Twitter’s average cost per ad engagement decreased steadily over the past seven quarters, culminating in an 18% decrease in the quarter ended Dec. 21.

Twitter’s average cost per ad engagement decreased steadily over the past seven quarters, culminating in an 18% decrease in the quarter ended Dec. 21.

While ad revenue, by contrast, increased during those same quarters, this chiastic trend isn’t sustainable, as Twitter itself conceded in the 10-K it filed Thursday.

The company noted its ad revenue increases were driven by its Promoted Products designed to enhance ad performance. At the same time, decreases in cost per ad engagement were driven by more users engaging with ads and an increase in available inventory thanks to Twitter’s mobile expansion and push into international markets.

While Twitter acknowledged that cost per ad engagement will decrease “in the near term,” it cautioned that it needs to continue to see ad engagement increases or else ad revenue will decline.

So what’s going to ensure the continuous increase of Twitter’s ad engagement rates? According to Twitter, this will come from the viability of its Promoted Products tools. This includes improved targeting and measurement features (Twitter has been aggressive here, rolling out CRM matching and retargeting in recent months) and, perhaps most importantly, a steady increase in the size and engagement of the Twitter user base.

“In the event that cost per ad engagement continues to decline, and we are unable to continue to offset the impact of such decreases on advertising revenue by increasing the number of ad engagements, our advertising revenue would decline,” Twitter said in its 10-K.

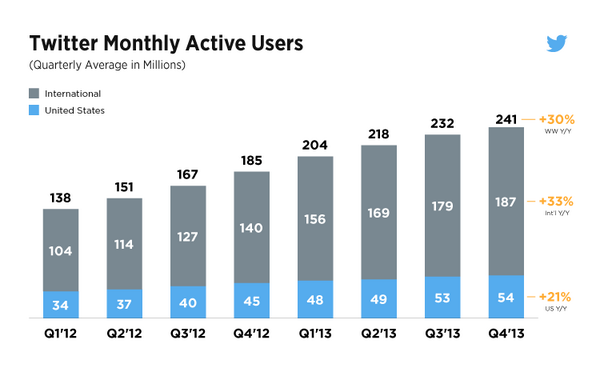

Here’s the problem: In its first-quarter earnings call, Twitter noted year-over-year growth in its monthly active users worldwide slowed to just 30%. In international markets, growth slowed to 33% and in the US, Twitter’s largest market, growth stalled at just 21%.

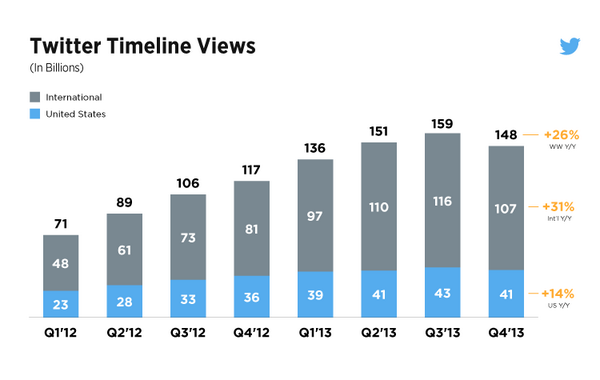

Additionally, Twitter Timeline views, which slowed to 26% growth worldwide year-over-year, actually declined from Q3 2013 to Q4 2013.

Twitter tried to pretty this up by stating user engagement was up, underscored by an increase in retweets and favorites. Certainly Promoted Products have been valuable for both Twitter and its advertisers, but as the social network itself admitted, the value of Promoted Products and its advertising relies on steadily nurturing not just Twitter users’ engagement, but its overall size as well.

Twitter did not immediately respond to requests for comment.

Update: A Twitter spokesperson responded to questions regarding whether last year’s MoPub acquisition contributed to the increase in available inventory by stating that it didn’t.

Additionally, the spokesperson sent part of a transcript of CFO Mike Gupta during the last earnings call in which Gupta acknowledged that average cost per ad engagement declined 18% quarter-over-quarter and “this was more than offset by the 70%-plus increase in total ad engagements…thereby improving our overall yield while maintaining the quality of our user experience and increasing advertiser ROI.”