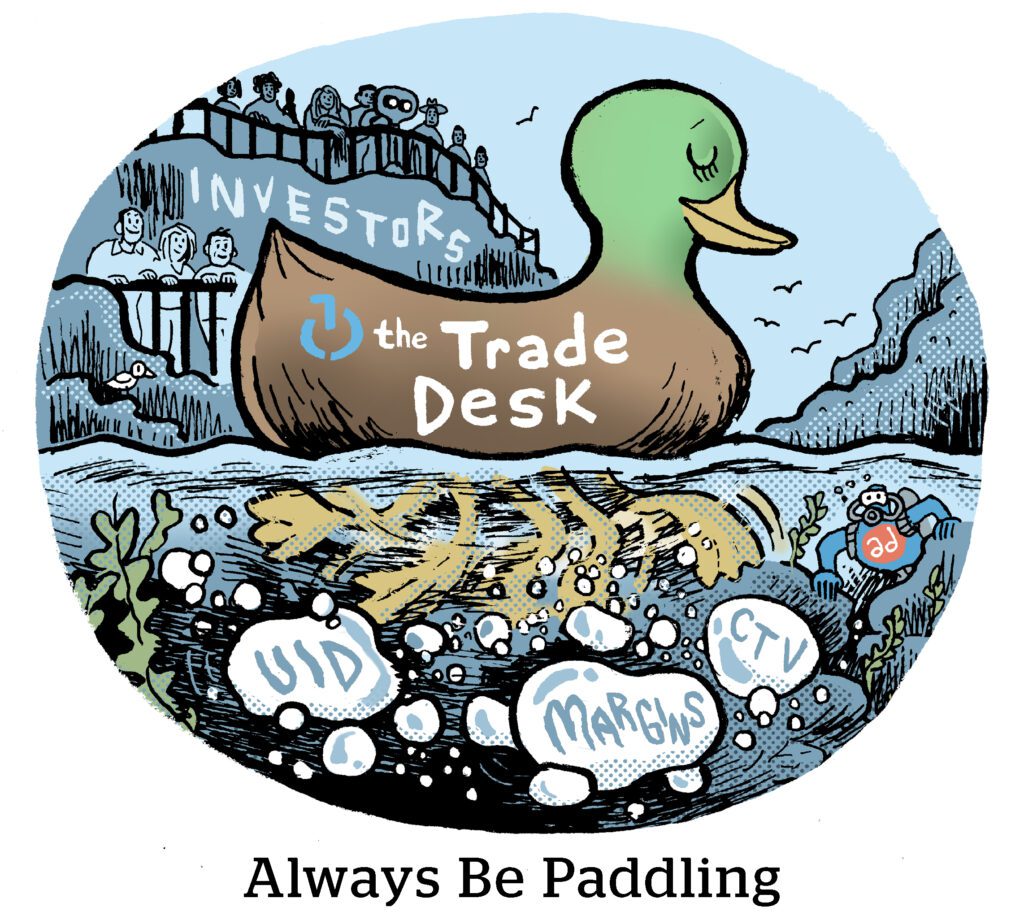

While other ad platforms, including Google and Meta, saw spend declines, The Trade Desk beat the ad market again by growing 24% year over year in Q4.

The Trade Desk earned $491 million in the quarter, up from $396 million during the 2021 holiday season, the company said on Wednesday. Revenue for the full year jumped from $1.2 billion to almost $1.6 billion, with company shares increasing 30% over the course of the day.

Retail media and CTV were both big themes, which has been the case for years. CEO Jeff Green said the company intends to invest hiring this year with a focus on shopper marketing and CTV, albeit at about half the rate as last year.

Green also shared updates on OpenPath and UID 2.0, both of which are products that demonstrate how far The Trade Desk has come since it went public in 2016 as a pure agency-based DSP.

The Trade Desk may have started with a focus on brand marketers, but it’s increasingly doing business on the supply side.

The OpenPath less traveled

There are many steps in the supply chain between advertisers and publishers. The Trade Desk itself operates in the murky middle and has a data marketplace with additional vendors that take a cut of the media budget.

But the online advertising supply chain also contains intermediaries that take more in fees than they generate in value to an advertiser or publisher, Green said.

“Often, and also on the sell-side ad exchanges, there can be an auction that is unfair,” he said.

(See Google’s latest antitrust suit brought by the US Department of Justice.)

But the supply-chain fee-eaters are primarily the SSPs and exchanges.

“We found in our discussions with publishers and content owners that often they are as frustrated as we are with the supply chain,” Green said.

TTD’s solution to the problem is OpenPath. SSPs and publishers that manage their own programmatic can plug into OpenPath as a way to improve match rates, essentially serving as a private marketplace.

Green was quick to distinguish OpenPath from supply-side platforms, which he said are used by publishers for yield management and planning.

But if you define a SSPs as programmatic pipes that plug directly into a publisher, then The Trade Desk is doing that more, which is already the norm in CTV where many content owners have purchased SSPs.

Unified together

Even more than during previous earnings reports, The Trade Desk really leaned into UID2 this quarter as an important part of its growth prospects. (UID2 was mentioned 43 times throughout the call).

UID2 is the identity anchor for The Trade Desk’s direct integration with Disney, which Green said represents the largest pool of CTV supply anywhere on the internet right now (Editor’s note: That would actually be YouTube). And, a month ago, The Trade Desk announced a UID2 integration with Paramount.

Those CTV Unified ID 2.0 integrations are also important because almost 100% of that streaming viewership is logged in by email, allowing for more personalization and control over campaigns. Green noted how different that is compared to walled garden platforms, which have more user-generated content and diminishing personalization controls.

UID2 needs publishers and broadcasters to integrate and provide their own data as matchable IDs. But what will truly unlock scaled adoption is advertisers on the system.

Green said it’s difficult to unpack how much revenue growth was attributed to UID2 in Q4 since UID2 matches may still rely on third-party cookies or IP addresses, among other identity signals.

But Green did set down an ambitious benchmark for growth. In Q4 2022, roughly 15% of The Trade Desk’s third-party data had UID2s associated with it. By mid-year this year, he expects that number to be near 75%.

“There will be dramatic upticks in what’s happening with UID2,” Green said.

And, to be clear, Green added that UID2’s surge in adoption isn’t driven by data marketplace trends, publishers or even marketers. It’s led by integrations with AWS, Snowflake, Salesforce and Adobe.

“We always said this change to the internet required adoption of the infrastructure players,” he said, “not knocking on two million publisher or content owners’ doors.”