The havoc wreaked on the advertising sector by Monday morning’s global stock slide, and the subsequent clawback, has tracked with the general market.

The havoc wreaked on the advertising sector by Monday morning’s global stock slide, and the subsequent clawback, has tracked with the general market.

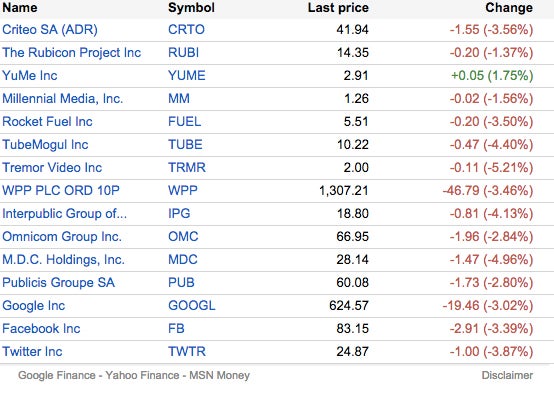

Starting at market open, a variety of ad-supported stocks ranging from tiny ad tech holdings (TUBE, RUBI) to platform heavies (FB, GOOG) plummeted and then recovered within a few hours.

Criteo, Rubicon, TubeMogul, YuMe and Millennial Media all weathered declines of 4-8% to gain back most of the losses by 1:30 p.m. Eastern. A few – including YuMe, Millennial Media and Rubicon – were even up on the day.

Similarly, the DJIA opened the day down more than 6% since the end of last week, and in the subsequent hours cut those losses to about 1% by 1:30 p.m. The roller coaster came in the wake of a Chinese market crash – what Chinese state media are calling “Black Monday.”

Market Challenges Remain

What sets ad tech companies apart is that, while the DJIA grew more than 5% between July 2014 and 2015, some of the better-performing publicly traded ad tech companies had no growth in share value, while others fell off a cliff. Rocket Fuel and the Rubicon Project plummeted more than 50% in that time range.

Criteo has been lauded for making gains despite the tough times for others in advertising automation, with shares up 170% from July 2014 to July 2015. But in the past month, Criteo has lost all of that headway, with shares falling from the mid-$50s at the end of July to $42 as of noon Monday.

Related Stocks

Agencies have had a chaotic year, with almost all of the world’s advertisers undergoing media reviews, but some analysts see them as insulated from the damage to other media stocks. Even though agency bellwethers WPP, MDC Partners, Publicis, Omnicom and Interpublic have underperformed compared to the S&P 500 this month, all five have remained stable over the past year.

While agency holding companies have their challenges, they are largely shielded from the impact of digital on broadcast consumption, which is punishing large TV media companies. Time Warner is down more than 20% since it passed $91 in mid-July, a number the company hadn’t reached since January 2002. Disney lost almost 20% of its value this month, while Viacom shares have been cut in half this year.

Digital-first companies have underperformed the market as well.

Google shares shot from around $542 to more than $672 following a strong earnings call in mid-July, but as Monday afternoon were trading at around $607. Yahoo was down 12.5% since its peak at the start of August, and Netflix had declined about 18% in the same period.