By Sarah Sluis, Kelly Liyakasa and Alison Weissbrot

Some publishers excel in programmatic in ways that make buyers take notice.

The best way to stand out in programmatic is by integrating sales teams so it’s easy to buy programmatically and direct with a single conversation. Smart publishers don’t create incentives that make salespeople push direct sales.

Programmatic buyers hate it when some types of inventory – often video, custom ad units or content – can only be secured through direct deals. Or when the publisher offers better pricing for a direct deal than a programmatic one.

But smart publishers know that programmatic buys can come with premiums because of unique data, which many of the pubs on our list offer to advertisers, whether it’s registration data, weather data or viewing and listening data.

And publishers without strong data can compensate with strong data partnerships and excellent customer service. For all the automation that programmatic promises, it still takes a lot of manual fiddling to make complex deals run properly.

Buyers with strong programmatic partnerships like to be briefed on a publisher’s strategy, to see if there are ways that upcoming products could help their clients.

“What makes a good programmatic publisher for us is someone who is transparent, and is open to having conversations about their tech offerings and what’s on their road map in terms of products of data,” said Melissa Bonnick, VP of programmatic strategy at Havas’ trading desk, Affiperf. “That helps us think about synergies that they might not have thought of.”

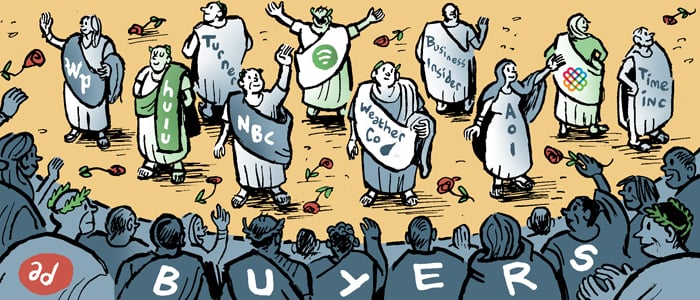

Excluding the duopoly, Facebook and Google, here are the top programmatic publishers, ranked from 10th to first.

10) Time Inc.: Ad Tech Acquirer

Time Inc.’s strategy to grow digital revenue has been to invest in ad tech, via its acquisitions of Viant and Adelphic. Reader and subscriber data informs those DSPs, but for advertisers, the offerings are kept separate from buy on Time Inc. owned-and-operated properties.

“Time Inc. is not necessarily a 300-pound gorilla, but a 200-pound gorilla,” Affiperf’s Bonnick said. “Programmatic is table stakes for them.”

On many recent earnings calls, the publisher has seen growth from programmatic. And its scale helps make it more interesting for programmatic buyers.

But will its ad tech arm ever converge with its owned-and-operated properties?

“Our focus has been on the Time Inc. media side and less on the tech side,” said Sarah Warner, managing partner and digital investment lead for programmatic and video at GroupM. “I haven’t seen the consolidated pitch yet. We will have to see what it is, and how gated is the access. I don’t think using the tech to get to the media is the wisest decision right now.”

9) Spotify: Hear It Roar

Spotify pioneered programmatic in digital audio when it launched the capability two years ago. Today, Spotify drives 70% of its programmatic revenue through private marketplace deals, half of which tap into its rich first-party data on consumer listening habits. Programmatic growth at Spotify is up 100% year over year.

“They have embraced and evangelized programmatic, and their folks are shouting from the rooftops about the importance of transitioning inventory,” Bonnick said.

Spotify built its own ad tech stack and trained all members of its sales team on programmatic. The music platform’s unusually rich listening data makes it intriguing for audience-based buys, said Brian Benedik, global head of sales at Spotify.

“Most programmatic buyers aren’t interested in transacting on publisher data,” he said, “but our reach, known demo data and user-streaming insights make us unique and truly impactful.”

8) Meredith: PMP Prioritization, Education

Meredith’s programmatic team gets props from buyers for clearly communicating its strategy and choices.

“Chip [Schenck, VP of data and programmatic] is very decisive in how he sets up his business,” Warner said.

The team also takes the time to educate buyers. “He can have in-depth conversations about the header and the waterfall, and how it’s impacting his business and mine,” Warner added.

Meredith shares information with buyers in order to make private marketplace deals succeed. “We provide bid guidance all the time, whether they ask for it or not,” Schenck said. “It’s part of the education process.”

Meredith has also invested in ad tech, buying native ad platform Selectable Media and shopper marketing platform Grocery Server. The publisher enables those native formats programmatically.

Overall, sales reps sell direct deals and programmatic as if they were the same thing. “We want it to be client choice,” Schenck said.

7) Business Insider: Leading In Transparency, PMP Success

Programmatic is a big deal at Business Insider, making up 45% of its revenue. About half of that is routed through private marketplaces and programmatic guaranteed.

The Axel Springer-owned company created Passport, which allows buyers to use data from content programs in programmatic campaigns. For example, a buyer could retarget readers of a piece of sponsored content.

Some buyers use reader data to target deals, which Business Insider stores in Krux. Or they layer in second-party data on those PMPs to reach categories like IT decision-makers, who read Business Insider content regularly.

Business Insider has a fully integrated sales team, a strategy used by many of the leaders on this list. Two programmatic VPs and three programmatic account managers are part of a team of 25 sellers.

Finally, the company prides itself on transparency. Jana Meron, its VP of programmatic and data strategy, has been an industry leader to make the supply chain transparent, and was the first publisher to implement ads.txt.

6) Turner: A Cross-Platform Approach

Turner set a goal to sell more than half of its inventory against audience-based guarantees instead of traditional demo-based buys by 2020, making it a leader in embracing a programmatic future.

Turner’s effort to augment more data-driven ad decisioning across its media properties have spurred new divisions like Turner Ignite and cross-network data partnerships, such as OpenAP.

While Turner has invested in the necessary technology to support tactics from header bidding to programmatic guaranteed, the broadcaster still prioritizes direct deals and private marketplace relationships across properties like CNN, Bleacher Report and video network Great Big Story.

Turner creates private marketplaces across multiple sites – for instance, one focused on sports content – which appeals to buyers who want scale and quality in one vertical.

“They have a wide set of sites underneath them, [and] they’ve done a good job aggregating and verticalizing all the sites in their portfolio,” Bonnick said.

5) Hulu: All About Audience And Integrated Sales

Hulu prides itself on making data the core of its advertising offering.

Although Hulu doesn’t enable contextual buys on a per-show basis, buyers can purchase audiences crafted by Hulu. The video-on-demand service also has demo-based guarantees backed by Nielsen and comScore metrics, third-party cookie data or CRM insights.

Hulu has also found a way to accommodate advertisers even though 75% of Hulu viewing happens on living room devices, which don’t support cookies. Hulu has developed audience matching capabilities using its subscriber information.

“We obviously see tremendous value in Hulu and where they are at in terms of their programmatic capability,” Warner said.

Another big selling point for Hulu? It only charges based on 100% completion, giving it a perfect viewability score. And advanced TV inventory gets the same priority as direct-sold deals, yet another reason Hulu consistently commands sky-high sell-through rates.

4) AOL (now Oath): The Programmatic Pioneer

Long before Verizon and Oath, AOL was among the earliest pioneers in programmatic.

As a web 1.0 portal, its mostly acquired ad stack made it an early owner of both content and the data pipes.

A few years ago, AOL borrowed TV vernacular to coin the phrase, “programmatic upfront” to bring data and technology to less digitally savvy businesses.

Soon AOL, as part of Verizon-owned Oath, will combine with Yahoo’s ad stack, which will include a new global omnichannel DSP, which sits on top of trillions of data points from 50-plus media and technology brands, mobile apps and verified IDs from Verizon.

3) The Washington Post: Building Its Own Ad Tech

The Washington Post built its own ad tech to improve speed and performance. Its Zeus platform, which rolled out in the past year, boosted page load times by 75% and viewability by 20%. And it didn’t require the publisher to rely on Google AMP or Facebook Instant Articles.

The Post built out its own content recommendation system, Clavis, which it uses both internally and for sponsored posts. And it has regularly unveiled new ad units, like FlexPlay. The publisher uses its deep pockets, courtesy of owner Jeff Bezos, to make long-term decisions, not short-term ones.

For example, its ad tech philosophy is not “the more the merrier.” It cuts low-performing partners that slow down its pages, and favors building its own technology (and licensing it out to others) over partnering with outsiders.

2) The Weather Co.: Data Provider + Publisher

The Weather Co. is starting to look less like a publisher and more like a data company. The company’s WeatherFX data can now be used across its programmatic buys, not just when a reader is checking the weather on the publisher’s app. Current partners include LiveRamp, The Trade Desk, AppNexus and Vistar Media.

“We all know weather informs so much more than checking Weather.com,” Warner said. “Using weather more as a signal than a media decision will be interesting.”

Like other publishers on the list, The Weather Co. has a powerful parent: IBM. The Weather Co. is weaving Watson AI into its programmatic capabilities.

Weather organizes its sales team by industries and agencies, with programmatic specialists for each sales vertical. The company’s goal is to make buying across different formats and products as frictionless as possible.

1) NBCUniversal: Premium Plus Programmatic

NBCUniversal put its money where its mouth was when it committed to transact $1 billion worth of targeted media on audience guarantees in the 2017-2018 upfront.

NBCU knows that programmatic tech and premium inventory aren’t mutually exclusive – and the TV network embeds that ethos across its portfolio.

NBCU has unified its portfolio, making all its inventory – including digital video and display, mobile, linear and video on demand – available programmatically with self-serve automation and precision targeting.

Buyers like GroupM’s Warner say that NBCU’s portfolio-based approach allows them to have more meaningful investment conversations and grow scale more quickly, since NBC doesn’t structure its programmatic inventory – or sales org – in a vacuum.

Among NBCU’s biggest bragging rights? It has sales rights in properties like Apple News, Snap, Vox and BuzzFeed.