Often, a question doesn’t have an easy answer in the digital advertising business. This is a column devoted to an answer to a single question or topic – and providing a bit of space for it.

Often, a question doesn’t have an easy answer in the digital advertising business. This is a column devoted to an answer to a single question or topic – and providing a bit of space for it.

Today’s participant is Jeff Green is Founder and CEO of The Trade Desk, a demand-side platform technology company. He recently answered one, make that two, questions in a conversation with AdExchanger.com beginning with…

What does DSP (demand-side platform) mean to you?

JG: Let me start by saying that one of the unfortunate things about ad technology is that we ruin words. I was in the middle of this before when I created the first ad exchange (AdECN) in 2004. We went out into the world and said, “We’ve created an ad exchange and we’re fair, neutral and transparent – and we run an auction for every impression.”

Then suddenly, that idea took hold. Before I knew it, there was no longer any distinctions (at least in powerpoint) between ad networks and ad exchanges. And nearly every ad network transformed into either an exchange or a marketplace, or something other than an ad network. The word “exchange” started to become diluted. We then had to open every sales conversation with, “Let me tell you about our type of exchange.” We would oscillate between saying, “Our competitors are not exchanges,” to “They’re a different kind of exchange.”

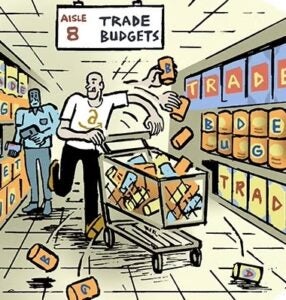

So, in 2012 it is now 2006 all over again, except that instead of us squabbling about the term “ad exchange,” we’re diluting the term DSP, which has come to mean something other than a demand-side platform. Instead it’s come to mean, “I plug into RTB (real-time bidding) inventory and I get access to the exchanges.”

There are often a variety of business models built on top of that – such as arbitrage focused business that are operating on 50 percent margins and offering little transparency – which I would argue is a business model that is closer to an ad network.

I’d argue that more often than not, most so-called DSPs are an outsourced agency, or they are a new type of ad network. Some DSPs have more service layers than they do technology—and their margins, their staffing, and sales pitch certainly do not lead with “platform.”

Anyway, it is admittedly self-serving to make this statement, but we’re one of the few companies that can actually say we’re a platform. We are a demand-side platform, or a buy-side platform. In fact, we often refer to ourselves as a buyer’s platform just because we’re trying to distinguish ourselves from the term DSP, which has come to mean so many different things.

As a buyer’s platform, we operate transparently. We leave a gap in the stack so that agencies and ad networks create the service layer – and can create and protect our client’s proprietary advantage when they play on our platform. We are trying to be the ad tech company that powers other ad tech companies instead of trying to compete with them all, which is different. Most DSPs are competing with ad networks and ad agencies. We don’t compete with them; we power them.

What’s your thought on Google’s position right now in the marketplace? Is it a fait accompli? Have they got it wrapped up?

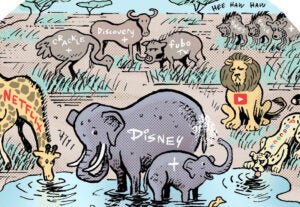

No, and I know at times I’ve somewhat been in the minority on this. It’s not that we shouldn’t keep our eye on Google, but display and search are different. People often want to apply what’s happened in search to display. It just can’t happen that way. The primary reason it can’t happen that way is that in search, Google is the publisher 75% of the time. In display, they rarely are the publisher. The argument that people often make is that Google has millions of advertisers plugged into them on the demand side, and they’ve got millions of publishers on the supply side and, as a result, the display ecosystem is theirs to lose. Unfortunately, most of the volume doesn’t come from the long tail and they have to continue to pay well.

The Admeld acquisition I think was a brilliant move for Google. But there is also risk. If Google takes too much margin –which is what’s required in order to really move the needle for investors accustomed to the high margins Google makes in search — than those publishers will eventually end up at other ad exchanges.

If Google decides to subsidize the business and accept lower margins, they may be able to sustain what they have. But I don’t see Google ever having more display market share than they have today. Every major publisher is going to fight against Google growing in display.

That said, I’d like to see some of the other could-be-competitors actually compete with Google.

By John Ebbert