Demand-side platform DataXu has released a new monthly study called “DataXu MarketPulse.” Among the insights: “DataXu analyzed the price paid for ad impressions across ad exchanges over the past 30 days, and discovered that the average daily price varied by over 100% during the period.”

Demand-side platform DataXu has released a new monthly study called “DataXu MarketPulse.” Among the insights: “DataXu analyzed the price paid for ad impressions across ad exchanges over the past 30 days, and discovered that the average daily price varied by over 100% during the period.”

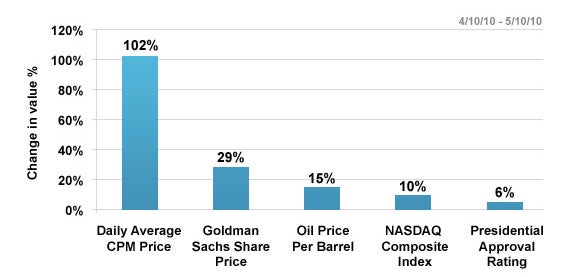

The company also compared CPM pricing volatility to other markets:

DataXu VP of Technology Bill Simmons discussed the studies findings and the use of financial market constructs in digital advertising.

AdExchanger.com: How do you determine a 100% fluctuation in CPM pricing? Isn’t every impression potentially different so an apples-to-apples comparison is impossible?

BS: You are right, all impressions are different. However, the graphic in DataXu’s MarketPulse shows an overall average CPM across all of our campaigns. What this is showing is that even when you aggregate this average across billions of impressions bought on multiple exchanges; you might expect the cost of media to stay fairly steady over a thirty-day period. However, this is not the case. Over thirty-day periods, we typically see the average cost of online display media change by over 100 percent.

If we break down inventory into to smaller and smaller buckets, like individual content categories or audience segments, the volatility measurement increases dramatically (sometimes as high at 500 percent). This finding is significant, since traditional media planning methods — where change orders may take days to execute — can’t keep up with these kinds of price swings on a day-by-day, let alone a second-by-second basis.

Please discuss how the variables involved with CPM pricing differ from the pricing in other markets.

Billions of dollars have been invested in technologies to predict and react to price swings in financial markets. However, one could argue that predicting price swings in advertising markets is actually a much harder problem.

As you pointed out, each impression is unique and fleeting. In financial markets, one share of IBM exists today and the next day. You have more than one chance to predict the price correctly. You can look at pricing trends over the past 30 days, and you have a pretty good chance of being able to buy that share at +/- 1% of yesterday’s price. However, in exchange-based advertising, each opportunity is unique and rare. On top of that, price swings of similar impressions can vary up to 100 percent day to day. If you want to reach a particular consumer with a particular ad three times a day, above the fold, during his or her lunch break, on particular types of content, you have very few chances to win that bid. It may be very valuable to you, but it’s very difficult to predict if others will be competing for that same impression. You don’t want to overpay, but you also don’t want to miss the opportunity. There’s an opportunity cost as well as an expected value, all which depend on tens or sometimes hundreds of variables. All of this makes valuation difficult.

How are all markets similar?

A market is simply a place where buyers and sellers meet to exchange goods or services. All markets are similar in that the more efficient they are, the more volume of goods can be exchanged. More volume of goods being exchanged, more rapidly, causes an industry to grow.

Although online ad markets are getting more efficient every day, they still have a ways to go. As many people have stated, we’re really still in the “wild west” phase of exchange-traded media, where if you are willing to take some risks you can get great returns. You need to be well-equipped to succeed beyond simple tactics like statically bidding for cookie segments.

Given your financial markets comparison, can you see the use of “tickers” in digital advertising, if you will, for audiences someday? For example, a CPM price that is tracked for impressions of men 30-45 who like golf.

There is plenty of evidence that markets work better when information flows freely. However, “tickers” might not be that useful where you have high variability of the goods being bought and sold. In any case, if ad price tickers could be implemented in a useful way, they would be run by someone who is neither a buyer nor seller. This way the information could be verified.

By John Ebbert