You can’t blame brands from being pretty much done with promises when it comes to digital marketing.

You can’t blame brands from being pretty much done with promises when it comes to digital marketing.

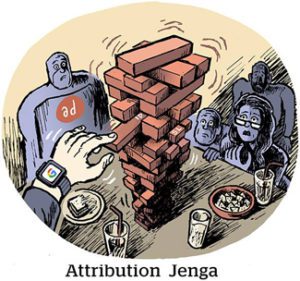

First, there was the promise of the internet followed by the promise of personalization. Later came the promise of multi-touch attribution (MTA).

But the methodologies that underpin the programmatic web are falling into disrepair.

And so many brand marketers, even some of the most sophisticated data-driven online advertisers, are reverting to tried-and-true methods to measure and plan their campaigns, including media mix modeling (MMM) and surveys.

Marketers are starting to partner with new analytics vendors that eschew MTA and focus more on cloud data integrations.

“It feels like forever I’ve been looking at attribution models about where to place the right bets to maximize ROAS,” said Matthew Lawson, chief digital officer of the bike maker Ribble Cycles. “And it’s always grated on me that they’re based on huge assumptions and are barometers of value at best.”

Lawson ran a review this past year to find a new marketing analytics partner, settling on a marketing measurement startup called SegmentStream. Ribble’s goal is to see how its campaigns contribute to “softer metrics,” as in, for example, rather than direct conversions, did ads generate site visitors who then looked at multiple pages, spent time browsing the site or revisited later?

The challenge is that soft metrics related to site engagement generally don’t trigger conversions, which makes it more difficult to attribute them to sales and other downstream actions. And it’s only getting harder to track these user actions based on third-party cookies or mobile ad IDs, Lawson said.

Ribble’s response has been to pursue new customers upstream with branding or prospecting campaigns rather than conversion-based performance. “But the actual attributed sales are always really tough to swallow,” Lawson said, because the attribution reports, particularly self-reporting walled garden platforms, don’t register the conversions.

MMM rises from the ashes

Five to 10 years ago, most marketers would have scoffed at the notion that panel-based measurement, MMM and customer surveys are being considered cutting-edge tactics.

But signal loss means that it’s back to basics.

“We aren’t constrained by historical or legacy data,” Ryan Maloney, VP of digital and creative at Hard Rock Digital, told AdExchanger.

Once upon a time, “legacy data constraints” mainly referred to a brand being beholden to its TV and ratings-based measurement, which usually prevented it from investing at scale in data-driven digital media. Nowadays, “legacy data constraints” is becoming a reference to the fact that marketers realize how dubious attribution reports can be on the web.

Hard Rock Digital, which recently partnered with performance agency Within for media buying and attribution, is now using a longer lens to measure incrementality – as in, whether certain channels contribute to sales or just claim more sales – and has also begun to use MMM.

Mix modeling makes sense, Mahoney said, because the major mobile platforms, from iOS and Android to walled gardens like Meta, TikTok and Amazon, can no longer be stitched together effectively – which is where MMM comes in.

Individually, the big digital media platforms can be treated as entire marketing channels, à la “TV,” “out-of-home” or “retail trade marketing,” that are bundled into MMM models.

The need for speed

Over the past year, for example, Activision has been reworking its attribution approach to rely less on last click in favor of developing new direct platform integrations, said Waleed Noury, the gaming company’s senior analytics engineer.

Each major online ad platform has its own self-reported attribution, but each is also in a different stage of development and has different attribution models, Noury said. TikTok and Twitter are earlier in their journey with server-side conversion APIs, following in Meta’s footsteps. Even if the data could be disentangled between the platforms – which it can’t – there still would be no apples-to-apples attribution.

“We want to validate the performance on a more in-depth analysis,” Noury said. “Were those sales the result of media, or was somebody going to buy the unit anyway? It’s a chicken-and-egg problem right now.”

Measuring media over a longer time horizon with a mix of MMM and online incrementality testing could help. The problem is this methodology takes a long time, especially by the standards of online ad optimization.

But faster isn’t always better, at least using MTA-like models.

In Activision’s view, the immediate feedback loop of mobile and web advertising is “not the most robust analytics,” Noury said.

Activision started working with revenue data platform Improvado last year to help streamline conversion data to dashboards that can be used by ad traders in closer to real time (or at least quicker than weeks or months).

Getting access to data in a timelier manner allows “our activation teams to make the decisions they need to in the short term,” Noury said.

Pony up

There’s also a nontechnical – but still big – challenge facing marketers who want to adopt incrementality testing and MMM, and that’s convincing the CFO and CEO that it’s worth the cost and the effort.

Children’s clothing retailer Carter’s hired Jeffrey Coleman a year ago as leader of the company’s head of digital marketing science. It’s an unorthodox job title but suits the brand’s emphasis on “science” as opposed to fast-moving web optimization. Coleman, an agency vet, told AdExchanger that part of his responsibility is “to be a go-between” for the company’s ad traders and the finance teams that set the overall marketing budgets.

Carter’s ditched its MTA methodology and doubled down instead on MMM, Coleman said. If it’s no longer possible to understand what happens inside media black boxes like YouTube, Facebook and Amazon, this approach at least measures the contribution of the black box itself, he said.

But that means setting aside larger sums for testing and vendors. For instance, Carter’s added Verity, a marketing automation startup, and is evaluating new attribution vendors.

It’s no coincidence that the brands, which are heavily invested in measurement overhauls, are companies with large marketing budgets and large first-party data sets, like Activision, Carter’s and American Express, which also switched in the past year from an MTA model to MMM.

Some data-heavy brands are still committed to MTA. But vendors and investors see the trend to alternate attribution clearly enough.

Last week, INCRMNTAL raised a $4.1 million seed round for its don’t-call-us-MTA attribution tech. Measured, an attribution startup focused on incrementality and geo-testing, raised $21 million in May. Amplitude has surfed the waves of the customer data platform category, but recently launched products for attribution analytics to meet demand in the market.

Analytics startups are helping marketers to convey that new (well, new again) marketing tactics are working, even if the attribution reports that higher-ups are accustomed to have gone haywire.

A gut feeling is fine, but marketers need proof, too.

“Don’t forget: You as a marketing leader always must have a story to justify what you are trying to do,” said Lawson of Ribble Cycle. “You have to have a bit of faith, [but] is that faith backed up by something?”