Facebook reported first-quarter earnings Wednesday, exceeding analyst estimates with ad revenue growth of 82% to $2.3 billion. In contrast, Google’s Q1 revenues were seven times larger at $15.4 billion, but its growth was only 19%. Read the earnings release.

Facebook reported first-quarter earnings Wednesday, exceeding analyst estimates with ad revenue growth of 82% to $2.3 billion. In contrast, Google’s Q1 revenues were seven times larger at $15.4 billion, but its growth was only 19%. Read the earnings release.

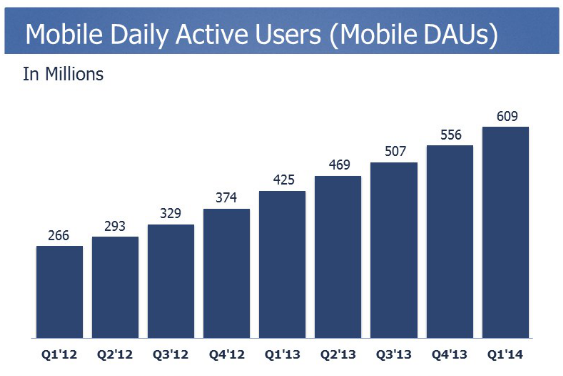

Mobile was the star of the show, from both an audience and revenue standpoint. The number of users accessing Facebook via a mobile device jumped 43% year over year to 609 million globally, and monthly active mobile users surpassed 1 billion for the first time. Mobile now contributes 59% of the company’s total ad revenues, up from 30% in Q1 2013.

As part of that shift to mobile, Facebook showed fewer ads in Q1. Its total impression volume declined 17% year over year – offset by price increases.

“We don’t have a strategy to decrease ad impressions,” CEO Mark Zuckerberg said during its earnings call with investors. “We have news feed ads which are higher quality and perform better, and we have this legacy of right-hand ads on desktop that perform less well. As we shift to news feed, raw impressions are decreasing but value is increasing. Overall, we’re trying to make it so the individual load on a per-person basis isn’t increasing; instead we’re … increasing quality especially on news feed ads.”

The mobile momentum comes as Facebook reportedly prepares prepares for a broad rollout of its mobile ad network, details of which will be unveiled at its F8 Developer conference next week. Facebook has all the pieces to make the network happen – including relationships with developers. The company has integrations with more than 75% of the 100 top-grossing iOS apps and 70 of the top Android apps. Additionally, it’s a popular supply source for legions of mobile advertisers, including app marketers buying through its Mobile App Install ads program.

The App Install ads have appeal beyond game developers, Zuckerberg told analysts. “We see more diversity on mobile than we saw on the desktop (app marketing platform). That was almost entirely games. (But) everyone who’s building apps on mobile needs installs, and we have the No. 1 product out there for delivering that.”

Likewise Facebook’s mobile revenue growth is about more than app installs, according to Chief Operating Officer Sheryl Sandberg. “A lot of people think a lot of our mobile ad revenue comes from this one source,” Sandberg said. On the contrary, she said, “our mobile ad revenue is very broad-based,” and includes branding, direct-response and app install spend.

On the topic of Facebook’s nascent experiment in selling CPM-based auto-play video ads in the news feed, Sandberg said the company had settled on a slow approach.

“We want auto-play video ads to be pretty common in the news feed before we push very hard in the ads business. We do expect to push that product but won’t see a material contribution this year,” she said.

Marketers have also embraced the ability to bring their own data to the Facebook platform. Ten times more marketers are now using Custom Audiences, its CRM-matching targeting feature, compared to last year. One of them was Ben & Jerry’s, which used Custom Audiences and other targeting factors to reach 14 million people – roughly 90% of them on mobile. The campaign drove an 8.1% sales lift, according to Facebook.