The independent measurement space was once Nielsen’s to lose – and now it’s taking pains to make sure that doesn’t happen.

Nielsen is in a delicate position. Although its long-established panel-based business is primarily what pays the bills, TV ratings aren’t the future.

The company’s success depends on moving away from classic TV ratings, while absorbing the demands of multiple industry stakeholders and continuing to protect the panel that powers its financial stability – at least for now.

“It’s the innovator’s dilemma,” said Megan Clarken, president of Nielsen’s Watch division. “We make investments in innovation every day, but those investments need to be balanced with our No. 1 priority: maintaining our core platform.”

Nielsen knows it’s under increasing pressure from brands and broadcasters to embrace cross-channel measurement based on outcomes and to account for non-linear viewing – and it has become the whipping boy for the media industry’s growing frustration with outmoded monetization models in the face of changing consumption patterns.

Clarken argues those issues have little to do with measurement.

“The marketplace is under pressure and when that happens, all eyes turn to the measurement provider,” she said. “We implement the rules, we don’t make them. We consider ourselves to be the referee, and like any referee we’re not always going to be loved.”

But others, like NBCUniversal ad sales chief Linda Yaccarino, say Nielsen has not innovated quickly enough to accommodate the industry’s changing needs.

Although Nielsen still has a virtual monopoly on linear TV measurement, the natives are getting restless and competitors like comScore and now Oracle aren’t standing still – and they don’t have a massive panel business to nurture.

Nielsen’s Challenges

Although TV viewing has been splintering under the pressure of fragmenting consumption habits for years, the past 12 months have been a “big wake-up call for Nielsen,” said Michael Bologna, president of addressable TV startup one2one Media and a former top Modi Media exec.

Dissatisfaction with the measurement status quo is reaching a fever pitch as broadcasters, brands and agencies have become vocal about moving away from sample-based measurement toward census-level cross-channel calculations.

In December 2016, for example, Yaccarino asked Nielsen to delay the syndicated release of Total Content Ratings (TCR), its cross-platform audience metric, because the product wasn’t “ready for prime time.” Nielsen capitulated, and a limited version of TCR didn’t hit the market until last March.

“Nielsen stumbled on the content ratings,” said Jane Clarke, CEO and managing director of the Coalition for Innovative Media Measurement. “They’re trying to make a syndicated product where everyone contributes their ratings, but to do it, you have to become a client, pay millions of dollars and give Nielsen all of your data for free. They’ve had cooperation issues on the content side and they haven’t come up with the right solutions on the ad side.”

NBCU also put on the pressure in 2017 with a commitment to earmark $1 billion in inventory for audience-based guarantees not using Nielsen’s numbers.

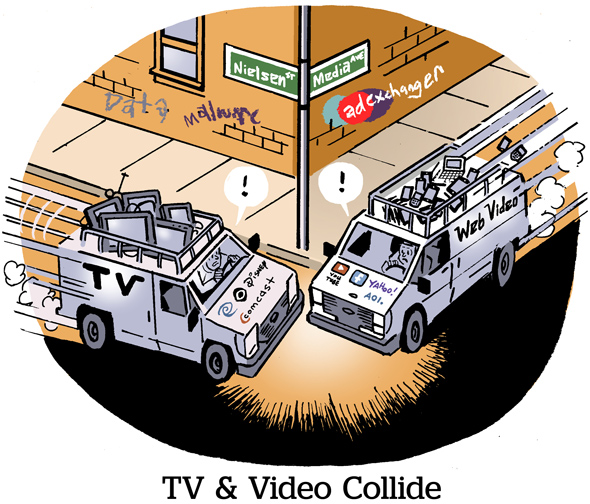

But Nielsen’s greatest challenge is also its biggest opportunity: measuring all forms of video wherever it plays regardless of when with unduplicated reach, including ads and non-commercial content.

Brands today want video households, not TV households, said Ed Gaffney, director of implementation research and marketplace analytics at GroupM.

Consider all the people watching old content on their DVR. They’re probably seeing the commercials, just not the right commercials, that is, if they’re not fast-forwarding through them.

Consider all the people watching old content on their DVR. They’re probably seeing the commercials, just not the right commercials, that is, if they’re not fast-forwarding through them.

“If enough people were doing that and we could measure it, you can be damned sure we’d figure out a way to get into the set-top boxes and replace the old commercials with the new ones,” Gaffney said. “Not to mention all of the cord-nevers using their parents’ or their roommate’s subscriptions. We need to measure them.”

But Nielsen’s ratings are often hamstrung by anachronistic rules created by consensus more than 10 years ago.

For example, a commercial break can only be included in ratings if the break stays intact, meaning the commercial load has to remain the same from the first day through the seventh, which rarely happens as content is distributed across platforms. To make a change, buyers and sellers have to come together and compromise.

Clarken noted that fixing problems like this is a top priority for Nielsen and its clients in 2018.

Making The Effort

Nielsen hasn’t been twiddling its thumbs.

Catalyzed by the inexorable shift toward outcomes-based measurement, Nielsen is shoring up its position through acquisitions, partnerships and discussions with clients and advisers behind the scenes.

“We’re chipping away, trying to find resolutions,” Clarken said, “although a lot of that work isn’t always acknowledged.”

Acquisitions over the past year, like attribution company Visual IQ and metadata and content recognition player Gracenote; the inclusion of smart-TV data in its data management platform, deals with the likes of Comcast to combine set-top box data into local TV ratings; and the roll-out of ratings for subscription video on demand are signs that Nielsen is bolstering its weaker offerings and preparing for a future of purchase-based measurement.

And that represents a growing, albeit somewhat belated, self-awareness that Nielsen needs to move as fast as consumption habits are changing.

Despite COO Steve Hasker’s departure in November – he left Nielsen to become CEO at talent agency CAA Global – he brought stability and organizational discipline to the company, said Dave Morgan, CEO and founder of TV ad-targeting platform Simulmedia, while Clarken has been hammering on the Watch side of the business where the profits are.

“They’ve done good deals recently, although you could argue they should have done them five years ago,” Morgan said. Regardless, the seeds Nielsen planted throughout 2017 should start to bear fruit with the buy side in the coming year.

“Nielsen doesn’t always seem to do what the doctor says immediately, but they do ultimately modify their behavior with a certain amount of stubbornness that will guarantee their survivability,” Morgan said. “They’re finally preparing themselves for a future based on purchase-level measurement and segment-based targeting.”

It’s unclear, however, whether Nielsen will take out its checkbook again to match Oracle’s splashy purchase of Moat – or whether Nielsen could even afford it.

Even so, third-party ad verification would enable Nielsen to help advertisers get a sense of the causal impact of digital ads and “unlock the true value of the Nielsen Catalina partnership,” said Tyler Pietz, head of solutions at independent programmatic agency MightyHive, and former VP of programmatic at IPG’s Cadreon.

“They missed the boat with Moat, but Integral Ad Science is still on the table,” Pietz said, noting the danger of Nielsen’s overreliance on Facebook panels to power its Digital Ad Ratings product.

But Nielsen isn’t in the market for third-party verification, at least not for now, choosing instead to partner and focus on building its own viewability product, Clarken said.

And that’s part and parcel with the company’s overall approach to investing in innovation while continuing to insulate its legacy business – a difficult-to-maintain mixture of action and reserve.

“We look for assets that will fit the portfolio today and in the future,” Clarken said. “We understand digital, we understand TV and we’re working to bring more comparability to this industry.”