Facebook is mostly an app company now.

Facebook is mostly an app company now.

Desktop monetization of Facebook’s owned and operated properties keeps shrinking both in actual numbers and as a percentage of the overall business. In the second quarter of 2015, desktop revenue shrank 8% and contributed less than one-fourth of Facebook’s total ad revenue, the company said in its earnings disclosure on Wednesday. (Read the earnings release.)

The desktop decline was more than offset by growth in mobile, as overall revenue popped 45% to $3.8 billion.

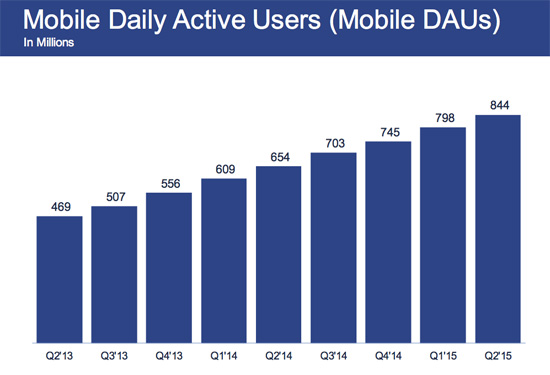

While some of that growth comes from rising prices, the larger factor is audience expansion. Some 200 million new users accessed Facebook apps on a daily basis in Q2 vs. the same period last year. Average mobile daily active users grew 29% to 844 million in June, while mobile monthly active users jumped 23% to 1.3 billion.

Facebook’s mobile bias extends to its ad tech business, which continues to be rooted squarely in mobile display and mobile video, leaving the desultory desktop display market to established players like Google and AppNexus.

Speaking of ad tech, COO Sheryl Sandberg’s key phrase with this business seems to be “go slow.” On the company’s post-earnings call with investors, she characterized Facebook’s ad platforms ramp-up as a long game.

“This is an important investment and it’s very strategic,” Sandberg said of the business, which includes the company’s Atlas ad server, LiveRail video SSP, and Audience Network mobile ad network. “We are going to put the time in to make this work, rather than look for any short-term return.”

And later, fielding a question on Atlas adoption by agencies and marketers, she said, “This is an enterprise sale. We have to work client by client. They have to then choose us and then we have to migrate their system.”

For all of its growth, both from an audience and revenue standpoint, Facebook’s mobile business looks to have considerable future upside. The channel’s 76% share of Facebook’s business in Q2 was up 3 percentage points sequentially, from 73% in Q1 2015, and up 14 percentage points YoY, from 62% in Q2 2014.