In 1897, a newspaper mistakenly published Mark Twain’s obituary, despite the fact that Twain was still very much alive.

When Twain read it, he is famously quoted as having remarked, “The reports of my death are greatly exaggerated.”

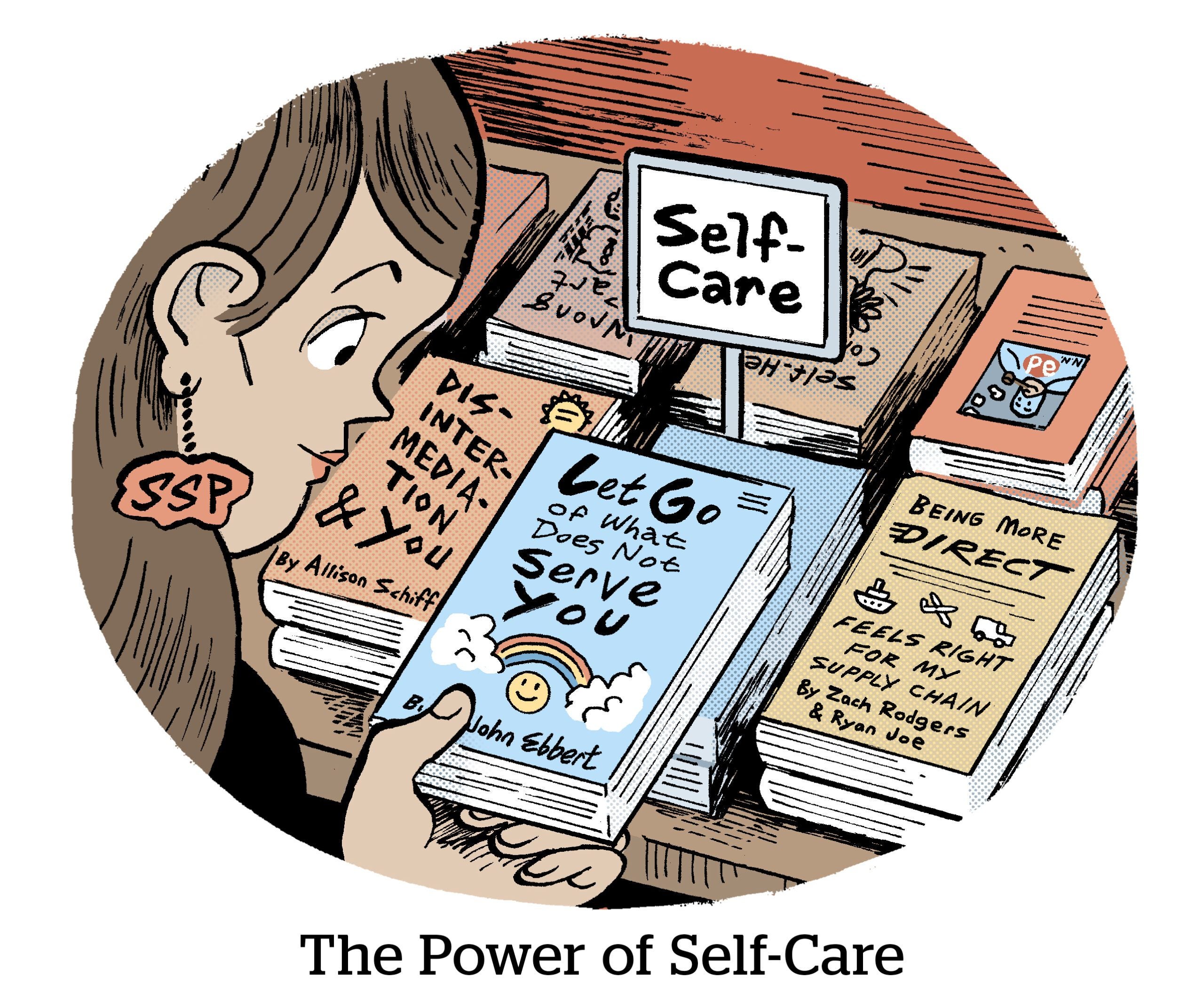

Supply-side platforms can relate.

Cutting to the quick

The past decade has been tumultuous for SSPs.

The rise of header bidding around 2014 equalized access to supply, and SSPs were forced to lower their fees in order to compete. Meanwhile, transparency solutions like Ads.txt and Sellers.json were released to (ostensibly) make it easier for publishers to sever ties with resellers.

Fast-forward to 2022, and DSPs began horning in on SSP territory. The Trade Desk’s launch of OpenPath, a direct-to-publisher product developed primarily to counter Google’s Open Bidding, was interpreted by industry observers as a sign SSPs could eventually be cut out completely.

Then, over the space of two weeks in early 2023, EMX filed for bankruptcy and Yahoo! shut down its SSP, a move that included laying off 1,600 people from its ad tech division. Around the same time, TripleLift laid off 100 people. The month before, Magnite had laid off 6% of its workforce.

AdExchanger published a podcast at the time with the title “The SSP Extinction Event.”

But it’s not like SSPs have just been standing still waiting to be wiped out by a wave of consolidation.

Despite – or perhaps in part because of – the prevailing narrative in the industry that SSPs are undifferentiated and easily disintermediated, Magnite and PubMatic both launched their own direct-to-buyer products last year.

Magnite’s ClearLine came out in April, and PubMatic followed with Activate in May. Both give advertisers direct access to CTV and online video inventory.

The times they are a-changin’

But are these moves part of a desperate bid to maintain relevance – or a sign that SSPs are just naturally adapting to new market dynamics?

Ask an SSP that question, and the answer won’t surprise you.

Supply-side platforms are transforming, said Michael Guzewicz, VP of strategic partnerships at OpenX, speaking on a panel with Magnite, TripleLift and Index Exchange about the evolution of SSPs at an identity event hosted by ID5 in New York City last week.

“All of us here have heard the term ‘dumb pipes,’” Guzewicz said, turning to his co-panelists.

“And I think I can speak for all of us when I say, no, that is not true – and how dare you!” he continued with mock outrage.

Programmatic has changed a lot over the past 10 years, so it makes sense that the SSP’s relationship with buyers and sellers is also changing, said Talia Comorau, VP of product management at Magnite.

Programmatic has changed a lot over the past 10 years, so it makes sense that the SSP’s relationship with buyers and sellers is also changing, said Talia Comorau, VP of product management at Magnite.

Signal loss, the rise of CTV, supply-path optimization and sustainability initiatives are reshaping the ad tech ecosystem and blurring the lines between buy-side and sell-side tech.

And yes, DSPs are developing direct relationships with the publishers that SSPs traditionally work with, but there’s still a big difference between the expertise of an SSP and that of a DSP, Comorau said.

“SSPs are built around the idea of efficiency and the optimization of publisher yield,” she said, “and I very much feel that there’s an important role to play there.”

The barely mentioned elephant

Be that as it may, what about the proliferation of made-for-advertising websites, which divert revenue away from legitimate publishers?

A report released by Adalytics earlier this month found that every major SSP other than Kargo and TrustX is still monetizing MFA inventory despite many having made public pledges to block these sites.

MFA only came up once in passing during the panel discussion when Guzewicz was ticking off a list of stuff OpenX is doing to support both buyers and sellers: “focusing on supply, rooting out MFA and beefing up our CTV chops.”

“But again, this is evolving,” he said. “We’re listening to the market. Publishers are asking us to do more, and the buy side is also asking us to do more.”

(H/t to the panel moderator, Joe Quaglia, ID5’s SVP of business development and sales, for the Mark Twain reference.)