“The Sell Sider” is a column written for the sell side of the digital media community.

“The Sell Sider” is a column written for the sell side of the digital media community.

Today’s column is written by Paul Bannister, co-founder and executive vice president at CafeMedia.

With the rapid growth of header bidding, publishers are now employing many supply-side platforms (SSPs) and demand sources in their technology stack. This benefits publishers, in the form of higher yield, and advertisers, who get better access to ad inventory, but introduces some new wrinkles into the puzzle.

For publishers, money is left on the table because multiple second-price auctions can’t bid against each other. Advertisers are losing out because their bid price on one platform might be adequate to win an impression but the second price sent to the publisher is beaten out by another buyer.

In the past, auctions were unified in the sense that a given impression was only made available for auction on one or maybe two SSPs, therefore all demand and supply was centralized in a single location. Now that publishers are integrating with five, 10 or even 20 different SSPs, bids and impressions are spread out in many places, leading to the challenges above.

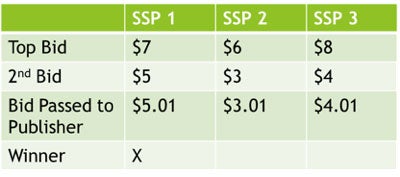

A simple illustration shows how this new problem manifests in outcomes that are worse for publishers and advertisers. This example is an auction of a single impression that is made available in three SSPs:

Each SSP runs an independent auction and submits 1 cent above the second-highest bid to the publisher. These bids then compete in a subsequent first-price auction in the publisher’s ad server, making the advertiser in SSP 1 the winner. You can see that the bid in SSP 3 was in fact the highest across SSPs. However, the second price passed to the publisher’s ad server was lower and lost in the second round of the auction.

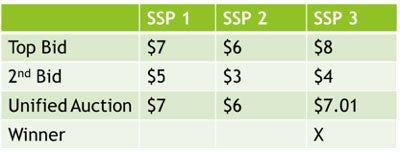

As a result, the advertiser bidding through SSP 3 lost out on an impression that they valued highly because their bid was reduced before an accurate allocation decision could be made based on value. The publisher lost $2 in revenue compared to a scenario where all bids compete in the same auction. If these bids had competed in the same auction, the bid passed to the publisher is 1 cent above the second-highest bid across all SSPs, or $7.01, as illustrated below.

The Solution: A Unified Auction

Instead of a collection of second-price auctions and then a final first-price auction, as happens now, a new, unified approach is necessary to increase market efficiency. This would entail moving the second-price auction out of the SSPs to a mediation layer that sits between them and the publisher’s ad server.

There are two obvious places where this can occur: in the wrapper/container tag or in a server-side platform.

In both cases, the SSPs would need to pass back not just the winning second price, but also the actual top bid. Then these aggregation layers could run a unified second-price auction and pass the true second price across all SSPs back to the winning SSP for clearing. The publisher would maximize the value of the impression and the advertiser that most wanted that impression would win it.

One minor side effect of this, to some extent already an issue because of interexchange bidding, is the possibility that advertisers could actually bid against themselves if their DSPs bid on the same impression across multiple exchanges. That said, there are a few ways to deal with this issue, the easiest being that the DSP also passes the buyer ID to the mediation layer. The buyer ID is unique within a given DSP, and the mediation layer could use it to discard all but one bid from the same advertiser.

Some Potential Solutions

Multiple firms are offering wrapper/container solutions or server-side solutions. While none unify all demand sources, many are plugged into a number of SSPs. There are many reasons to be skeptical that any of them will achieve full demand coverage though, including competitive issues, transparency and pricing. That said, a partial solution to these problems, such as a unified auction that only covers some SSPs, is better than none at all.

Alternatively, a number of nimble and savvy publishers are starting to think about building their own mediation layers either on the server side or client side. Publishers could work with their demand providers to allow for all bid information to be passed. That would enable publishers to mediate and conduct a true unified auction.

It’s more likely that publishers will be able to accomplish complete auction unification as the competitive issues go away, transparency is not an issue and the pricing is “free” – excluding all of those software developers.

Many companies will be striking their own path or going in the directions laid out above, but it’s clear that this is a next phase of progress within the programmatic space. A unified auction will solve for the scattering of demand brought about by header bidding and provide even greater value to publishers and advertisers.

Follow Paul Bannister (@pbannist), CafeMedia (@CafeMedia) and AdExchanger (@adexchanger) on Twitter.