After taking the stand as a DOJ witness on Day One of the government’s ad tech antitrust trial against Google in Virginia last month, Kevel CEO and Founder James Avery sent AdExchanger’s coverage of his testimony to his parents.

“It was like, ‘Wow, look at our son,’” Avery said. “You know, it’s rare I get to share an article about what I do with my parents and it makes sense to them.”

But beyond making his parents proud, participating as a witness in a historical antitrust trial was gratifying for another reason.

“I never thought I’d have a chance to really say my piece like this,” Avery said.

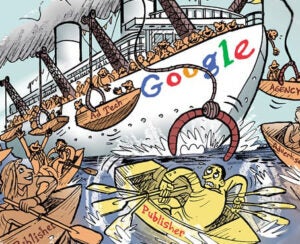

Avery was called as a government witness because Kevel – back before its rebrand from Adzerk in 2020 – had tried and failed to compete with Google in the ad server market. To survive, Kevel was forced to pivot its business model away from the open web and into retail media.

Avery told the court he “quickly realized [the ad server market] was not a market we could win because of the tie between Google’s demand through AdX.” He also said Kevel lost numerous customers to DFP, and when he was asked how many publishers Kevel was able to convince to switch from DFP to its own ad server, Avery responded: “I don’t know of any.”

Avery spoke with AdExchanger.

AdExchanger: Was this your first time ever testifying? Were you nervous?

JAMES AVERY: It was my first time, but I wasn’t overly nervous. It was more weird than anything. Because before you testify, you sit in a back room with no phone, no electronics and no clue when they’re going to come and get you.

Once I was up there, though, I did think the judge would ask me more questions. But she didn’t really do that.

She seemed like she was in observation mode, especially at the beginning of the trial. Did any of the questions you were asked by either the government or Google’s lawyers surprise you?

One that came out of left field was when Google asked about a blog post on our website [from 2022] that I hadn’t even written about traditional publishers building ad platforms.

Right. As proof that traditional publishers weren’t forced to rely on Google’s ad tech tools.

None of the companies mentioned in the blog are our customers. It was just marketing. Wishful thinking, you know? And that’s what I said, that this is just marketing fluff.

I remember Google’s lawyer asked if you planned to take the blog post down, since it’s not true, and you said “no.”

That’s right. We’re leaving it up, and I almost want to put a note at the top: “As seen in US v. Google!”

Ha, you should do that. And there was also a 2019 email exchange that came up during the trial between you and our executive editor, Sarah Sluis, about the tie between DFP and AdX. How did that end up as evidence?

We were subpoenaed and had to share all communications that met certain criteria, including that email with Sarah where I said, “turns out monopolies are pretty effective.” I was asked to reread it during my deposition, and I remember I started laughing, because it was nice to see that I still agreed with myself.

At one point, when you were on the stand, you said that publishers don’t leave DFP because they’re “deathly afraid” of getting banned from AdX. Do you know of any publishers that actually got banned from AdX for that reason?

As I recall, I was answering a question about whether there were other ways to get access to Google demand beyond AdX.

And yes, there could be possible hacks to do it. For example, we’d thought about whether we could get the tag to render and then inspect it in some way. But then you might be doing something outside the approved terms – and no publisher will touch anything that could potentially get them banned.

We’ve talked to publishers who’ve been banned from AdX for other reasons, like a content issue or something like that, and it was massively detrimental to their business. Google has, like, zero customer service, so you’re just out in the cold until you can call in a favor and hopefully find somebody to help you.

When did it become clear that Adzerk had to shift its business from being an ad server for open web display to focus on retail media and commerce?

When did it become clear that Adzerk had to shift its business from being an ad server for open web display to focus on retail media and commerce?

We always knew we were trying to compete with the biggest player, but at the time, around 2010/2011, Google wasn’t the only ad server on the market. Other ad tech companies had ad servers, like OpenX. But then they started to shut down, and their publishers would just go straight to Google.

Usually, when there’s a shutdown in ad tech, it’s sort of a free-for-all. Oracle Advertising shutting down is one example and we’re also seeing it now with Microsoft shutting down PromoteIQ. There should be an opportunity to win their customers. But that didn’t happen when OpenX and others shut down their ad servers.

During your testimony, you said you’d asked Google multiple times for a way to integrate directly into AdX, but you were rebuffed and given no explanation. Just to play Devil’s advocate, why should Google be obligated to give other ad servers access to its exchange?

I don’t think they should be obligated to do it. This is more a question of whether Google has a monopoly position and whether they’re abusing it. Look at Microsoft. There wasn’t anything illegal about Microsoft building a web browser. The issue was Microsoft abusing its desktop monopoly through bundling.

I don’t think it’s the government’s job to force Google to deal directly with Kevel or with anyone. But I think it’s fair to say Google should have to expose its demand in the same way every other partner in the industry is exposing their demand.

If Google released a header bidder, it would be amazing for the ecosystem, because publishers wouldn’t need a direct integration. All they’d need is Prebid.

What do you think the outcome of this trial will be if Google loses?

If I had to place a bet, I’d say the judge makes Google spin out the ad server and AdX. That’s where I think it’s headed.

But who knows? The only thing we know for sure is that Google will appeal.

This interview has been lightly edited and condensed.

For more articles featuring James Avery, click here.