Salesforce’s data management platform (DMP) continues the strong ascent it began last quarter, according to Advertiser Perceptions’ Q4 Programmatic Intelligence report, and has moved closer to catching Oracle.

Oracle DMP, despite leading in marketer use and intent, lags behind in the selection factors relevant to marketers.

Advertiser Perceptions Chief Strategy Officer Kevin Mannion noted that Oracle inherited its legacy position from its BlueKai acquisition.

“They are a de facto source for advertisers,” he said. “They have a position of dominance. But what we’re seeing is their position is not invulnerable, because in consecutive [reports], others are moving ahead in terms of technology and client relationships.”

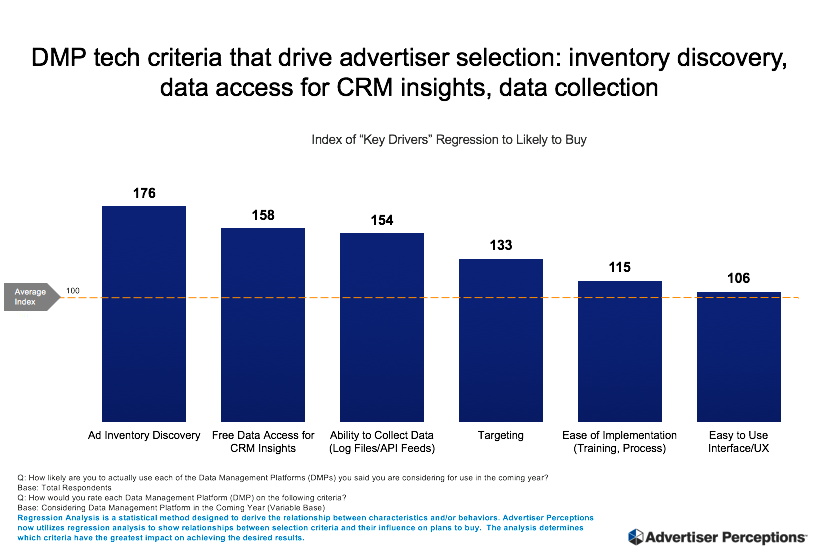

The DMP tech criteria that drives advertiser selection the most, according to Advertiser Perceptions, are ad inventory discovery, free data access for CRM and the ability to collect data via log files and APIs.

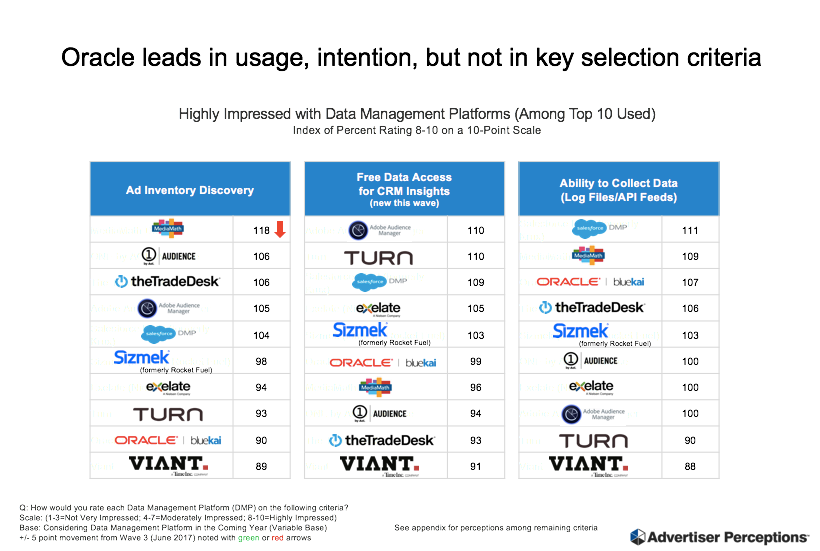

It was a mixed bag for Oracle in those categories. Oracle DMP was low among its peers in ad inventory discovery (MediaMath topped the category) and was middling in free data access for CRM insights (Adobe Audience Manager led), but was ranked third in its data collection abilities (Salesforce DMP topped).

The Trade Desk ranked the highest for the type of analytics marketers want: quality of post-ad campaign evaluation, insights and recommendations.

But even Oracle DMP’s analytics capabilities lagged behind its peers in areas like cross-device identification and analysis (the top three were MediaMath, Viant and The Trade Desk) and setup and QA participation (the top three were Salesforce DMP, The Trade Desk and eXelate).

Mannion was surprised that marketers and agencies were fairly neutral toward Oracle, since the vendor led in funnel metrics like familiarity and consideration.

“From my experience, Oracle has the cachet and name recognition,” Mannion said. But over the past year it has been weak, compared to its peers, in many areas where advertisers evaluate potential DMP partners. “To us, that spells trouble,” Mannion added. “They need to respond to that.”

Could Oracle DMP soon find itself out of consideration? It wouldn’t be unheard of.

“Some media brands that have been leaders in the past are no longer,” Mannion said, pointing to the decline of companies such as [x+1], which was acquired by Rocket Fuel, which was then acquired by Sizmek. Lotame also used to be high on the list in terms of consideration and retention – but is no longer.

In all, the two DMPs with the most impressive momentum belong to Salesforce and The Trade Desk.

“From its [demand-side platform] roots, The Trade Desk is still the darling of agencies, and marketers really gravitate toward Salesforce,” Mannion said. “We did some qualitative work with agencies and marketers, and marketers, because of their CRM connections, tend to have a real positive view of Salesforce and welcome them as a DMP.”

What of Adobe and Neustar?

Adobe and Neustar are also legacy players in the DMP space. Adobe ranks relatively high in Advertiser Perceptions’ report, as it’s third in consideration amongst both agencies and marketers.

But Adobe’s challenge is “a need for differentiation,” Mannion said. It’s got a great brand and a great name, he continued, but it doesn’t have Oracle’s legacy positioning, The Trade Desk’s strength with agencies or Salesforce’s strength among marketers. (Adobe might dispute some of those points.)

Meanwhile, Neustar has been quiet, despite the fact that it acquired a legacy DMP in Aggregate Knowledge. “You don’t hear about them as much,” Mannion said. “And that does present a marketing problem.”