Embarrassing revelations – and quite a few memorable zingers – have been emanating from the witness stand over the past few weeks during the Justice Department’s ongoing antitrust trial against Google over its search dominance.

For example:

Microsoft CEO Satya Nadella declared: “Everybody talks about the open web – but there is really the Google web.”

Sridhar Ramaswamy, founder of the failed search engine Neeva (and former longtime head of Google’s search and ad products), observed that Google’s multibillion-dollar payments to maintain its search default status “make the ecosystem exceptionally resistant to change.”

Jerry Dischler, Google’s VP of ads, was forced to admit that Google has repeatedly raised the price of search ads by 5% (and sometimes as much as 10%) without telling advertisers, purely in an effort to hit revenue targets and meet Wall Street expectations before earnings.

And a document was submitted into evidence in which Adam Juda, VP of product management at Google, appears to joke about auction manipulation. Juda quipped (alongside a winky-face emoticon) that he’d have “another bad year” at Google’s Marketing Next conference if he had to tell advertisers that the only way to maintain their winning position in Google’s randomized and generalized second-price search ads auction is to bid significantly higher.

And those are just a few juicy nuggets. It’s all very entertaining and will probably end up as a Netflix docuseries.

But now that we’re nearly four weeks into what’s slated to be a 10-week trial, it’s worth digging into the question: What happens if Google loses?

Suit up

If the court sides with the DOJ, there will be a second hearing or trial to determine the right remedy.

There will also most definitely be a flurry of appeals, as well as who knows how many private lawsuits brought by businesses – including (possibly) browsers – seeking compensatory damages for any harm suffered as a result of Google’s practices.

Private plaintiffs would get treble damages in this situation, meaning the court is allowed to award them up to three times the amount of actual sustained damages.

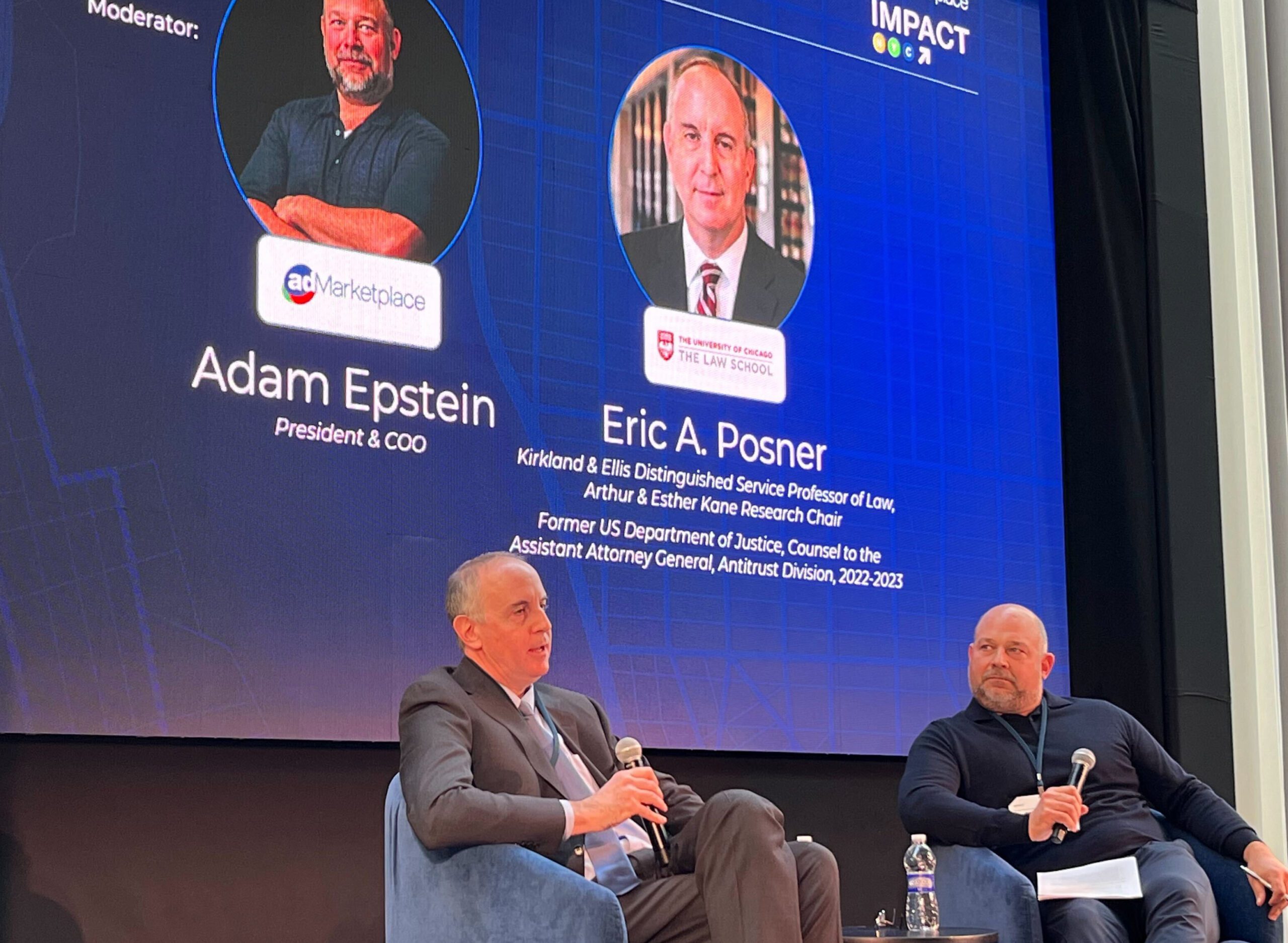

And because the DOJ will have already proven its case, “these follow-on cases will be somewhat simpler,” said Eric Posner, an antitrust scholar and professor at the University of Chicago Law School, speaking at an event hosted by programmatic search company adMarketplace in New York on Wednesday.

“The plaintiffs – advertisers, publishers or whoever – will just need to show, given that Google has behaved illegally, the extent to which their behavior caused harm,” said Posner, who, until recently, served as counsel to Jonathan Kanter, assistant attorney general for the DOJ’s Antitrust Division. Kanter is one of the main architects of the government’s case against Google.

(Posner, however, didn’t work directly on the Google Search case, which is why he’s able to speak publicly about the trial.)

Searching for a remedy

But what about forcing Google to divest certain assets?

Although a breakup is highly unlikely in this case – that would be an extreme measure – it is on the table.

In fact, nearly every potential remedy is on the table, from structural relief (aka a breakup) to enforced conduct or behavioral change, like forbidding Google from entering into exclusive default search deals.

The DOJ is simply making its case to the court that Google acted unlawfully to maintain its search monopolies. If its argument is successful, it’s seeking any form of relief that the court believes will cure the anticompetitive harm and “fix the problem,” Posner said.

It’s also possible that the court will get a little creative with its remedy.

Say the judge calls for Google to break the tie between search results and search advertising, mused Adam Epstein, president and COO of adMarketplace and an attorney himself who clerked for a US District Court judge in the early 2000s.

If Apple sold its own web-based search ads, it could probably do so for less than Google charges and still make a profit. The roughly $18 billion Google pays Apple to be its default search engine is no doubt a bargain compared with the ad revenue Google generates tied to the searches it powers on Safari.

If Apple sold its own web-based search ads, it could probably do so for less than Google charges and still make a profit. The roughly $18 billion Google pays Apple to be its default search engine is no doubt a bargain compared with the ad revenue Google generates tied to the searches it powers on Safari.

Separating search results from search ads ticks multiple boxes, Epstein said, because it would force Google to compete with others for ad space, which would create fair price discovery and compel the company to innovate.

Hey, it could happen.

The court has “a tremendous amount of flexibility to fashion a remedy that would respond to the abuse of market power,” Posner said.

Onward to March

But regardless of whether Google wins or loses, there’s a second antitrust trial waiting in the wings – and no reason why revelations from the current search case won’t affect the upcoming ad tech case.

Earlier this year, the DOJ sued Google for allegedly monopolizing the digital advertising market by controlling both sides of the ad stack. That trial is set to begin in the Eastern District of Virginia starting in March – less than five months from now.

Information from the search case can be admitted as evidence in other cases so long as it’s legally relevant, which “is going to be a big concern for Google,” Posner said.

To be fair, just because something looks bad from the outside doesn’t mean it’s legally relevant. Doing something bad in one market may not be admissible in a case dealing with the dynamics of a different market.

But even if findings from the search case don’t make an appearance during the ad tech case, the advertising industry will have had an earful.

A turn of phrase like “shaking the cushions” sticks with you. Google can’t unring that bell.