarcity in Q4 due to upfront buyers taking the lion’s share of inventory and leaving very little to filter down to partners that don’t have the luxury of big budgets they offer broadcasters in advance in order to lock down deals. However, we have to collectively think beyond BVOD and focus more on the growing AVOD ecosystem, as this is where buyers will find true liquidity this Q4, and it will be a sophisticated bidding logic that secures them the supply, not deals booked months in advance.

4. CTV data can exist at scale

You can’t really have a healthy open marketplace unless buyers have the ability to target audiences. We have already established that the open exchange in CTV supports identity at scale. The next step is to look at the growing data opportunities, including contextual signals that can now be passed by publishers in the open marketplace.

How can a publisher extract value from the open marketplace?

CTV sellers should ensure the SSPs they are working with are communicating to their DSPs the value and security that their inventory available within the open marketplace offers. The IAB Tech Lab protocols and technology from independent brand safety specialists allow publishers to push traffic to the open marketplace that CTV ad buyers can now target in confidence.

How should a buyer approach the CTV open marketplace?

If you are struggling to find high-quality streaming inventory for the remainder of 2021 due to buyers locking up BVOD supply in their upfronts, see how ad-supported streaming services are surfacing their inventory enriched with IDs, contextual insights and controls in place to protect ad buyers.

Conclusion

If the CTV ecosystem continues to overlook the open marketplace in favor of deals, we are going to see less investment from DSPs and SSPs in the open exchange. The true promise of addressable TV may never really materialize as we go full circle back to direct deals, but transacted via costly automated booking systems that do not offer any of the controls, price or audience discovery that OpenRTB can offer.

P.S. Before I get shouted at on Ad Tech twitter

I am fully aware that fraud in the CTV open marketplace exists today, however, I am also aware that we (the industry) have some of the smartest minds in engineering building solutions and protocols to make it harder for the bad actors to suppress what is quickly becoming the fastest area of growth in television, FAST and AVOD.