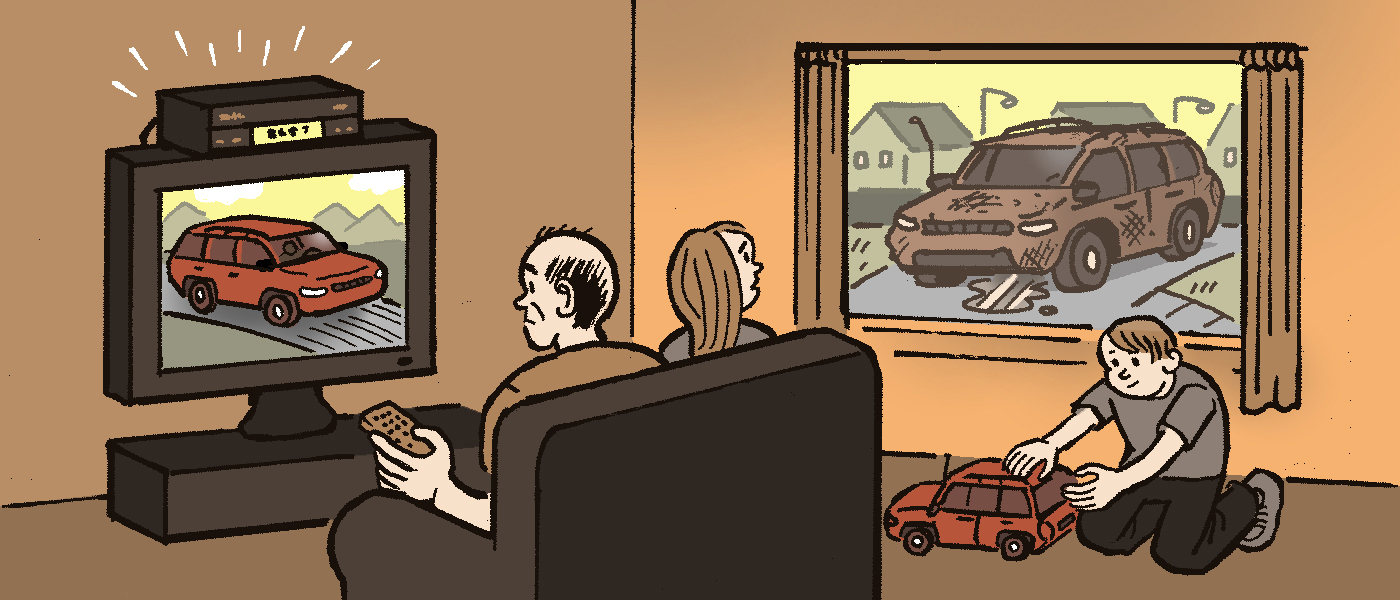

Deterministic data from set-top boxes is changing how linear TV is bought and valued.

Like the Nielsen ratings panel, set-top box data connects to a physical address and household. But unlike Nielsen’s 40,000 families – which provide a “truth set” for TV viewership – set-top boxes reach millions of households, allowing marketers to overlay purchase and CRM data to create targets.

Many multichannel video programming distributors (MVPDs) license set-top box data to comScore, Nielsen (which signed a deal with Dish in April) and ad tech companies like Simulmedia. These entities then aggregate and sell that data to TV networks and agencies.

“You will not find a TV network, a research company or a big piece of ad tech that is not trying to race forward to [incorporate new] data sets,” said Andy Fisher, chief analytics officer at Merkle.

One way is by using set-top box data to supplement Nielsen panel data. Marketers can target beyond age and gender. “We are moving into a demos-plus world,” said Mark Zagorski, Nielsen Marketing Cloud’s EVP.

Set-top box data ties to specific households, which means that marketers, through a data match, can understand the buying tendencies of those households. Then they can buy ads on the shows that the best prospects watch most.

Because they are still buying the entire show’s viewership, this is termed index-based buying. In contrast, with addressable TV, marketers only buy the audiences they want to reach.

“The main leap the industry is moving toward today is from demographic buying to index buying,” said Samba TV CEO Ashwin Navin.

TV networks like Viacom, Turner and NBC Universal are building systems that allow marketers to do index-based buying.

Viacom Vantage, for example, did 11 deals last year using “advanced currencies” – that is, deals that incorporate data from third parties like comScore or matched credit card data from American Express, instead of just Nielsen panel data. In this year’s television upfront, that number is on track to triple.

These “advanced currencies,” many of which incorporate set-top box data, change the value of TV inventory. A program with a smaller number of viewers but with an audience that’s more valuable to marketers will be in higher demand.

But while marketers are already using this data to plan and value media, set-top box data has limitations that the industry is either working around or working to solve.

What Set-Top Box Data Can (And Can’t) Do

Set-top box data is “extremely valuable, but imperfect,” comScore Chief Research Officer Josh Chasin said.

Each data set has geographic and demographic biases. For example, because these are paid services, subscriber age and income level are higher than national averages. People who subscribe to satellite TV are often rural or suburban, because dishes historically worked better in those areas than in urban areas. And each cable company serves only a balkanized area of the US.

There are also technological limitations, as the boxes themselves “were never designed to be a measurement device, except for TiVo,” noted Dave Morgan, CEO at Simulmedia, which licenses data from TiVo and other set-top box providers.

He estimates that only half to two-thirds of all boxes can measure exact viewing. Many boxes use old hardware that isn’t often updated. Some cable companies are further along than others in updating their boxes. Sources called out Dish, Charter, Comcast, Cablevision and TiVo as early leaders.

Because set-top boxes are always on, it’s not always clear when the viewer stops watching. Measurement companies must use algorithms to infer when the viewer tunes out, using proxies like a lack of channel- or volume-changing.

And while set-top box data tracks to the household level, Nielsen ratings panels track the viewing of individual household members.

For digital advertising natives, these gaps in set-top box data can be off-putting. “I have certain expectations about accuracy and one-to-one data,” said Oleg Korenfeld, EVP of ad tech and platforms for Mediavest/Spark. “In TV, a lot of it is at the household level, or even the ZIP code and broader than that.”

Smart TV data could plug some of these holes. Smart TVs possess automated content recognition (ACR) tech that could ensure that programs and ads are being viewed without the hassle of the algorithms the set-top box companies must use. They are also internet-connected, enabling cross-device matching and easy extension of TV campaigns to the digital world. But right now, that data isn’t part of any larger data sets because the tech is still the “new kid on the block,” Chasin said.

Because of its limitations, set-top box data works better when commingled. Often, data sharing is a “two-way street,” noted Tara Maitra, SVP and general manager of content and research for TiVo: It will license data and receive data from third parties. For set-top box companies that want to sell addressable on their own inventory, licensing data could mean getting back stronger data sets in return.

New Data, New Currency?

While set-top box data is being used to build new currencies to measure TV, its current limitations keep it from being as valuable as a Nielsen ratings panel. Even as some advertisers and broadcasters want to get away from Nielsen, it’s still a fact that only Nielsen’s TV ratings passed the Media Rating Council (MRC) accreditation process. Rentrak (now comScore TV) didn’t pass its first audit in 2015.

“People [in the industry] hope to get to the point where you don’t need to have all these expensive panels anymore,” said Jane Clarke, CEO and managing director of the Coalition for Innovative Media Measurement (CIMM), an industry organization that includes marketers, TV networks and agencies. “But we don’t think we’re there yet when it gets to accuracy.”

Despite the immaturity of these currencies, deals are already happening, albeit in small tests and cautiously. Advertisers hope to expand beyond Nielsen ratings panels.

“We firmly believe that the idea of a single currency is behind us,” said Dan Aversano, Turner’s SVP of ad innovation and programmatic.

Turner is transacting using other currencies at marketers’ request, but it’s “the Wild West,” Aversano said. “A lot of these data sets right now were not built to be currencies. If an advertiser wants to use Nielsen MRI Fusion data as a guarantee, that’s a risk for them and a risk for us. It’s not predictable.”

Eventually, these alternate currencies will stabilize.

“Advertisers will demand more standardization around advanced currencies, and TV publishers will work together to facilitate that,” said Bryson Gordon, SVP of data strategy and Viacom Vantage. “It’s going to take off as we see more scale and adoption in these advanced currency deals like with Vantage.”

Until standardization happens, using multiple currencies fragments and complicates what had been a relatively simple advertising market.

For now, “Nielsen is the truth,” Merkle’s Fisher said. “If one person says the truth is this, and another says the truth is that, how do you adjudicate between the truths?”

Who Will Win?

This new data economy will have different effects on set-top box companies, third-party research firms, ad tech companies and TV networks.

Because set-top box companies don’t have comprehensive data sets like Facebook, this fragmentation weakens their position.

“An advertiser doesn’t want to buy the Comcast footprint and then the Verizon footprint,” Clarke of CIMM said. “The data needs to get licensed to someone, whether it’s the agency or a third-party like Nielsen, that can combine it nationally and make it easier to buy across the whole country. If they don’t have a standard way of combining their data, it’s not going to be that useful.”

Comcast is a notable exception. Because it has so much data across its multiple business units, it could legitimately build a walled garden.

“I look at Comcast as the Facebook or Google of linear TV,” Korenfeld said. “What comScore and Nielsen are doing is nowhere near the size of Comcast,” he added, pointing to the cable company’s 22 million subscribers, which far surpass those companies’ measurement panels.

The danger for Comcast and other TV networks is that they could lose control of their inventory if marketers start placing budgets in the hands of ad tech middlemen.

“Ad tech companies see the opportunity as the $70 billion TV market is moving to data-driven selling,” said Lorne Brown, CEO of Operative and the chair of the National Association of Broadcasters [NAB] digital committee. “Today, 40% to 50% of display is inhaled by ad tech. Even if 10% of TV is taken by ad tech, that’s $7 billion that advertisers and TV media companies stand to lose.”

To get ahead of this threat, TV networks – like Comcast’s NBC – are building their own data platforms that allow marketers to buy in a data-driven way without using an intermediary.

But advertisers may not want to rely on a TV network to place their inventory. They have skin in the game. Marketers may prefer to rely on an intermediary to identify undervalued inventory.

And if the FCC unlocks the set-top box, companies like Google can enter the space by collecting data about viewing behavior.

“Everyone knows this is the future, but there is a lot of debate about the direction it will take,” Fisher said.