While it’s not surprising that a Forrester report (sign-up required) commissioned by video ad platform SpotXchange suggests that the market for real time bidding for video inventory is starting to take off, the conclusion of the analysts is hardly cheerleading.

While it’s not surprising that a Forrester report (sign-up required) commissioned by video ad platform SpotXchange suggests that the market for real time bidding for video inventory is starting to take off, the conclusion of the analysts is hardly cheerleading.

The report identifies three things hindering the growth of online video RTB, starting with the lack of consistent technology among major buyers and sellers. Forrester also suggests greater education of non-digital media buyers and sellers about what to expect from online video RTB. Underlying the last point is the sense that there has been some foot-dragging when it comes to publishers, some of whom still regard the acronym as actually meaning “race to the bottom” when it comes to prices for premium inventory that is mostly sold on a direct basis to agencies and advertisers.

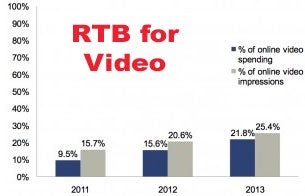

Despite those concerns, there is no doubt that online video — like display advertising generally — has started to emerge as a significant segment within the wider RTB universe. Forrester estimates that $387 million will be spent on online video RTB this year, meaning that it will comprise 15.6 percent of U.S. online video spending in 2012. The researcher expects online video to grow to over 20 percent of video ad dollars in 2013 with $667 million in spending.

The overall rise of RTB is related to the shift towards relying on data and automation to buy and sell online advertising and away from the markedly less transparent, more manual process associated with the traditional business of Madison Avenue.

To put the concept of online video RTB in context, it’s worth noting that most estimates peg the U.S. online video market at roughly $2.5 billion for 2012 — and that space has been growing at double digit rates for years, even in the depths of the recent recession. Though online video is often fairly or unfairly compared with TV — after all, whether a program is on a TV, a PC, a smartphone or a tablet, it’s all “video” in the minds of the consumers advertisers want to reach — it’s a far cry from the $70 billion that broadcast and cable bring in every year.

So with that in mind, how significant is online video RTB? For a beginning, it’s pretty impressive, given that it took years for online advertising to make this kind of progress. But it’s still got a long way to go.

“This year, video RTB is quite meaningful as technology has solved the issues holding us back in 2011 and trading desks aggressively market video as an extension of display bidding,” Dave Marsey, SVP/Media Practice Lead, Digitas, told AdExchanger. “The long-term vision when we started RTB with display was to have the ability to buy across display, video, mobile, and social. We’re well on our way with video and social and mobile continues to gain steam as well.”

Much of the growth in spending on online video RTB stems largely from brand advertisers — historically under-invested online — flocking to a familiar, TV-style creative format, the Forrester report says. “While most of this investment comes from digital buyers, TV and print buyers are also beginning to see online video as a strong media buying opportunity.”

Increasing interest in cross platform media sales is surely driving more participation from non-digital TV sellers. But, as with most issues between the traditional side and the digital side, there are still plenty of areas of conflict and concern.

“With the technology advancements, the key headwind is the publisher as they look to protect the premium that video inventory command,” Digitas’ Marseys added. “I imagine a bifurcation of inventory along-the-lines of efficient, less endemic versus more premium placement and deeper content integrations as this continues to play out.”

Publishers are naturally worried about cannibalizing their direct ad sales, especially when it involves premium inventory. If an advertiser can get the same audience and placements for a cheaper price, why wouldn’t there be more pressure on the seller?

If buyers can demonstrate that publishers’ yield can be enhanced, rather than merely maintained and protected, publishers would be more convinced to loosen their grip on that premium inventory. And unless that premium inventory is found in the RTB mix, advertisers will have little incentive to ramp up their spending to a much greater degree.

Forrester makes a pretty good case that publishers’ needs can be met. For instance, advertisers’ demands have led to greater amounts of volume and CPMs have apparently risen to match that desire. And unlike general display RTB advertising, which is largely driven by cheaper direct response dollars, brand advertisers have been looking to online video RTB — again, because video in some ways resembles TV in that it can offer a clearer proposition for consumer engagement, mainly because it encourages the broadcast-like “lean back” mindset in viewers, at least to a greater degree than other internet content formats.

Noting that “demand for the highest quality inventory is well outstripping supply,” Forrester adds that “This will result in average CPMs climbing from over $7 in 2011 to north $9 by the end of 2012 — and premium publishers can expect significantly higher CPMs.”

By David Kaplan