It’s a cliche to say that data is fuel but, in GasBuddy’s case, that’s literally true.

The GasBuddy app, which helps drivers crowdsource information about cheap fuel prices, has access to opted-in location data from more than 15 million monthly active users.

Users are more than willing to share their data, because they’re receiving a utility in return, said Jordan Grossman, GasBuddy’s EVP of ad sales who joined in late 2017 from Google, where he headed North America sales at Waze for more than four years.

But Grossman doesn’t see a reason why advertising in GasBuddy’s app can’t also be a utility of sorts.

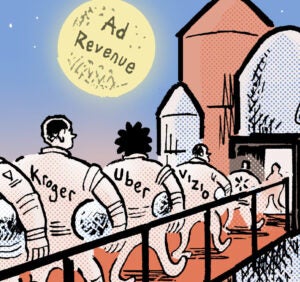

The convenience store market alone is worth around $650 billion a year, and 80% also sell gas. There is an opportunity for CPG brands to insert themselves into the consideration set right before a visit to the pump. But since most convenience stores – 62% – are privately owned and operated, it is difficult to reach C-store shoppers at scale.

“Our users have intent and they’re low in the funnel, but they haven’t necessarily made up their minds yet – we’re trying to help brands transform what were traditionally impulse buys into planned purchases,” Grossman said.

Grossman spoke with AdExchanger about retiring ad units, the value of location data and why QSRs need to watch their back.

AdExchanger: What was your first order of business when you came on board at GasBuddy?

JORDAN GROSSMAN: We had a tremendous amount of waste – around 22 different types of ad units running across our site and app. And so we ran an audit, and for any unit we wanted to maintain or refresh, we had to come up with a very specific rationale for why and a clear objective or KPI tied to that unit.

The core reason drivers come to GasBuddy is to see the nearest and cheapest opportunities to save on fuel. They’re not hanging out for hours in the app, they’re coming to find something quickly and be pointed in the right direction. The advertising and the content we show needs to align with that and provide value through the opportunity to save time or money, because you’ve only got a short amount of time to make an impact.

What units did you junk?

There was a lot of inventory being sold below the fold. We removed all ads with lower than 20% viewability, like banners you can scroll past. We also got rid of a bunch of display ads embedded in content, because it was just too many ads. At the same time, we created an anchor unit that appears in organic search results that is appended to the bottom of the screen, which means it’s always viewable.

What other units did you create?

We also developed a stitched ad unit specifically for convenience stores and co-op shopper marketing programs that allows CPG advertisers, like Five Hour Energy, for example, to appear within a location listing for a fuel partner. And we have a merchandising unit to help the actual fuel retailers themselves, like Shell, Exxon, ConocoPhillips or BP, to create more product awareness by running messaging about the quality of their fuel within a stitched unit appended to their own organic search results.

On top of that, we’ve got a drive-to-retail unit triggered by proximity to help increase foot traffic so merchants that don’t sell fuel, like Applebee’s, Dunkin’, IHOP or Wendy’s, can show up in organic search results, too.

And there’s a paid search unit we have in beta that’s about to launch at the national level to give our fuel partners the ability to do SEM and paid-inclusion on a CPC basis.

Why is QSR a growing category for you?

There’s a war brewing between convenience stores and traditional QSRs right now. QSRs, which used to own breakfast and coffee marketing, are starting to hemorrhage customers as convenience stores spend billions of dollars to enhance their customer experience. It’s not bulletproof glass, cigarette smoke and blinking bulbs anymore, it’s free WiFi, organic food options, a well-lit environment and comfortable seating. We create ad units to accommodate the restaurant industry and help them stay top of mind.

How else do you use location data?

Location data powers our app. Our search results are driven by the price of fuel and where you are when you tap to find “Fuel near me.” We also know that everyone on GasBuddy is there for a reason, which is what qualifies our users not just as fuel consumers, but potential convenience store customers.

The context of where someone is and what they’re doing is a critical part of any location strategy. We know with 100% certainty that someone is researching a trip to the pump, and that allows us to serve messaging that is well timed to what a person is actually doing.

People are finally starting to call BS on location without context, like companies that capture someone when they happen to pass within a geofence and then target them with an ad 12 hours later. Who cares if someone passes within half a mile of a store hours before? That sort of thing doesn’t matter, but there are still some advertisers investing in it, because they’re not fully educated.

What other targeting can you do?

We can filter by fuel grade to create audience buckets and make inferences about the type of vehicle someone is driving. People searching for diesel, for example, are probably truckers or commercial-type purchases.

We also created a recall center where GasBuddies can enter the make, model and year of their vehicle so we can push them information if there’s an active recall to do with their car. Over 1.5 million people have shared their information. It serves as a utility for drivers, but it also allows us to create audience segments based on vehicle type.

Do you sell programmatically?

We do offer some of our ad units programmatically, but none of our premium or custom units. It’s mostly local tier-two or three auto companies that advertise that way, rather than our national partners, as a way to get more volume and alignment against our audience at a cheaper price.

Eventually, we envision our paid search ad to be a self-serve unit so you can buy it just like you could buy a Google search ad, and that will help our SMB revenue surpass national revenue in the future. There are millions of SMBs out there, and the thing about the Fortune 500 is that there are only 500 of them.

This interview has been condensed and edited.