From global leaders to energetic startups, “internal disruption” has become the driving force behind marketing resources.

From global leaders to energetic startups, “internal disruption” has become the driving force behind marketing resources.

“The scary thing for me is to see how fast the disruptors are themselves being disrupted,” said Pepsi’s beverage group president Bradley Jakeman at the ANA’s Masters of Marketing conference. He pointed to the speed with which a company like Uber has seen diverse new models within a category that was invented mere years ago.

Ideally, Jakeman would stay ahead of the curve, but new technologies constantly emerge, altering consumer behaviors, which means a big brand like Pepsi is vulnerable to the fortunes of digital startups. That’s not ideal.

“I’d rather disrupt myself than have some digital startup with a VC with long arms do it for me,” said Jakeman.

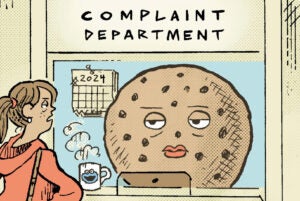

Mondelez CMO Dana Anderson decried the market expectations created by unicorns and their outrageous growth rates, calling the Ubers and Facebooks of the world “the turd in my packaged goods punch bowl.” For a company like Mondelez with roots in the early 20th century, there can be unrealistic pressure to compete on the tech industry’s terms.

Anderson said the solution isn’t to pay high-priced advisors who can escort a big brand through the digital wilderness. While organizations like Pepsi or Mondelez are too big to keep pace with the digital revolution, they’ve developed independent, nimble internal teams designed to adapt to change.

“We have parts of the business that are entirely unencumbered by scale,” said Jakeman.

Mondelez has a growth team that meets weekly to communicate across business sectors (finance, supply chain, regional, marketing, etc.) without the laborious process of running every idea up a series of flagpoles.

Brand investments in teams dedicated to growth underscore a growing neurosis: According to a report released Thursday by the ANA and McKinsey, marketers are increasingly concerned about “the impact of threats from more agile competitors.” Last year, 51% of brands’ tech investments were meant to retain a competitive edge. That percentage grew to 66% this year.

But as Jakeman said, even disruptors are being disrupted. The ride-sharing company Lyft is embracing a marketing ethos of flexibility over stability, said CMO Kira Wampler. “Our best customers today are the most likely to resist tomorrow’s advancements,” she said.

“You should be associating yourself with people or ideas you wouldn’t have been comfortable with [in the recent past],” said Jeff Charney, CMO at the insurance company Progressive.

And that goes double for agencies. Jakeman said that unless agencies pivot quickly away from a model they’re comfortable with, “the global agency will become a dinosaur concept.”

While a company like Pepsi might have once produced four TV commercials per year, each taking four months and costing about $2 million, now the company is producing literally hundreds of pieces of marketing content, each of which needs to happen in days and cost roughly $20,000.

“The big question,” posited Jakeman, “is: Are we as an industry structured to deliver this?”