Is cross-device ID graph operator Intent IQ planning to sue all of ad tech?

Probably not. But an unusual dilemma has programmatic vendors and ad tech platforms worried about a flurry of potential patent infringement suits.

But let’s back up.

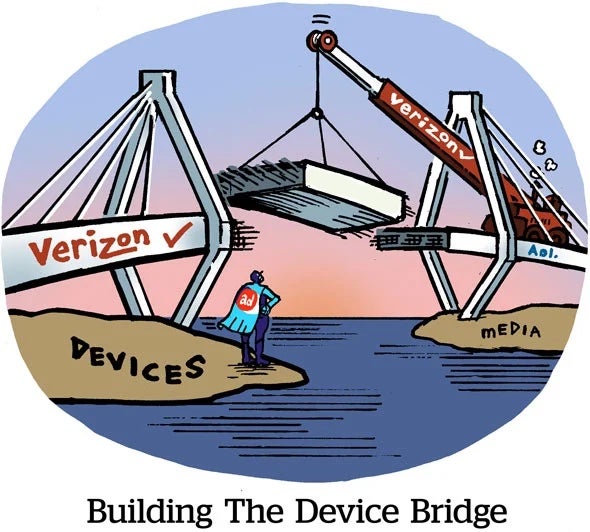

Last week, the IAB Tech Lab released its new OpenRTB standards, but with a caveat. The new standards include what’s known in legal parlance as an “exclusion notice” alerting the industry that Intent IQ has an IP infringement claim against the OpenRTB specs. The claim arose during discussions about the ID bridging code that went through a public comment period earlier this year.

This exclusion notice could mean nothing. One IAB Tech Lab director, speaking anonymously because its internal discussions are confidential, told AdExchanger it’s a strange situation where “everyone might just shrug and move forward.”

But on the other hand, there is now an unspecified IP infringement claim attached to the OpenRTB standard – and the claim comes from a company that earns a significant amount of its revenue from patent litigation by taking a broad interpretation of its IP.

“I hold the patents for probabilistic cross-device [targeting] because I personally invented it,” Roy Shkedi, CEO of Intent IQ and its parent company, AlmondNet Group, told AdExchanger.

The IP Biz

Intent IQ and AlmondNet Group have filed a litany of lawsuits against Amazon, AWS, Microsoft’s LinkedIn and Xandr units, Lotame, Roku, Comcast’s FreeWheel, Viant and LiveIntent, to name a few.

And it’s been a lucrative business.

Reza Mirzaie, the company’s legal counsel, told AdExchanger during a call last week that it “depends on the year” as to whether Intent IQ earns more as an ad tech and data vendor or as a patent litigant. Although that only extends to the past three or four years, when the company began ramping up patent infringement suits.

In June of this year, for instance, a jury decided in favor of Intent IQ in a patent suit against Amazon, which was required to pay $122 million. That suit targeted Amazon running cross-device campaigns based on consumer profiles. Although, the damages charged to Amazon were actually well below the $348 million Intent IQ had pressed for because the judge cited an “issue as to conventionality” with one of its claims, meaning it was directed toward an abstract idea, not a concrete invention.

But Intent IQ mostly doesn’t go for large infringement damages claims, as it did with Amazon. “We always prefer to partner and do business first,” said Fabrice Beer-Gabel, Intent IQ’s VP of strategy and partnerships, during the same call last week.

Still, many of Intent IQ’s largest licensees are with companies that opted to acquire a license during the course of similar lawsuits, such as Meta, Microsoft, Roku, Samsung and FreeWheel.

The legal context

Speaking with AdExchanger last week, Intent IQ’s leadership repeatedly referred to its patent portfolio as “foundational” to the online advertising industry.

These patents are “foundational” in that they assert IP ownership over ad tech’s building blocks.

For example, one former dataxu product executive, who was at Roku when Intent IQ sued the streaming platform in 2022, told AdExchanger that Intent IQ “claimed a broad patent on targeted TV advertising based on any online data.”

While that may sound like a bizarre overreach to anyone who understands how ad tech works, jurors and judges typically aren’t acquainted with the ins and outs of online advertising.

Once Roku purchased dataxu in 2019, it began doing cross-device advertising, thus allegedly infringing on Intent IQ’s IP, said the former employee. That case involved back-and-forth arguments over whether a user clicking to sign in on a Roku device – and thus calling a server for their login details – counts as manual or automatic processing of information.

Roku eventually paid the Intent IQ license.

However, Roku has since joined a case led by Meta challenging the same two patents, which they claim shouldn’t be patentable as they are obvious processes to the industry (establishing “obviousness” is a term of art in patent law, meaning a professional in the field would be expected to know the process or technology). In August, a judge ordered Roku’s case would move forward and be joined with Meta’s petition to undo the patent claims, according to a source with knowledge of the case.

Intent IQ also filed a suit against Lotame this year, targeting its Panorama ID product. This suit, which is still open, involves patent claims about “providing collected profiles to media properties having specified interests,” as well as for any “method, computer system, and stored program for accumulating descriptive profile data along with source information for use in targeting third-party advertisements.”

Microsoft now pays for an Intent IQ license, having been sued after finalizing its acquisition of Xandr from AT&T in 2022. Intent IQ had a preexisting case against LinkedIn, too.

“We became a very attractive target,” one Microsoft Advertising employee who came via Xandr (and dates back to AppNexus) told AdExchanger. Microsoft doesn’t care about ad tech nuances and doesn’t want to deal with patent shenanigans, the source said, so the company now pays for an Intent IQ license.

The LinkedIn suit was based on Intent IQ’s IP claims over “computerized systems for added-revenue off-site targeted internet advertising,” as well as a “media properties selection method and system based on expected profit from profile-based ad delivery,” among others.

The Tech Lab take

“Exclusion notices” aren’t unheard of for standards organizations, according to IAB Tech Lab CEO Anthony Katsur.

Intent IQ’s notice was the first such instance for the Tech Lab, though – and it begs a very important question.

Are ad tech vendors exposed – and should they be concerned – about using the OpenRTB specs?

Neither Intent IQ nor the Tech Lab could provide a satisfying answer.

“That sounds like a question for the IAB Tech Lab,” Shkedi told AdExchanger when asked whether vendors should have any qualms about implementing the new OpenRTB standards without fear of drawing an IP suit.

For IAB Tech Lab companies moving forward with the spec, Katsur said, the Intent IQ exclusion notice is “a conversation that product owners and engineers need to have with their counsel.”

That may not assuage people’s concerns, though, especially coming from Katsur. He is known as a fire-breather and straight-shooter, but he’s clearly taking a guarded, legalistic approach to Intent IQ’s claims. Which is to say, he’s taking them seriously.

If Intent IQ were to sue a Tech Lab member for patent infringement, it would be the company’s sole liability, not the Tech Lab. So it’s on each business to make the call.

And every time a vendor puts the new specs through a legal review is like a roadblock for adoption – especially when the exclusion notice was filed by an extremely litigious plaintiff.

Intent IQ has more than 80 patents and appears very ready to put them to use.

“Better to be aware of it and make an informed decision,” Katsur said, “versus not being aware of it and potentially ending up in some form of negotiation.”