Back in December, Operative founder Lorne Brown reclaimed the CEO role at online ad sales software management company. He replaced Mike Leo, tapped for the post back in 2004.

Back in December, Operative founder Lorne Brown reclaimed the CEO role at online ad sales software management company. He replaced Mike Leo, tapped for the post back in 2004.

The New York company is working on serving the largely untapped mid-market and smaller publishers and while looking to sharpen its position as an alternative to the supply side providers by putting more of an emphasis on helping automate the guaranteed, direct sales process — as opposed to offering greater automation for only the smaller, unsold inventory.

We spoke with Brown about the subtle differences between Operative and other publisher-facing ad tech vendors as well as the continued challenges around audience measurement.

Why did you decide to take back the CEO role?

It came at a good time, because it allowed us to do some soul-searching on what we wanted to be and what we didn’t want to be. One thing we wanted to consider was the way we go about helping publishers bring their whole yield curve together in one system. The way we thought about that was a little short-sighted because we started dipping our toe too far into the programmatic, remnant inventory space, and our clients didn’t really want it that badly. We were predicting they would, so it was part of an innovation gamble that we probably would have done differently.

What’s the problem you’re specifically trying to solve for publishers, if greater automation from an outside entity isn’t the answer?

There’s much less of a focus on helping publishers sell their remnant inventory and a much bigger focus on figuring out how to help their direct-sales teams grow their ad revenue more efficiently. Machines and programmatic systems are really good at efficiency. But as brand dollars start to pour into digital media – or another way to say it is “impressions-based media” – and traditional companies start to face more of the challenges that the impression-based industry faces today, they’re going to have some margin impact, too.

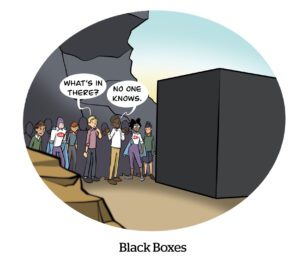

What they really want is for Operative to help them get machine-like automation, but point it at the direct sales, the people business, the idea and creative business, so that they can buy and sell branding media more efficiently in the way that machines do. But they don’t trust machines to do that, right? There’s a reason that a lot of these companies don’t want SSPs and exchanges to expose their product catalogs, and these guys are doing everything in their power to convince publishers that that’s okay and argue with anyone that disagrees that they shouldn’t be doing it.

Are you suggesting that the guaranteed, reserved inventory sales process only have a little more automation, rather than a lot?

Well, there’s a place for [automation of remnant sales], but I don’t know one publisher that has said they get their CPMs up by selling their remnant inventory through Google or through PubMatic or Rubicon.

In the last two years, direct-sales revenues for our biggest publishers inside of Operative saw their revenue grew 20%. And that was all directly sold. And their effective CPM is also up over 10%. That’s a signal that the direct sales are going in the right direction and CPMs are, too, whereas in the direct response or programmatic areas, they’re just going down. The most interesting piece is that the average number of line items per order in that same period of time, in the last two years, grew 44%.

So revenue’s up 20, and the line items are up 40. Complexity is outpacing revenue growth by 2x. That’s because they have more production systems, ad servers, like a mobile and a video ad server, not just a regular ad server, and there’s more targeting.

Most of these dollars are coming from brands, so brands are saying, “Look, we’re going to buy more impression-based media, and over time, we’ll take a lot of our TV budget and put it there, but in order to do that, you need to give us something really cool.”

Really cool means really complex, but it also means a lot of money. So that doesn’t mean they should just quit and give up because it’s too complex. They just need help, and their help isn’t going to be SSPs and ad exchanges to help them capture those revenues. They’re looking to Operative to help their direct-sales teams become more efficient because of all that increased complexity associated with all that directly sold ad revenue.

Well, as you said, you’re not an SSP. So what is Operative?

We are the core platform to help publishers grow their directly sold media more efficiently. We help any seller of media organize their products so they’re easily findable by sales people, have up-to-date inventory, so their ad-operations teams know what was sold, so billing knows what was delivered, and what was contracted.

That’s plumbing. So we need to get good at plumbing, which we already are to some extent. We’re the best at impression-based media. The other thing that we’re getting really good at is enabling innovations, and that is another way of saying integration. The average number of systems that our publisher clients wanted us to integrate with in the last two years has gone from three to six. You can only imagine the complexity if we fast-forward three to five years from now. It’s not even about digital and traditional anymore. For Comcast it’s about TV that’s live and non-live TV. There’s no display or banners or digital media. It’s live and non-live.

Is that where you see the divide – live or non-live – as publishers and advertisers expand their respective cross platform focus?

It’s going to be sold by impressions, so they’re betting on Operative to help bail them out of some future pain-points that they might have, as brands start to spend more as they get smarter.

I recall there was a recent study that said something like 83% of CMOs don’t believe the GRP [gross ratings point] will be the currency of record. It’s a backward-looking metric.

Do you want to see the end of the GRP? What should it be replaced with?

There’s just so much speculation on what the currency of the future will look like. I think the GRP plays a role, but it has to change in some way to be more current. The online metric, the impression… has become much more meaningful than the GRP because of the vast variety that you can use.

Brands have a huge appetite to reach people, different types of people, just like the direct response people do. But they want to do it across the platform in a way that creates different levels of engagement and other types of metrics. So yeah, I think that there will continue to be some sort of bifurcation, a lot actually, according to the type of advertising that’s being done and the type of creative that’s being done, the amount of screens it’s going across, and the intention of clients.